HOME >> SOURCE

China, West can cooperate on BRI debt issues

By Liang Haiming Source:Global Times Published: 2020/3/19 21:58:40

Countries will never be asked to repay loans using third-party funds

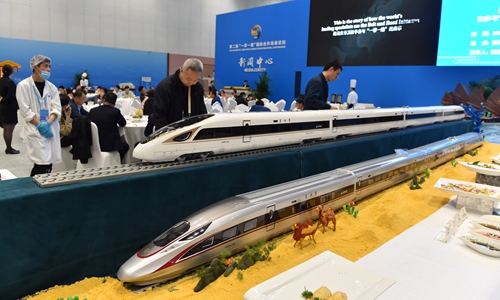

Models of China's Fuxing high speed trains are on show in the dining area of a media center at the Second Belt and Road Forum for International Cooperation in Beijing on April 23, 2019. Photo: IC

The new coronavirus will not increase debt defaults of projects under the Belt and Road Initiative (BRI). China has never asked and will not ask BRI countries to pay loans with funds from the IMF or the World Bank. China and Western countries can cooperate on the debt solvency of BRI countries.

As the coronavirus has escalated into a pandemic and cast a shadow on the global economy, many may have concerns that BRI project debts will become unsustainable. The US has even questioned if funds from international organizations such as the IMF or the World Bank could be used to repay China.

Such speculations follow the same line of thinking as so-called debt diplomacy. There is no evidence that BRI projects will default on debts due to the coronavirus.

Projects with commercial contracts and related arrangements have very limited risks. There are usually several parties involved in one BRI project to hedge risks collectively. Before projects break ground, arrangements such as financing, financing guarantees and risk underwriting are settled to ensure projects can be implemented and weather risks.

BRI projects, which are usually infrastructure construction, could last two to three years, or even five to seven years. A coronavirus outbreak that has months-long impacts is not enough to strangle the cash flow of BRI projects. Besides, the projects are largely funded by BRI policy banks and commercial banks. Despite the equity market slump due to the pandemic, banks have not been greatly influenced.

Tying China to BRI countries' debts and calling the China-proposed BRI "debt diplomacy" or a "debt trap" are nonsensical accusations.

For one, countries including those in the BRI have incentives to borrow. In today's fierce international competition, any country that can attract low-cost and sustainable foreign funds will gain a competitive edge. Such a development would show financial prowess, not weakness.

BRI countries' debt issues are not necessarily related to the BRI projects. In fact, prior to joining the BRI, many nations' debt levels were already high. China was a latecomer and certainly not the biggest creditor. Those debts have been primarily accumulated as a result of long-term borrowing from other countries and international financial organizations.

Many BRI countries have long been receiving loans from European countries, the US, Japan and even India. Why are investments from these nations, with nearly identical "debts," regarded as "sweet pies" while those from China are seen as "debt traps"?

The reason is that Western countries are touting Chinese "debt traps" to protect their own interests. They do not want to see BRI countries turn to China for more loans after borrowing from them, because they worry these countries may repay China before them, therefore affecting their interest.

China has never asked and will not ask BRI countries to repay loans with funds borrowed from third parties. There may be situations where some BRI countries, which have borrowed from multiple nations and face multiple repayment dates, pay interest using other loans.

Should such situations arise, Western countries like the US should not jump to conclusions and pin the blame on China. China and Western countries should cooperate with each other and share information in solving the problem of BRI countries' debt repayments.

The author is dean of Hainan University Belt and Road Research Institute. bizopinion@globaltimes.com.cn

Posted in: ECONOMY