HOME >> SOURCE

Chinese stock investors confident amid epidemic

By Yang Kunyi Source:Global Times Published: 2020/3/10 19:48:40

More money goes online, pushing turnover levels higher

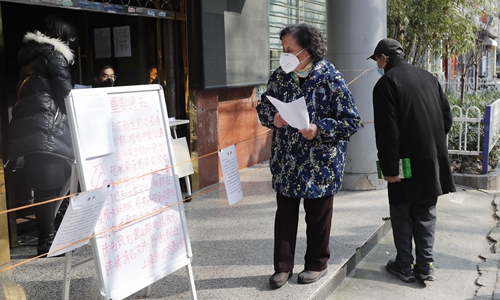

Individual investors consult online trading procedures at a Bohai Securities bourse in Shanghai on February 3. It was temporarily closed during the coronavirus epidemic. Photo: cnsphotos

As the coronavirus epidemic comes under control in China, Chinese investors are displaying enthusiasm in the A-share market despite the coronavirus outbreak plunging global stock markets.According to a report by financial media stcn.com, searches to set up stock market accounts on Chinese language search engine baidu.com have soared since February 3, especially among internet users in Wuhan, Central China's Hubei Province. Wuhan's number of searches topped the nation from February 9-16.

The investment enthusiasm coincides with a two-year high Chinese stocks experienced last week. The blue-chip CSI 300 index on Thursday jumped to its highest level on record at 4,206.72 following a 2.2 percent rise, and the Shanghai, Shenzhen and Hong Kong benchmark indexes all increased around 2 percent.

For 10 consecutive days from February 19 to March 3, the total trading volume on China's two major bourses exceeded 1 trillion yuan ($144.1 billion). The turnover peaked at 1.4 trillion yuan on February 25, according to the Xinhua News Agency.

Behind the stabilizing market are the country's containment of the virus, optimism over government stimulus - both fiscal and monetary - and the current valuation of the market generally regarded as reasonable, Li Daxiao, chief economist at Shenzhen-based Yingda Securities, told the Global Times.

"People are confident because the situation is getting better," Li said. "It is a strong indication of the government's capacity to contain the epidemic and stabilize the situation."

The delayed resumption of work following the Spring Festival holidays in January has meant people are staying home for much longer than usual, and they therefore have more time to research and analyze the stock market, Li said.

"We have not been allowed to go to the office, so I might as well spend more time on the stock markets," said a resident in Wuhan surnamed Wu. "It might make up for some of my income losses and, as the epidemic is coming more under control by the day, I'm pretty confident that things will change for the better."

Li noted that while increased time at home may have triggered the surging interest in the stock market, the ultimate driver remains stable investor sentiment and confidence in the profitability of the market, backed by China's robust economy and policy tools.

While many stock markets have plunged recently, China has been less affected largely due to its relatively independent monetary policies, said Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology.

"People have good reason to feel secure," Dong said. "The yuan is not yet an international currency, and China's 10-year and 30-year government bond yields remain between 2 percent and 3 percent. The stock market is also at a reasonably low valuation."

Investor confidence is particularly prominent in the food and medical industries this week. According to a report from financial media jrj.com, industries with relatively inelastic demand are experiencing robust growth, with food, medical and retail stocks demonstrating the sharpest growth in the last 10 days. The daily consumption sector has absorbed over 7 billion yuan.

The relative optimism in the Chinese stock market is in sharp contrast to the violent selloff in the US market. On Monday, major US indexes plunged, triggering a circuit breaker that temporarily halted equities trading and led to speculations of a future bear market.

In addition to the US market, many other global markets have seen sagging investor confidence amid the coronavirus outbreaks worldwide. Japan's Nikkei 225 Index on Monday plunged below 20,000 to its lowest level in 14 months, and Australia's commodity-heavy market dived 7.33 percent.

On Tuesday the A-share market rebounded after opening low. The Shanghai Composite Index increased 1.82 percent, and the Shenzhen Composite Index rose 2.65 percent.

"Amid the global downward trend in the stock markets, China is expected to become a safe haven for investors worldwide," Dong said. "And it is possible that more foreign investors - not just private investors in China - will be drawn to the stock market here."

Posted in: INDUSTRIES,BIZ FOCUS