EU split over price cap on Russia oil, waking up to US coaxing

Punitive measures will be lose-lose situation for both Moscow and Brussels, only benefit Washington

European Commissioner for Energy Kadri Simson (left) and Czech Minister for Industry and Trade Jozef Sikela (second from left) hold a press conference after the European Union Energy Ministers Meeting in Brussels, Belgium on November 24, 2022. Photo: VCG

The split among European Union (EU) governments over what level at which to cap Russian oil prices was "predictable," as European countries become sober to the fact that the US coaxing of Europe into slapping punitive measures on Russia was only to boost gains for Washington. If the price cap is decided, observers said, both Russia and Europe will suffer, and the US will be the only one to benefit.

EU governments Thursday disagreed on what level to cap Russia's oil prices in order to curb its ability to finance its operations in Ukraine without causing a global oil supply shock, Reuters reported.

The European Commission, the Czech EU presidency, the US and G7 presidency Germany all held talks on Thursday in a bid to resolve differences and reach an agreement before the price cap takes effect on December 5.

Countries such as Poland want the cap set at $30 a barrel, arguing that the G7 proposal would benefit Russia too much, given Russia's production costs are estimated at $20 a barrel. Cyprus, Greece and Malta, countries with large shipping industries that could suffer the heaviest losses if Russian oil cargo is disrupted, argue that the cap is too low and want either compensation for business losses or more time to adjust.

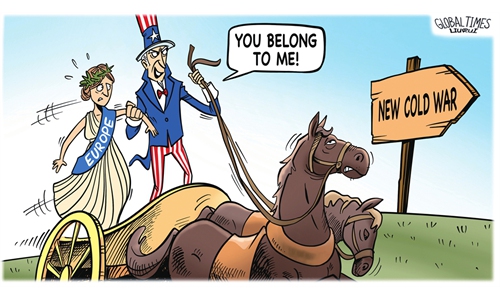

US Europe Illustration: Liu Rui/GT

The price cap was led by the US. Under an earlier iteration of the US plan, which has been spearheaded internally and externally by Treasury Secretary Janet Yellen, a price cap in the range of $40 to $60 per barrel was under consideration, with some officials eager to keep the limit as close to the lower end as possible, Bloomberg reported in August.

Russia does not plan to supply oil and gas to countries supporting a price cap on its oil, Reuters quoted the Kremlin as saying on Thursday, but will make a final decision once it analyses all the figures.

The EU's split is totally predictable, as the Russia-Ukraine crisis marches into its ninth month and EU countries are becoming increasingly clear the US is coaxing them to benefit itself, such as through exporting oil to European countries for huge gains, said Li Haidong, a professor from the Institute of International Relations at the China Foreign Affairs University in Beijing.

His view was echoed by Lü Xiang, research fellow at the Chinese Academy of Social Sciences. Lü pointed out that the US economy has been sluggish this year, but its Q3 GDP showed signs of recovery with GDP accelerating at a 2.6 percent pace.

The US has been exporting record volumes of crude oil and petroleum products recently, and Europe has become a major destination for these exports, media reported in October.

The US tactic is to egg on European countries standing on the front line of provoking Russia while it hides behind them and counts the money as Brussels and Moscow slap punitive measures on each other, Li said.

He warned that the price cap will result in a lose-lose situation for both Russia and Europe, and especially the latter, which is already mired in an energy crunch and facing a bitterly cold winter this year; this will even wreak havoc on the global energy market.