Test kit makers’ orders shoot up as Europe sees virus resurgence

By GT staff reporters Source: Global Times Published: 2020/11/8 18:18:40

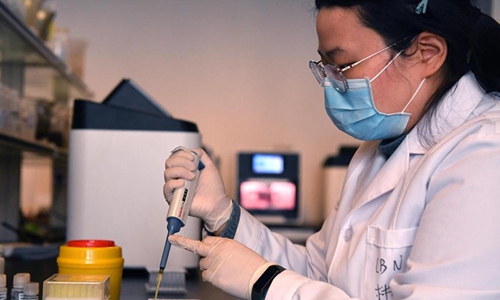

A staff checks the nucleic acid test kit at the plant of Luoyang Ascend Biotechnology Co., Ltd in Luoyang, central China's Henan Province, March 4, 2020. Photo: Xinhua

As some European countries kick off mass testing amid a second wave of COVID-19, Chinese test kit manufacturers may see a new round of orders from overseas, but they will also face more competition from foreign producers, industry observers say.

Chinese COVID-19 test kit manufacturer Guangzhou Wondfo Biotech Co told the Global Times on Sunday that the number of overseas orders for the company's test kits has increased amid a resurgence of infections there, without giving details.

"Amid skyrocketing overseas orders, the company has taken a series of measures to ramp up production capacity of antibody test kits, with output rising to 1.8 million units per day from previous 300,000 units," the company told the Global Times.

Wondfo's COVID-19 antibody test kits have been exported to more than 70 countries and regions in Europe, Asia and Latin America.

Last week, the National Medical Products Administration granted approval to antigen tests developed by Wondfo and Beijing Jinwofu Bioengineering Technology Co, broadening the types of available COVID-19 test kits and increasing the supply to better meet demand. Wondfo's new products obtained CE certification from the EU in August, and they are steadily being readied for export sales.

The approval comes as several places in Europe have decided to conduct mass tests for COVID-19, as a second wave sweeps the continent. Slovakia asked every adult to get tested twice by Sunday, and every resident in Liverpool in the UK was required to get tested starting on Friday.

Slovakia has around 5.45 million people, way smaller than the population of Qingdao, East China's Shandong Province, where 9 million people were tested last month. Although the antigen tests can produce results in less than 20 minutes, they should be used as an aid to the current diagnostic methods and not as the sole basis to diagnose COVID-19.

However, if more European countries decide to purchase the new antigen test kits, it might bring new demand to Chinese kit makers, Bai Yu, president of the Medical Appliances Branch of the China Medical Pharmaceutical Material Association, told the Global Times.

The sector has been seeing rising demand since the outbreak of the COVID-19. Profits for some of the leaders in the industry have been significantly bolstered. According to its third-quarter results, net profit in the first three quarters for BGI Genomics, a leading test kit maker in China, were up nine-fold year-on-year, driven by increasing demand.

Another Chinese kit maker Dian Diagnostics' profit increased 156 percent to 899 million yuan ($135.9 million) in the third quarter.

However, unlike in March and April when Chinese exporters all but dominated the global supply, Chinese makers are not short of competition in antigen test kit production, Bai told the Global Times.

"Chinese manufacturers, small and big, dominated the world's supply back then because they were the first to respond to COVID19," Bai said. "Now larger pharmaceutical giants have joined the competition."

In late September, US-based medical company Becton Dickinson said that its fast antigen test products have been greenlighted in Europe. Other overseas medical companies such as Roche and Qiagen said that they were ready to launch their own rapid antigen tests for COVID-19 in September.

Newspaper headline: Test kit makers’ orders jump amid Europe’s 2nd wave