Illustration: Luo Xuan/GT

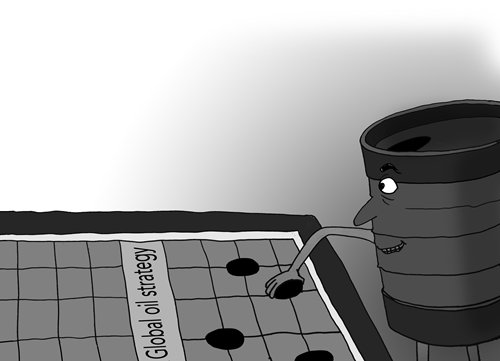

China's energy transformation toward renewable sources doesn't negate the need for the nation to become an oil power to support the economy's continued growth. With domestic oil and gas production unable to meet rising consumption, local oil giants will increasingly focus on overseas expansion, particularly considering that major domestic oil fields are running low after decades of drilling.

An outreach into overseas markets is becoming a higher priority for domestic oil producers, which are also pushing for digitalization to rejuvenate the business of producing the "black gold."

This trend doesn't mean the nation is indulging in a reckless oil investment spree. Instead, there is evidence that domestic industry participants are being fully rational, knowing that a market-oriented approach to the country's global energy footprint should prevail.

Drilling rigs can still be seen around the city of Daqing, Northeast China's Heilongjiang Province, the nation's largest and oldest oilfield, a continuing reminder to even first-time visitors of the city's oil DNA. But a greater use of emerging technologies of the Internet of Things are transforming the old oil wells into digitalized facilities, a major change in the nation's oil sector.

Take the China National Petroleum Corp (CNPC)'s Daqing Oilfield Co as an example, the decades-old field's digital push that allows for remote monitoring of oil and gas production is just part of a broader effort to sharpen its competitiveness.

Daqing Oilfield has also emerged as one of the frontrunners in China's global outreach in the oil and gas arena. It reported 170 million tons of new crude oil reserves last year, and crude output from its overseas fields hit 5.5 million tons. Latest statistics showed that the company's overseas oilfields had crude output of 2.49 million tons in the first five months of the year and the reading is expected to exceed 6 million tons for the whole of 2018. Also, the company estimates that by 2030, half of its oil and gas output will come from its overseas fields.

The overseas push is expected to make up for shrinking domestic output from wells that have been exploited for decades, which makes further extraction increasingly difficult, Xin Li, deputy director of Daqing Oilfield's market development department, said in an interview with the Global Times.

Although local oil companies have over the years made substantial progress in exploring overseas markets, they still need to learn from famous foreign companies such as France's oil and gas major Total, US oil supermajor ExxonMobil, British-Dutch conglomerate Royal Dutch Shell and British oil giant BP, particularly in terms of management.

This suggests that domestic oil companies, with apparent cost and technological edges over their foreign counterparts, should refine their management skills to align them with international majors. After all, a sheer focus on market share might not prove to be commercially viable in the global oil industry. In some geographically contentious yet oil-rich regions, it's proven to be of great significance for Chinese oil majors to find a cooperation mechanism that maximizes the advantages of a commercially viable partnership among Chinese entities, local market players and global oil majors.

A shift toward quality, meaning genuine market success, has become the core strategy of Chinese oil producers' overseas expansion doctrine, which bodes well for the sector's influence on the economy.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn