South Korea's move to curb OLED equipment exports won’t deter Chinese technology drive: analysts

Protectionism won’t deter Chinese technology drive: analysts

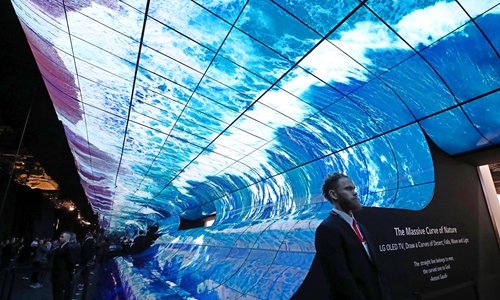

South Korea's LG launches new OLED product during Consumer Electronics Show in Las Vegas on Tuesday. Photo: VCG

South Korea's attempt to restrict exports of organic light-emitting diode (OLED) equipment to China, which experts have termed a protectionist measure, will inhibit the country in the long run, while helping enhance the research and development (R&D) capacity of the Chinese industry.

South Korea will restrict the export of OLED production equipment, which will be designated as "national core technology," and make government approval compulsory for exports, according to a recent report by Business Korea. It was not clear when the new rule would take effect.

This is a follow-up measure to avoid any recurrence of technology leaks by equipment companies after officials of Toptec Co, a Samsung Electronics parts supplier, were accused of selling Samsung's latest OLED display technology to China's BOE Technology Group Co, the report said.

An employee with BOE who asked to be anonymous told the Global Times on Tuesday that "in fact, BOE did not rely on South Korean exports."

Wu Shuyuan, an analyst with Beijing-based Sigmaintell Consulting, said that the restriction attempt by South Korea aims to protect its own industries, which will bring more harm rather than benefits to the country in the long run.

Wu told the Global Times on Tuesday that if South Korea designates OLED equipment as its national core technology, local producers will lose many of their clients across the world to rivals from Japan, which does not have such restrictions.

It will also drive Chinese equipment manufacturers to step up R&D to reduce their reliance on South Korean companies, Wu said, noting that "the competitive advantage of the Korean semiconductor industry will be gradually weakened."

The South Korean plan to restrict OLED exports will not hamper Chinese companies' resolve to keep developing technology, an industry insider surnamed Yang told the Global Times on Tuesday.

Yang said that compared with companies like Samsung and LG, Chinese OLED equipment manufacturers started growth at a relatively late stage, but they expanded fast during recent years.

In October 2017, BOE started to produce flexible OLED displays at its first flexible OLED line in Chengdu, capital of Southwest China's Sichuan Province.

Chinese start-up Royole Corp's flexible OLED displays are made at the company's "quasi-G6" OLED production line in Shenzhen, South China's Guangdong Province, which started operating in June 2018, industrial website oled-info.com reported.

China's OLED equipment mainly depended on imports from such countries as South Korea and Japan previously, but the domestic industry is catching up via increasing investment, Wu said, noting that the Chinese government plans to invest about 300 billion yuan ($44 billion) in the industry soon.

Wu said that China is expected to increase its self-sufficiency rate of semiconductor devices to 70 percent by 2025 from current nine percent .

With the advance of its structure and technical improvement, China's OLED industry has achieved stable growth since 2011, rising from $530 million to $10.35 billion in 2017, askci.com reported, citing industry figures. China's OLED output is estimated at $13.11 billion in 2018.

Li Yaqin, general manager of Sigmaintell, told the Global Times on Tuesday that the semiconductor industry is technology- and capital-intensive, requiring support at the national level in terms of policies, funding subsidies, technology upgrades and talent development.

The industry should develop in a coordinated manner by not only promoting devices and applications but also materials and equipment, Li said.

"This requires us to keep up with basic technologies, especially the cultivation of local scientific research talent."