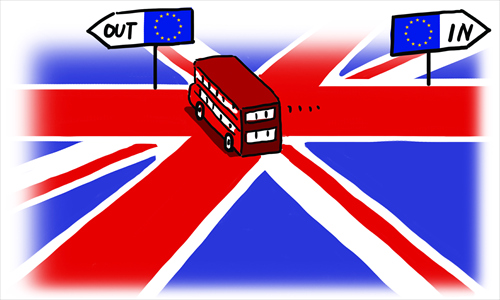

The UK and EU’s post-ref step remains unclear

Illustration: Liu Rui/GT

A new chapter in the course of European integration has started. On Friday morning, when the referendum result giving the victory to "Brexiters" was officially announced, the world was shocked. Although Brexit had been ahead in numerous opinion polls, reality is much tougher than theoretical scenarios and fears. International markets made this evident by reacting nervously and suffering high losses. The pound also fell to a three-decade low. These are the first signs of instability in a phase that can be called an "adventure" for the UK and Europe.

The question dominating the discussions of British and European politicians as well as various scholars and analysts is what happens next. The process is unprecedented and will damage the image of the EU. For many decades, enlargement had been one of its main priorities, which culminated with the addition of the countries of Central and Eastern Europe in 2004. And now, a major European state, the powerful UK, will start disengagement negotiations because 51.9 percent of its voters want to leave.

The EU cannot be as neutral or indifferent vis-à-vis Brexit as some of its initial statements indicate. In their first reaction, top EU politicians Donald Tusk, Martin Schulz, Mark Rutte, and Jean-Claude Juncker portray the situation as almost "business as usual" and refer to Article 50 of the Treaty on the EU setting out the procedure for the withdrawal of a member state. But Germany is more realistic. It has already elaborated on a plan and is prepared to push Brussels to negotiate an association agreement with London.

The main challenge for the German government, however, is to find a delicate balance in order to avoid offering too much leeway to the UK in gaining access to the internal European market. If the EU makes many concessions, incentives will be given to other member states to leave, following the British paradigm.

Chancellor Angela Merkel and Finance Minister Wolfgang Schäuble will have to devote much energy to complicated negotiations with their British colleagues and combine political gains with economic losses. More importantly, they need to do so in 2017, the year federal elections will take place in the country.

The problem for the UK and Europe is that theoretical plans - as the one for an association agreement between Brussels and London - are not always perfectly applied in practice. By contrast, they often lead to different interpretations and generate misunderstandings. Also, they remain an affair of the elites and are not of interest for ordinary citizens who are expecting answers to real problems and do not pay attention to the evolution of legal compromises or conflicts.

The day after the Brexit vote will be difficult for the UK as its internal cohesion has been already put into question. Scotland imagines its future within the EU and it is considering organizing a new referendum in order to possibly gain its independence and apply to become a member state.

The day after will be even more difficult for the EU. Although eurosceptisicm in the UK has its roots in the traditionally problematic relationship between the country and Europe and is therefore largely different from that of other member states, where it is principally associated with the ongoing economic crisis, the referendum result may open "Pandora's box." It might reinforce "Leave" tendencies in Sweden, France, Italy, Austria, Greece, and other countries.

As it normally happens during crises, several scenarios have been imagined by the media. This is also the case after the Brexit referendum as both the UK and the EU are entering uncharted waters. Patience is required though, especially as far as medium-term and long-term consequences are concerned. Everything will depend on how the next UK government will negotiate, if it will trigger Article 50. This is highly possible but should not be taken for granted on the grounds of David Cameron's and Boris Johnson's reserved stance.

For the time being, countries engaged in various partnership patterns with the UK - including China - are only impacted in their exports and imports by the fall of the sterling pound as well as in the course of stock markets. Last but not least, it is important to remember that the UK never joined the eurozone or Schengen and is still a NATO member.

The author is a lecturer at the European Institute in Nice, France. opinion@globaltimes.com.cn