People wait outside of a restaurant in Daxing district of Beijing on January 17, 2023. Photo: VCG

With the release of the epidemic restrictions and the kick starting of a new policy cycle, I think the Chinese economy will brace for a new start in 2023. When we released the outlook report in July last year, I pointed out that China's economic recovery may be the main hedge against the risk of global economic recession this year. Looking at it now, it's materializing.

We predict that the Chinese economy will achieve a natural recovery led by domestic demand in 2023, with a year-on-year growth of 5.3 percent. The driving force for growth mainly comes from two aspects:

One is the catch-up effect of consumption and service industries. If the epidemic situation stabilizes, consumption and services will recover substantially from the second quarter. The excess savings accumulated by China's household sector during the epidemic will gradually be converted into purchasing power after reopening.

The second is a property stabilization at the bottom of the "L-shaped" path. Real estate-supporting policies have continued to step up. Once the pandemic situation stabilizes, new and old policy measures will pass through more obviously to property sales and investment. This is a necessary condition for stabilizing growth and investment.

External demand may be the biggest uncertainty for China's economic growth this year. We expect that the global economy to fall into a "rolling recession" in 2023. It should be said that China's export sector is relatively resilient. So, I expect a low-single-digit decline in exports this year, but not a sudden collapse like in the global financial crisis.

Overall, the nature of this year's growth will be more organic rather than policy-driven, benefiting from the normalization of economic activities after the anti-COVID-19 policy adjustment. At the same time, after this bottleneck is resolved, previous stimulus policies will come through more effectively. We think massive stimulus is neither necessary nor possible. Fiscal policy will still be proactive. Monetary policy should remain accommodative, but it is also necessary to learn from the lessons of the central banks of developed countries such as the Federal Reserve, pay attention to the inflation risk after reopening and withdraw from the pandemic-era policy mode in a timely manner.

Over the past few years, in the face of rising geopolitical risks and changes, international investors are indeed re-examining the pricing of Chinese assets. In the fourth quarter of last year, Chinese assets were sold off indiscriminately. We were one of the first to argue that China could be much oversold. To restore market confidence, we said at the time that three factors are needed:

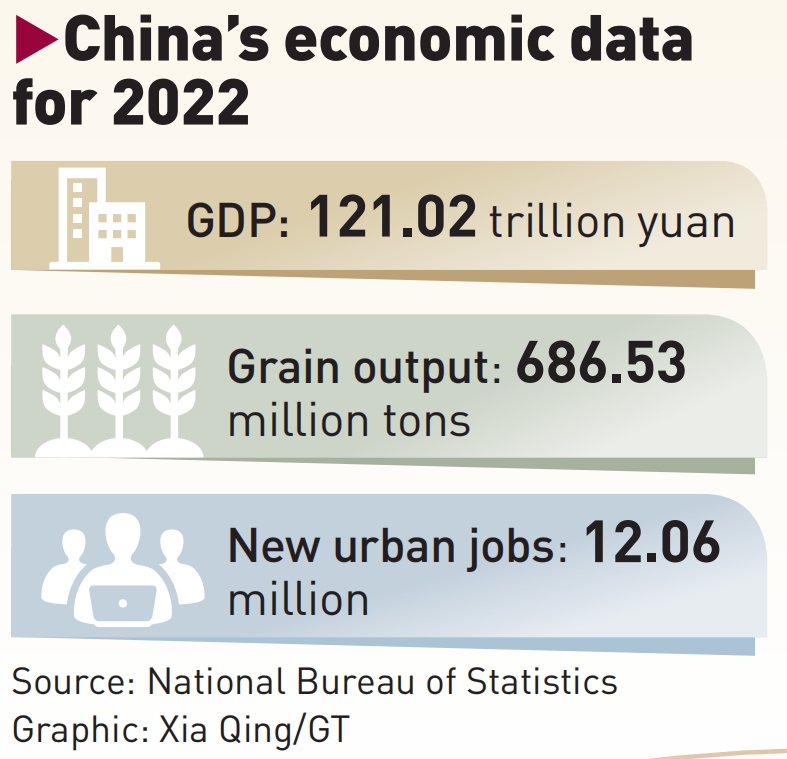

Graphic: Xia Qing/GT

First, refocus on economic development. Investors look to China for growth.

The second is an adjustment of pandemic policy. Previously, overseas investors could not see the exit mechanism and could hence feel uncertain about the economic prospects.

The third is a stabilization of the real estate industry, because real estate accounts for a large proportion of the economy and is also linked to the banking system, which is related to financial stability.

Looking at it now, two and a half of the three problems have been solved. Both the 20th National Congress of the Communist Party of China (CPC) and the Central Economic Work Conference have emphasized that development is the top priority, and the prevention and control of COVID-19 has also entered a new stage. The support of real estate policies has also been significantly increased, but it will take time to see the effect, so there is still half to be resolved.

Since the end of October and the beginning of November last year, A-shares, Hong Kong stocks, and Chinese concept stocks have all reaped significant gains. The Chinese yuan has returned below 7 against the US dollar, and the yield of Chinese government bonds has also bottomed out. It can be said that the most pessimistic stage of China has passed. More investors eye China upswing in the new year.

So, going back to what I said earlier, China's economic recovery this year may be the main hedge against the risk of a global economic recession.

The author is chief China economist at Citi. bizopinion@globaltimes.com.cn