HOME >> SOURCE

Chinese brides drive global diamonds supply

By Ma Jingjing Source:Global Times Published: 2019/12/1 18:43:40

Creative diamond designs more appealing to millennial consumers

The diamond market in China has seen fast growth in recent years, mirroring the growth of China's middle class. Photo: VCG

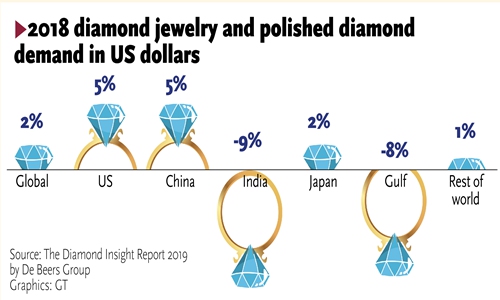

2018 diamond jewelry and polished diamond demand in US dollars. Source: The Diamond Insight Report 2019 by De Beers Group Graphics: GT

On a romantic snowy Friday night in Beijing, a couple took a stroll down the street to take selfies in the snow and of a diamond."This is from him when he proposed to me," said the women named Li Xiang, pointing to a 2.1 carat diamond ring on her finger.

"Diamond is crystal clear, as pure as love," Li said, noting that "Without diamond, I wouldn't accept his proposal."

Li's mentality is shared by many other Chinese brides, and explains why China is increasingly becoming a key growth point for the global diamond industry.

In first-tier cities such as Beijing, Shanghai and Shenzhen, South China's Guangdong Province, about two in ten new couples buy diamond rings for their marriage ceremony, as they consider diamonds a symbol of love, Zhao Chenxi, manager of Xinyue Yuchen Beijing Diamond Co, told the Global Times on Friday.

The diamond market in China has seen fast growth in recent years, mirroring the growth of China's middle class. Chinese demand for diamonds saw robust growth in 2018, up five percent in US dollar terms annually to about $10 billion, according to the Diamond Insight Report 2019 released by the global diamond mining company De Beers early in November.

Compared with the US' $36 billion diamond market which is just under half of total global diamond jewelry demand, the China's market still has huge development potential.

It is part of the reason why Diamond Producers Association (DPA), an alliance of seven of the largest diamond mining companies in the world, including Petra, De Beers and Rio Tinto, has stepped up promoting the appeal of diamonds in China. The association launched various offline campaigns this year, as well as a WeChat public account to educate young consumers of diamonds.

"Chinese consumers have consumption power," Mabel Wong McCormick, managing director of DPA Greater China, told the Global Times on Friday.

Data from consulting firm BAIN released in 2018 showed that Chinese luxury spending represented 32 percent globally, but spending on diamonds only accounted for 16 percent, indicating a rosy outlook for China's natural diamond market.

McCormick said that aside from buying diamonds for marriage proposals, Chinese consumers tend to buy diamonds for themselves on birthdays, job promotions, and other personal milestones. This is especially a trend among young consumers.

Coming to mainland

Growing demand boosts the influx of both international diamond decorations retailers and loose diamonds into the Chinese mainland market.

Diamonds mines are mainly located in Russia, Australia and South Africa, while the main cutting and polishing centers are in Mumbai and New York City, according to industry insiders.

India is the largest cutting and polishing center of rough diamonds, representing around 70 percent of activity worldwide, Zhao said, who imports polished diamonds from India and then designs them in line with clients' needs. "Most vendors buy diamonds from India, including international brands like Tiffany & Co. However, due to different designs and brand premium, diamond rings of the same carat sold by luxury jewelry retailer Tiffany may be twice the price of a domestic brand," he said.

According to Tiffany's website, the company now owns over 300 stores worldwide, of which 36 are located on the Chinese mainland.

With strong double-digit growth seen in the mainland in the first half of 2019, the American jeweler is seeking expansion. Tiffany CEO Alessandro Bogliolo said at an exhibition in Shanghai in September that the company plans to launch Asia's first Blue Box Café in Shanghai and its first airport store in Beijing, the Xinhua News Agency reported.

On Thursday, Hong Kong-based Chow Tai Fook Jewellery released financial results for six months ended on September 30, showing that revenue from the mainland grew 12.2 percent year-on-year, compared with a drop by 20.3 percent in revenue from Hong Kong, Macao and other markets.

This indicates Chow Tai Fook's increasing reliance on the mainland, which contributed 68.5 percent to the group's revenue during the period.

Given fierce competition from global retailers like Tiffany and Cartier in first and second-tier cities in the mainland, Chow Tai Fook plans to tap new growth potential in down market. In 2018, the Hong Kong jeweler launched a project targeting lower-tier cities, aiming to establish 500 new stores by the end of March 2020, media reports said.

Millennial consumers

Offline expansion alone can't boost a brand to Chinese millennial consumers, as many of them pay more attention to diamond quality and high cost performance, Xue Chen, a Shanghai-based diamond industry observer, told the Global Times on Saturday.

"In China, millennial consumers would acquire more diamonds if designs were more appealing," read De Beers' Diamond Insight Report.

International jewelry retailers are changing their strategies in China to build commercial alliances in hopes of appealing to a wider range of consumers. In June and July, Cartier teamed up with the Palace Museum in Beijing to hold a craftsmanship and restoration exhibition, showing the brand's Asian elements in its products.

The museum is one of the most successful producers of intellectual property for creative products in China, with many products including lipstick quite popular with consumers.

McCormick said that although e-commerce is quite popular in China, most consumers still buy diamond decorations at brick-and-mortar stores.

Purchasing diamonds at offline stores is not only an enjoyable process but also assures reliability to clients, she said, noting that they tend to search product and price information online before making decisions.

In addition to internal competition, the diamond industry faces challenge competition from cheaper crystal glasses and gold, which serves as an investment tool.

"In China, diamond rings are rigid demand for weddings, but have little investment value except for rare diamonds with big carats," Xue said, noting that average Chinese prefer buying gold for investment.

Posted in: INDUSTRIES,ECONOMY