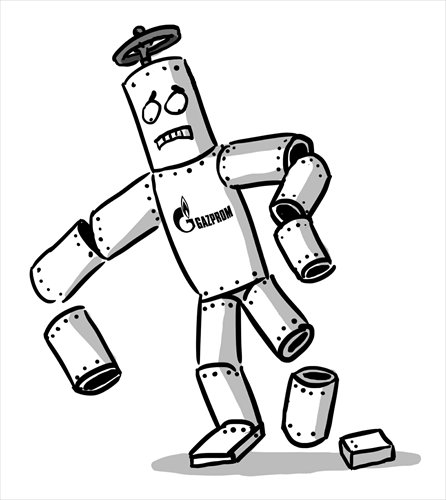

Gazprom's status limits Russia's gas sector

Illustration: Liu Rui/GT

Most companies tend to draw attention based on their main function, but in the case of Gazprom, one of the world's largest gas extraction companies, based in Russia, key global players pay more attention to the impacts the company has on geopolitical and diplomatic issues. In fact, Gazprom has reached such a vast size, that it combines the material considerations of natural gas, the economic benefits of natural gas politics, and the complex geopolitical considerations of gas pipelines.

In the first decade of the 21st century, Gazprom played a substantial role in consolidating the regime of Vladimir Putin and reviving Russia's diplomatic efforts. With the support of Putin, Gazprom has successfully monopolized export channels for natural gas. This places Gazprom in a role in which it can mediate with the outside world on behalf of Russia.

By utilizing price issues as well as its pipelines, Gazprom has become Putin's "scepter." Moscow and Kiev have given hints of two "gas wars." Russia has cut gas exports to Europe, which plunged the continent into an energy crisis. During this process, Gazprom consolidated its Belarus pipeline and reduced gas purchases from Central Asia.

At the same time, Gazprom scrapped subsidies for gas in former Soviet republics. It has also engaged in long-term negotiations with China over gas supplies.

In effect, Russia had initiated its own kind of "Gas OPEC" in conjunction with Iran and Qatar. During that time, Gazprom had boundless ambitions in terms of the international natural gas market.

But since then, the situation has been transformed. The shale gas revolution has swept North America, and also affected the entire world.

Gazprom has attained powerful market status and unique political functions via its monopoly, but this gives it an unusual status as a "giant." As shale gas rose in significance, Gazprom was slow to realize its potential role.

Indeed, Russia has always taken its natural gas reserves for granted, and has always enjoyed an advantage in terms of reserves and extraction costs.

However, it failed to foresee that the closure of the American market and the wide application of Liquefied Natural Gas (LNG) technologies would fundamentally alter trade flows and the pricing principles of the world's three regional natural gas markets, namely North America, Asia Pacific and Europe.

When Qatar's LNG companies marched into Europe, China began to acquire natural gas from Central Asia, and North America began to export its natural gas, Gazprom was working on constructing new pipelines to Europe and mired in a trade freeze due to disputes with the EU over contract prices. Meanwhile, as Gazprom faces pressure from EU anti-monopoly investigations, it is at a loss in terms of developing alternative markets.

Within Russia, Gazprom has been criticized for its inefficiency. The cost of constructing pipelines remains stubbornly high. The development of gas fields in East Siberia and the Arctic continental shelf remains an elusive, long-term goal. At the same time, different political forces have re-divided the oil and gas industry and more commercial and efficient companies such as Rosneft and Novatek have been established. They have not only encroached on Gazprom's domestic market share, but also challenged its export monopoly status.

All these elements have put pressure on Gazprom. For Gazprom, the core of its development lies in maintaining the European market and carving out the Asian market. In terms of Europe, relations with Ukraine will be crucial, but at the present, ties are not positive. In terms of Asia, negotiations with China will be the key issue. Although both sides have been willing to compromise in terms of prices, it is not yet certain whether Gazprom and the China National Petroleum Corporation will sign a contract by the end of this year.

Nonetheless, the essence of the issue is whether Russian authorities have the determination to de-politicize Gazprom and make it a real commercial company. Only through market-oriented reforms can Russia's natural gas competitiveness remain a source of vitality.

The author is an assistant research fellow at the Academy of Chinese Energy Strategy with the China University of Petroleum, Beijing. opinion@globaltimes.com.cn