PPI falls to four-year low

November inflation rate stays under 2% for 3rd month

Graphics: GT

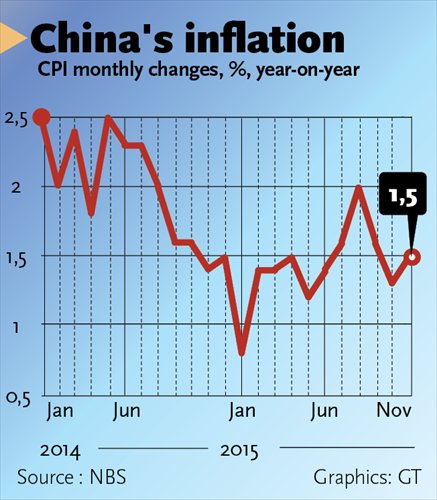

China's November inflation rate stayed under 2 percent for the third consecutive month, while producer prices continued to remain in negative territory for the 45th month in a row, official data showed Wednesday, fueling expectations of more supportive policies in the face of growing deflationary pressure.

The Consumer Price Index (CPI) rose 1.5 percent in November compared to the same period last year, higher than the annual increase of 1.3 percent in October and 1.6 percent in September, data from the National Bureau of Statistics (NBS) showed. The average market forecast for November's CPI was 1.4 percent, according to media reports.

The NBS mainly attributed the pickup to rising food prices, as vegetable prices surged 9.4 percent from the same period last year, while pork prices rose 13.9 percent. The average inflation rate in the first 11 months was 1.4 percent.

Food prices, which account for nearly one-third of the weighting in China's CPI, rose 2.3 percent from a year ago.

The increase from October's 1.3 percent was caused by rising vegetable and fruit prices, rebounding prices for household services and medical and health services, Liu Xuezhi, an analyst at Bank of Communications, told the Global Times.

Liu said that the CPI lacks the strength to rise and the PPI is expected to continue to linger in negative territory for some time.

"With global commodity prices remaining down and lackluster economic growth, prices of non-food products lack the momentum to pick up," Liu said.

Liu said he expects the full-year CPI to fall between 1.4 to 1.5 percent, lower than 2014's 2 percent and will not rise by much in 2016.

Weak demand

The Producer Price Index (PPI), which measures wholesale prices, dropped 5.9 percent in November compared to the same period last year, and was flat the previous three months.

The index suffered the 45th straight month of negative growth, the NBS data showed.

Producer prices continued to fall broadly, with oil-related sectors and heavy industry such as ferrous metal processing seeing the sharpest price declines, data showed.

The PPI and CPI are related as price fluctuations in the production phase usually translated to changes in consumer goods prices after a period of time, according to the Xinhua News Agency.

"The weak PPI level reflects weak demand and pressure from overcapacity, as well as declining prices of imports," Liu said.

"Prices of goods in the industrial sectors showed wider declines, reflecting the prolonged impact of receding global commodity prices, including world oil prices," Xie Yaxuan, a macroeconomics analyst at China Merchants Securities, told the Global Times Wednesday.

Global oil prices lingered at their lowest level in nearly seven years, with copper prices at a six-and-a-half-year low, according to media reports.

Liu said he expects the decline in the PPI to gradually subside in 2016.

China's GDP growth was at a six-year low of 6.9 percent in the third quarter, marking the first under-7 percent growth rate since the global financial crisis.

Trim overcapacity

To cope with downward pressure, the People's Bank of China, the central bank, has stepped up monetary easing measures, with five interest rate cuts and four across-the-board cuts in the banks' reserve requirements in 2015.

However, recent economic data showed persistent downward pressure.

Experts said more monetary and financial policies are expected.

"Inflation is an important gauge for interest rate adjustments, and there will be more cuts in interest rates in 2016," Xie noted.

Supply-side structural reforms will lend more steam to sustainable growth, President Xi Jinping said in November at a meeting of the Central Leading Group for Financial and Economic Affairs, according to the Xinhua News Agency.

Such reforms include trimming overcapacity and providing goods in high demand, according to experts.

Liu said supply-side reforms are needed to help sectors suffering from overcapacity, and the government needs to increase supply to meet consumption needs, and boost the development of the tertiary industry to cope with downward pressure.

There are also optimistic signs as China's economy shifts gears.

Retail sales in October rose by 11 percent over the same period last year to 2.8 trillion yuan ($440 billion), NBS data showed, with January-October figures rising by 10.6 percent from last year, NBS data showed.