HOME >> SOURCE

Tesla will start Model Y production in China

By Xie Jun in Shanghai and Ma Jingjing in Beijing Source:Global Times Published: 2020/1/7 22:13:40

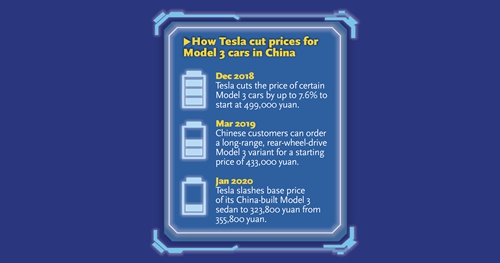

Model 3 price expected to be cut another 16% in H2 2020: analyst

Tesla CEO Elon Musk attends a ceremony in Shanghai on January 7 in which the US electric vehicle giant delivers made-in-China Model 3 cars to Chinese customers. Photo: Yang Hui/GT

US electric vehicle giant Tesla delivered made-in-China Model 3 cars to Chinese customers in Shanghai on Tuesday, and announced it would start producing Model Y cars at its Shanghai plant.Tesla CEO Elon Musk and Shanghai Mayor Ying Yong attended the ceremony.

At the event, Musk said that Tesla intends to continue making significant investments in China, and it will make Model 3, Model Y and future models in China.

"Something that would be I think super cool would be to … create a China design and engineering center to actually design an original car in China for worldwide consumption," Musk said. He reckoned Model Y will have more demand than probably all of the other cars that Tesla provides.

In addition, Musk said Tesla can try something kind of radical, like a cyber truck, "something cool and different and the world hasn't seen before."

Musk danced along to applause from his Chinese audience as he delivered made-in-China Model 3s to 10 customers from the Chinese mainland.

Graphics: GT

The deliveries came after the company announced a price cut on January 3. According to Tesla's website, the price of the Model 3 was reduced by about 16 percent to 299,000 yuan ($42,963).

Graphics: GT

Cui Dongshu, secretary-general of the China Passenger Car Association, told the Global Times on Tuesday that the automobiles being delivered in the first quarter of 2020 show that the number of orders is insufficient.With more components of Tesla vehicles being made in China and the increase in production capacity, there is huge space for Tesla to reduce the prices of vehicles produced in China, Cui said, noting that the price of the Tesla Model 3 may be further cut to 250,000 yuan, or about 16 percent, in the second half of 2020.

Tesla's Shanghai plant now produces more than 1,000 Model 3s per week and it will be able to reach the 3,000 goal soon, one Tesla executive noted earlier.

Tesla has motivation to step up localization, as the manufacturing cost of its Shanghai factory is about 65 percent lower than the Model 3 production lines in its US factory, Zeng Zhiling, an analyst at Shanghai-based consultancy LMC Automotive, told the Global Times on Tuesday, noting that the move will also help nurture China's supply chain.

According to A-share companies' statements, domestic Tesla suppliers are in the lower end of the industrial chain, mainly providing low-value-added items such as car body components.

Currently, South Korean battery maker LG, domestic battery maker Contemporary Amperex Technology Co and other competitive players are competing to supply batteries to Tesla, Zeng said.

Zeng said a relatively mature industrial chain has formed in the Yangtze River Delta region and is able to supply most of the components Tesla's Shanghai factory needs.

Tesla's shares on the Nasdaq closed up 1.93 percent to $451.54 on Monday. The new record high raised its market capitalization to more than $81 billion, more than 20 times that of China's local electric vehicle maker NIO Inc's $3.87 billion.

Graphics: GT

Dozens of Tesla-related A-share stocks surged on Tuesday. Printed circuit board (PCB) manufacturer Olympic Circuit Technology Co rose by the daily limit of 10 percent to 27.95 yuan, following media reports that the company is a main PCB supplier of Tesla.Market-driven investment

Tesla's Shanghai mega factory confirms that international capital flows to markets that have potential, Zeng said, noting that US administrative orders alone can't force the return of US companies.

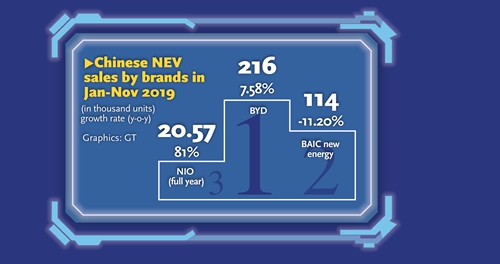

Despite economic downward pressure, China's sales of new-energy vehicles (NEVs) maintained a growth trend in 2019. In the first 11 months, China's sales of NEVs reached 1.04 million, up 1.3 percent year-on-year, data from the China Association of Automobile Manufacturers showed.

"Tesla is accelerating production in a bid to grab a larger market share of the high-end NEV sector in China, as other traditional automakers like Mercedes-Benz and BMW are accelerating their NEV expansion in the market," he said.

However, Tesla still faces challenges to spark Chinese consumers' enthusiasm for NEVs, because the country's subsidies for electric vehicles are to be phased out by the end of 2020, analysts said.

Posted in: INDUSTRIES,COMPANIES