Culture clouds Chinese in West Africa

Three decades ago, China under the leadership of Deng Xiaoping underwent major transformations. Major social and economic reforms were introduced aimed at making the country a market economy and global player.

The sweeping changes have seen the economic growth hit an average of 10 percent annually, mainly driven by increased exports of low-priced goods.

The strong demand for China's products is bringing revolution in the world economy. Africa has been the most affected by these developments.

Since 2000, its exports to China have grown by close to six times. Despite the surge, trade between Africa and the Asian economic tiger only represents less than 5 percent of Chinese overall international business. From the African perspective, however, the growth shows that there is economic potential in the once ignored region.

Contrary to many perceptions that Africa is one, huge bloc with uniform economic pattern, the continent is divided into three segments, mineral-endowed nations, agriculturally-rich zones and a mix of the two.

The mineral-rich nations are mainly concentrated in the West, North and Central. East Africa has no minerals but vast chunk of arable land. This includes Kenya, Uganda and Tanzania. On the other hand, the majority of nations in the South like Zambia and Zimbabwe have a blend of richness in agriculture and natural resources.

All exports to China from West Africa are basically oil. Some nations such as Benin, Burkina Faso, Mali, and Chad top this up with agricultural items like cotton, a critical raw material for China's fast-expanding textiles industry. With its sizeable number of people, about 30 percent of the continent's population, West Africa is an attractive consumer market for Chinese products. Nigeria leads in the region in the consumption of the products, accounting for 42 percent. It is followed by Benin, Ghana, Togo, Ivory Coast and Gambia.

But it is in Southern and East Africa where China's presence has been most heavily felt. A mix of heavy investments in infrastructural projects, mining and trade is propelling relations with the Asian nation to new levels. The majority of firms operating in these regions are State-owned. Others are strongly supported by the Chinese government. Firms here do not operate in the conventional way of maximizing profits. They provide concessions, bid for contracts at abnormally low prices and source for cheap inputs from China, just for the sake of gaining market access. With approximately 60 percent of Africa's population under the age of 24, China's investment and job creation have become key ingredients in reducing poverty.

East Africa and South Africa seem to be expanding faster than the rest of the continent. And they seem to be attracting more Chinese firms. So what has made Chinese investments in the continent non-uniform?

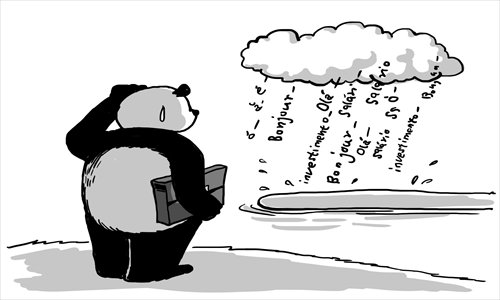

One of the major challenges facing Chinese investors in the non-English speaking nations in the continent is cultural differences. While Chinese culture is closer to the Anglosphere, West Africa is clouded by French culture, inherited from its colonial master. It is also because of wide cultural differences that Chinese investments are rare in Arab-speaking nations in North Africa despite them having huge oil reserves. Besides, the English language is friendlier to Chinese, who learn English in school, than is Arabic or French.

These challenges explain why China is discriminatory in its investments. What Beijing seems to yearn for is an investment destination with minimal working culture frictions. Where barriers are seen, divestiture has been carried out. Today, it is feared that pioneer firms in the North and West might be relocating to East and Southern Africa due to a lack of harmony in working culture. Due to the near-compatibility of cultural settings, Chinese companies in East and Southern Africa are fast embracing 24-hour operations with minimal resistance from the locals.

But where large-scale businesses are being carried out in these relatively "tough" areas, China has entered into joint ventures with State-owned companies to secure sources of commodities. In Angola, where majority of the population speak Portuguese, Sinopec has put up a $3.5 billion oil investment project with an Angolan parastatal, Sonangol. In Gabon, the CMEC/SINOSTEEL consortium financed by the Chinese Export-Import Bank, has invested about $3 billion in the exploitation of iron ore deposits.

Going forward, it is critical that African nations make it conducive for international firms to operate in so as to encourage foreign direct investments. Rwanda is a leading model globally, where it has now shifted from French to the more widely-spoken English as a national language. Others should do the same.

The author is a journalist on African issues based in Nairobi, Kenya. mkapchanga@gmail.com