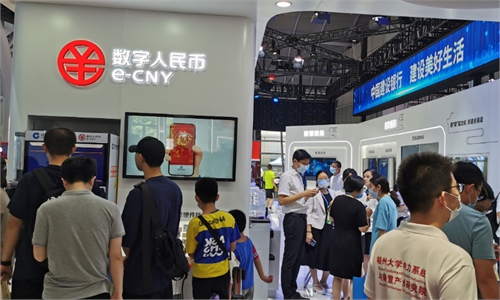

Visitors use digital yuan for payment at the 5th Digital China Summit in Fujian, East China's Fuzhou Province on July 24, 2022. Photo: Yin Yeping/GT

With China’s digital yuan becoming more widely used across a growing number of scenarios and platforms, it will serve the real economy and people's lives by being better, faster and more inclusive in usage, experts told the Global Times.

Alipay, the payment e-wallet operated by Alibaba Group, has joined the digital yuan processing network, making it the first payment platform to support China’s digital currency, Li Chen, Chief Compliance Officer of Alibaba's fintech arm Ant Group, said recently.

Starting from December 12, Taobao users can pay for items using the digital yuan. Additionally, other Alibaba platforms including food delivery site Ele.me and grocery store Freshippo will also start accepting digital yuan.

“Alipay joining the digital yuan acceptance network as the first payment platform sent an important signal: there is no competition or replacement in the relationship between digital yuan and third-party payments like Alipay and WeChat Pay. They are just money and digital wallets,” Wang Pengbo, a senior analyst at consultancy BoTong Analysys, told the Global Times on Wednesday.

Alipay’s adoption of digital yuan as an express payment option across its platforms including Taobao will help popularize the use of digital yuan as part of everyday life, Wang said.

There are currently 92 merchants including SF Express and suning.com connected to the digital yuan app.

Since the start of the year, the digital yuan has made rapid progress across an array of financial application scenarios. At present, trial programs have been carried out across three rounds in a number of pilot cities.

According to recent data released by the People’s Bank of China (PBC), the central bank, as of the end of August, the cumulative transaction volume of digital yuan had exceeded 100 billion yuan since the digital currency initiative kicked off in December 2019, with merchant stores that support the digital yuan coming in at 5.6 million.

At present, the PBC has selected 10 designated institutions as digital yuan operators following a period of comprehensive evaluation.

Throughout the lifespan of the pilot program, businesses using digital yuan have reported positive feedback, with no major incidents or safety concerns, the PBC said.

“The digital yuan pilot program has been carried out to the current stage, and it has shifted from simple scenarios and user expansion to being constructed as an entire system,” Wang said, adding that how to issue and manage digital yuan in the future and provide institutional protection for the long-term healthy development of digital renminbi should be addressed.

Global Times