Washington needs clear rules covering foreign firms

Source: Global Times Published: 2020/8/26 20:08:16

Illustration: Tang Tengfei/GT

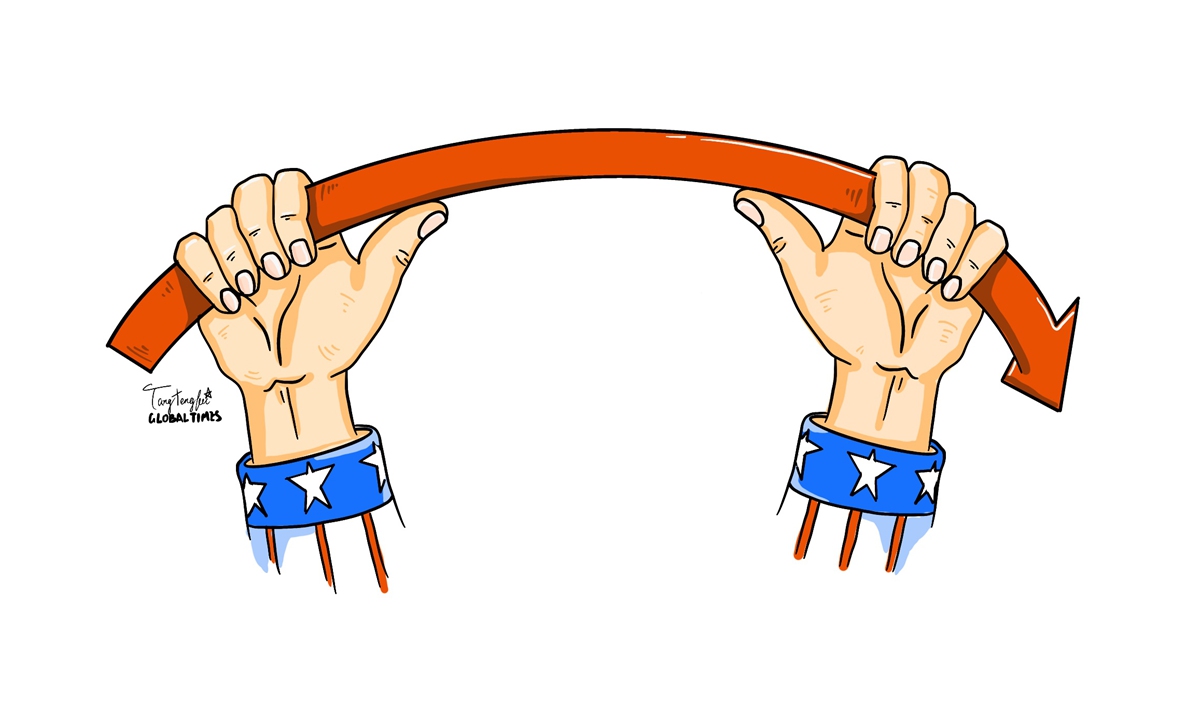

US-traded Chinese firms will either opt for a dual listing, or delist from the US and come back to their home markets as a result of an unfortunate trend gripping the US in which a clearly defined framework is still not in place for foreign companies to operate.

China is already leading the innovation pack for the next billion customers. That the US market is shutting the door on Chinese companies will only end up accelerating China's push for self-dependence in core technologies at the cost of American suppliers.

Chinese companies listed in the US or trying to do business in the country are currently having a very hard time. Two years ago, we already saw moves to balkanize the capital market platform between the US and China.

It's still without question that the US is home to top global exchanges where there are the greatest amount of liquidity, the largest access to global capital, and asset managers from around the world. For the foreseeable future, the US would remain the gold standard in terms of the place to list on. In this sense, China still needs to improve if it aims to become a globalized capital market platform.

There are very few truly foreign businesses listed on Chinese exchanges. It therefore still has the feeling of being a domestic-focused exchange rather than something more global such as the NASDAQ.

The incumbent US administration is not welcoming Chinese companies and Chinese investment. This is disappointing. In order to build a globalized economy, the US needs technology leaders from around the world to list on its stock exchanges.

Unfortunately, the US doesn't have a mature regime to govern data security, data privacy or the overall mechanism through which foreign technology companies are supposed to operate. Consequently, there have been ad hoc and unpredictable moves by the current US administration targeting certain companies - something that has obviously been going on for several years.

There should be a clearly defined framework. There is a huge missed opportunity for the US government to set in place regulations to govern all listed companies. If a company abides by all of these requirements, then it shouldn't be banned. Their hastily put-together ban just doesn't look good for an open market economy.

As a consequence of the vaguely worded regulations, an increasing number of Chinese companies that would have previously considered an IPO in the US are now coming home. This trend will continue. This is especially unfortunate because the world moves forward with the globalization of companies, for example Apple becoming less Americanized and Alibaba becoming less Chinese as they position themselves in a global economy.

Nevertheless, this won't cripple China's push for homegrown innovation in the technology sphere.

We're just now starting to get a taste of China's innovation abilities in markets like the US and Europe, where Chinese-bred applications such as TikTok are anything but replicas of other apps. TikTok exemplifies a Chinese technology that couldn't be replicated by its competitors such as Facebook, because of the strength of its algorithm. It's this application that is now so addictive for consumers both in emerging and mature markets. It's the Chinese model that markets including Indonesia, India, Nigeria, Pakistan and Brazil are now aiming to replicate rather than Silicon Valley's.

Chinese innovation is perfectly suited to the demands of the next billion technology users, especially since Chinese-inspired technologies are much easier to use and their prices are lower.

The US' moves to add Chinese firms such as Huawei and ZTE to its Entity List have awakened Chinese tech firms to their vulnerabilities in core technologies, core software like operating systems and other core hardware inputs.

In the short term this will likely be very painful for such companies as they lose access to American operating systems and chips. However eventually, all Chinese companies will be forced to think more critically from the outset about how they build their supply chains in a parallel but separate way from the US to prevent any future shocks.

That's bad news for the US, as many US chip companies rely on Chinese hardware manufacturers like Huawei, Oppo, Vivo and Xiaomi for their revenue, meaning an indigenous push for Chinese chips would be a massive blow to American chip manufacturers.

Likewise, if those companies build phones that no longer need an Android operating system and can instead work on something like Huawei's Harmony operating system, it would have a huge impact on the ability of American technology companies. Ultimately, the US risks losing access to these emerging economy consumers.

The article was compiled by Global Times reporter Li Qiaoyi based on an exclusive interview with US-based Ben Harburg, managing partner of Beijing-based venture capital firm MSA Capital. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT