HOME >> SOURCE

PBC closer to digital currency as global interest rates drop

By Li Xuanmin Source:Global Times Published: 2020/3/24 21:43:40

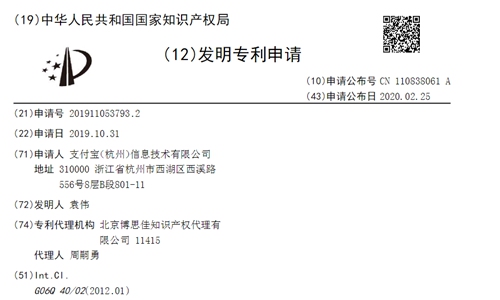

A screenshot of Alibaba's publicized patents related to China's official digital currency. Photo: Li Xuanmin/GT

China's central bank is one step closer to issuing its official digital currency. It seems the People's Bank of China (PBC), in collaboration with private companies, has completed development of the sovereign digital currency's basic functions and is now drafting relevant laws to pave the way for its circulation, industry insiders said.

As more central banks around the world are cutting interest rates to zero or even entering negative territory to release liquidity into the market amid the COVID-19 pandemic, China should accelerate the launch of its digital currency, industry insiders noted.

Cryptocurrency is seen as the most convenient tool to transmit a central bank's zero or negative interest rate policy to commercial banks.

Alipay, the financial arm of domestic technology company Alibaba, reportedly publicized five patents related to the official digital currency from January 21 to March 17.

The patents cover including issuance, transaction recording, digital wallets, anonymous trading support and assistance in supervising and dealing with illegal accounts, according to detailed patent information that industry insiders provided to the Global Times.

Alipay denied having any such patents when reached by the Global Times, saying that some of the information is inaccurate, without further elaborating.

An industry insider, who spoke on condition of anonymity, told the Global Times on Tuesday that the patents concern the basic functions of a digital currency, including circulation, payment, issuance and an anti-money laundering function.

"Judging from the patents, the first step of technological development has been basically completed," the person said.

But he noted that the next step, which involves digital currency legislation and working with banking and insurance regulators on supervision, could be more lengthy, which poses uncertainties for the exact date of the launch.

The Global Times reported earlier that a number of private enterprises, mostly based in Shenzhen, South China's Guangdong Province, such as Alibaba, Tencent, Huawei and China Merchants Bank, have participated in the development of the digital currency.

Cao Yan, managing director of Digital Renaissance Foundation, said that in terms of development, it is more efficient for the PBC to work with private institutions that have rich experience in blockchain technology and third-party payment.

Cao believes the central bank should accelerate the launch of its digital currency in the face of the unprecedented coronavirus pandemic. The global virus outbreak has prompted central banks like the European Central Bank and the Bank of Japan to cut their benchmark interest rates to near zero or into negative territory.

"If there is a chance China is considering lowering its interest rates into negative territory as a final option and directing such policy to commercial loans and lending, a circulated digital currency rather than M0 (money supply) will be able to achieve that," Cao told the Global Times on Tuesday.

RELATED ARTICLES:

Posted in: ECONOMY