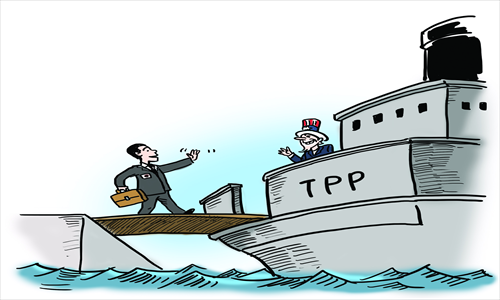

TPP could see Japan being fooled again by US political hoodwinking

Recently, Japanese Prime Minister Shinzo Abe officially announced that Japan would join the US-led Trans-Pacific Partnership Agreement (TPP) negotiations. Despite widespread opposition from domestic agricultural and other groups, the Japanese government, some large enterprises and mainstream media still insist that it is beneficial for Japan to join the TPP.

Various calculations have failed to tell whether and how much Japan would benefit economically. However, given the history of Japan-US political and economic relations, Japan's move bodes ill rather than well.

Since the 1970s, Japan has followed many economic agreements with the US, few of which benefited Japan. In most cases, the US reaps the profits while Japan bears economic losses more or less.

The Plaza Accord still rankles in some people's memories. Ministers of finance and central bank governors from five developed countries, including the US, Japan and Germany, signed an accord on September 22, 1985, at the Plaza Hotel in New York City. They all agreed on the depreciation of the dollar against other leading currencies.

After the accord was signed, the Japanese yen appreciated nearly 100 percent against the dollar in 10 months. Many Japanese enterprises that relied on exports for profits lost a price advantage and struggled for survival.

As a result, Japan's fast pace of economic growth since the 1960s was contained. From then on, Japanese enterprises invested and built factories abroad in a succession to make profits, leaving Japan with a bubble economy and long-term economic stagnation after the bubble burst.

When signing the Plaza Accord, then prime minister of Japan Yasuhiro Nakasone and minister of finance Noboru Takeshita did not foresee the serious consequences that would ensue. It was said that Nakasone anticipated a 10 to 12 percent appreciation of the yen, but the US treasury secretary James Baker, who was responsible for executing the accord, managed to double the yen's value. Even though the Japanese government negotiated with Baker and others frequently, it was ultimately unable to keep the exchange rate down.

The incident shows that the US has political superiority and can push matters to its advantage.

The US domestic situation now is very similar to the days when the Plaza Accord was signed. The US was in a financial crisis at that time because the Reagan administration engaged in an arms race against the Soviet Union which caused a huge fiscal deficit. And the US domestic manufacturing suffered large deficits in international trade for many years after it lost competitiveness to Japan and other nations.

Now, due to years of war and another financial crisis, the US government deficit has reached its ceiling several times. In particular the US bears huge deficits in international trade and has limited manufacturing.

In the Reagan era, the US proposed the Plaza Accord to prevent large amounts of Japanese goods from being exported to US. Nowadays, the TPP is being strongly pushed in a similar domestic crisis, in which the major object is Japan again.

With so many similarities in all aspects, who can guarantee that the TPP won't be another Plaza Accord?

At present, Japan cannot negotiate on the TPP from an equal position with the US, as many clauses have been agreed on with other nations involved and Japan is unlikely to amend them by negotiating with these nations one by one.

From previous agreements that the US has signed with other nations, the TPP has higher aims than simply eliminating tariffs and opening the market. According to the North American Free Trade Agreement that the US signed with Canada and Mexico, and the recent Free Trade Agreement between the US and South Korea, an enterprise from one nation can sue the government of the other nation and appeal to the World Bank's arbitration tribunal. Such verdicts were usually in favor of the US.

What's more, the TPP may prohibit governments from taking protective measures on their home products. Such rules deprive governments of control over their economy.

The current average tariff on Japanese goods exporting to US is only 2 percent. Under the circumstance of US economic recessions and declining consumption, Japan won't make much money even if such tariff is eliminated. Once it joins the TPP, domestic agriculture, healthcare, financial and communications industries will be open to the US, which could bring tremendous losses.

To make it worse, the Japanese government will lose its control over the domestic economy and play by rules set by the US. It is indeed worrying that Japan would take such a big risk to align with the US definition of free trade.

The author is a scholar living in Japan. opinion@globaltimes.com.cn