Trump’s reelection bid poses more risks than financial war

Source: Global Times Published: 2020/10/8 21:04:31

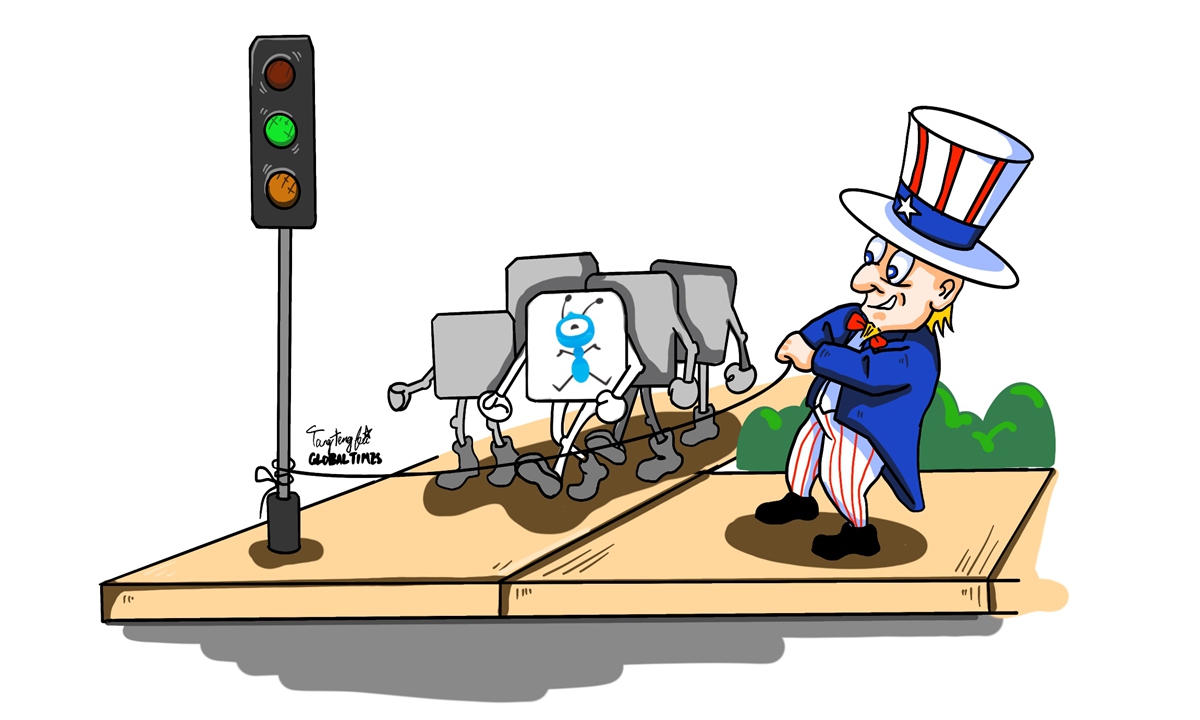

Illustration: Tang Tengfei/GT

The US President Donald Trump has been provoking confrontations both at home and overseas in order to gain four more years in the White House. With less than one month left before the November 3 election, Washington is unsurprisingly preparing its crackdown on Chinese firms again.Citing anonymous resources, Bloomberg reported on Wednesday that the Trump administration is exploring restrictions on Chinese digital payment platforms under Ant Group and Tencent. With the bottom line plummeting alongside Trump's reelection road, the world is facing rising risks and a financial war is just one threat with a crucial need for comprehensive coping strategies.

As long as Trump's poll ratings benefit, businesses, countries and regions, and even international organizations could be targeted by his administration.

And it's no longer breaking news that the US is trying to bully Chinese tech firms after its years-long national effort to attack Chinese 5G frontrunner Huawei and its recent robbery-like crackdown on social media platform TikTok.

Though sources have stressed that the digital payment measures are still under discussion and may not be rolled out before the presidential election, it's certain that the Trump administration will make use of all its resources and opportunities in exchange for imminent political interests, even ignoring the long-term interests of the country's development or the well-being of US residents.

There is also the growing possibility that Trump may refuse to hand over presidency if he loses the election, which would cause further instabilities in both the US and around the world.

Meanwhile, many countries and regions are facing a second wave of COVID-19 infections, and it is inevitable that the instabilities caused by Washington could further impact global economic recovery.

With the novel coronavirus continuing to spread and many countries rolling out inefficient or perfunctory stimulus plans, the global economy may face a vicious cycle, and structural contradictions may continue emerging amidst the ongoing pandemic and weak economic recovery.

The number of confirmed COVID-19 infections has exceeded 36 million across the world as of Thursday, and the US has topped the list with more than 7.5 million, per data from the Johns Hopkins University. Media reports revealed that over 25 American states have seen escalating number of infections this week.

Plagued by the deadly virus, the global economy will likely record a steep recession this year. Many economies had reported record contractions in the second quarter, in which the US economy saw a historic slump at 32.9 percent.

With the world's largest economy and superpower under mounting pressure domestically, it is highly likely that certain US politicians will further create conflicts around the world and try to damage international organizations and global systems.

Although basic economic development rules will not be invalidated by the ill-intended US political forces in the long run, firms and economic entities across the world must be fully aware of the rising risks and comprehensively prepare for any possible obstacles amid the rapidly evolving international environment.

The article was compiled based on an interview with Zhao Xijun, vice president of the School of Finance at the Renmin University of China. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT