HOME >> BUSINESS

China's top financial buzzwords of 2013

Source:Globaltimes.cn Published: 2013-12-24 17:29:00

| Editor's Note |

China’s economy saw tremendous change over the past year. The new China (Shanghai) Pilot Free Trade Zone (FTZ), established in September, stands as a symbol for the country's future financial reforms, while existing issues such as increasing the retirement age once again became hot topics. Chinese media captured these changes in ten phrases:

| Hot Topics |

Establishment of China Railway Corporation

Establishment of China Railway Corporation  |

The Chinese government has approved the establishment of China Railway Corporation to perform the commercial functions of the defunct Ministry of Railways (MOR) as part of the cabinet restructuring plan. Read more: China's cabinet to reform departmental system |

Property curbs

Property curbs  |

Chinese major cities including Beijing, Shanghai and Chongqing announced detailed regulations to cool down the housing market over the weekend, following the central government's call to curb property prices in early March. But some industry insiders remain skeptical of the effectiveness of the new rules. Read more: Beijing, Shanghai's detailed property curbs receive mixed reaction |

Gold rush

Gold rush |

Buying gold has long been regarded as the best way to invest safely. All over the world, more and more people are collecting gold. Businesses are going all out to attract the most buyers and trying their best to get the most out of the gold rush. As a result, some rather luxurious gold items have emerged. Read more: China's small investors give gold prices big lift |

Cash squeeze

Cash squeeze |

Monetary liquidity in the market has been sufficient on a large scale since the beginning of this year, China's central bank was quoted by China Central Television as saying on June 24. Read more: China’s banks weigh options amid cash squeeze |

Likonomics

Likonomics |

'Likonomics', the term to describe Chinese Premier Li Keqiang's economic policy, was coined on June 27 by three economists at Barclays Capital. Like "Thatcherism", "Reaganomics", and more recently “Abenomics”, "Likonomics" has become the buzzword to describe the implications of China's new economic program. Read more: Likonomics: China's economic reboot |

Local government debt

Local government debt |

While China’s local governments construct highways, railroads and other expensive infrastructure projects to bolster their contribution to GDP, they are accumulating tens of billions of yuan in debt along the way, a trend which many observers say could spark a crisis to the world’s second largest economy. Read more: China orders sweeping audit amid looming debt |

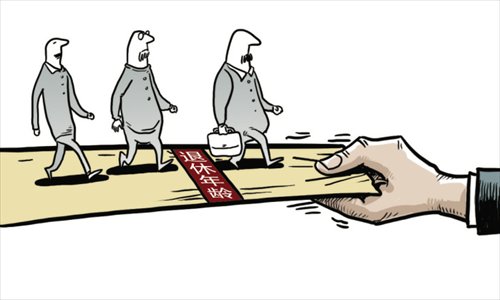

Increasing retirement age

Increasing retirement age |

Chinese experts have proposed a new pension scheme, raising the pension age, to ease the financial burden of an aging population. The scheme, drafted by experts from Tsinghua University, was unveiled on August 12 to solicit feedback from the public. Read more: Experts propose increasing retirement age to relieve pension woes |

China (Shanghai) Pilot Free Trade Zone (FTZ)

China (Shanghai) Pilot Free Trade Zone (FTZ) |

On July 3, the State Council approved plans to establish a trial free trade zone in Shanghai’s Pudong New Area. The 28 square-kilometer zone is not only the first in the city, but the first of its kind in the Chinese mainland. The model will be implanted to other regions should this trial be successful in Shanghai. Read more: Shanghai pilot FTZ to be inaugurated on September 29 |

Yu’E Bao

Yu’E Bao |

Yu'E Bao, China's first fund investment platform for online shoppers, came online on June 13 and within six days had attracted 1 million of Alipay's 800 million users to invest directly in a money market fund. The fund, called Zenglibao, is offered by Tianjin-based Tianhong Asset Management Co and has a minimum investment of 1 yuan ($0.16) with no maximum limit. Read more: Yu'E Bao warned on paperwork |

Bitcoin

Bitcoin  |

Bitcoins, a peer-to-peer virtual currency, attracted tens of thousands of Chinese investors to cash in the market, hoping to earn fat profits within a short period of time. China has decided to ban all financial and payment institutions from establishing any Bitcoin services, as the digital currency carries high risks, the People's Bank of China said in a notice released on December 5. Read more: World banks on Bitcoin |

| Related Daily Specials |

China's inequality index highlights urgency for distribution reforms

First quarter economic development stable, says statistics bureau

China says ‘no’ to EU anti-dumping duties

Everbright blames trading frenzy on computer error

China’s CPI rebounds to hit seven-month high

Four 'single' ones: happy signal for online retailers

China’s leaders meet to set economic goals, priorities for 2014

Beijing warns US to avoid debt default

Web editor: guwei@globaltimes.com.cn

Posted in: Economy