SOURCE / INDUSTRIES

Will Chinese firms flock to buy US soybeans?

Country to continue diversifying agricultural import sources despite easing tensions: industry insiders

Photo: VCG

Graphics: GT

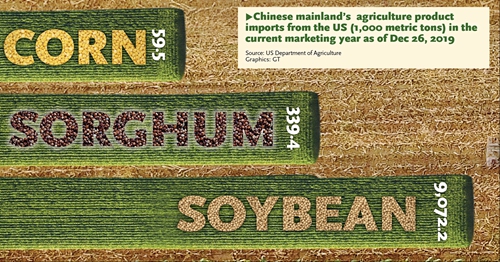

China's purchases of US crops used to be a big sticking point in the phase one trade deal negotiations, and while Chinese industry representatives anticipate that the deal might bring bilateral soybean trade back to normal, firms may not flock to buy US crops even if the deal is finalized next week.Orders will only be made based on market demand, and it takes time to judge that demand, an industry insider told the Global Times on Thursday, adding that contact between Chinese soybean processing firms and US soybean producers "never stopped."

At the invitation of the US side, Chinese Vice Premier Liu He will lead a Chinese trade delegation to the US from January 13-15 to sign the first phase trade deal, Gao Feng, spokesperson of China's Ministry of Commerce, told a regular press conference on Thursday.

Experts predicted that apart from soybeans, the phase one deal might also include pork and other food products that China needs.

Gao, the spokesperson, said that "China will improve governing rules with regard to quotas on wheat, corn and rice based on WTO rules, which is not contradictory to expanding US agricultural product imports."

"The signing of a phase one trade deal may bring China-US soybean trade back to normal, as that will enable US soybeans to regain their price advantage in the global market," Li Guoxiang, a research fellow at the Rural Development Institute of the Chinese Academy of Social Sciences, told the Global Times on Thursday.

"Currently, even though China has already exempted some US soybeans and pork from tariffs, firms still have to go through a complicated and long application process before items from the US could be exempted, which potentially increases purchasing costs," Li explained.

These barriers might all be lifted if a trade deal is inked next week, Li said.

"Then, Chinese enterprises will buy US soybeans 'voluntarily,' and that's all based on market demand," Li noted, adding that with the recovery of China's hog production, demand for soybeans will be huge this year.

The timing is also beneficial for the US as January is the selling season for US soybeans and in March, soybeans from South America will come into the market, Jiao Shanwei, editor-in-chief of grain news website cngrain.com, told the Global Times on Thursday.

Jiao said that Chinese companies may either buy soybean futures on the Chicago Board of Trade directly, or from the world's top grain trading houses namely Archer Daniels Midland, Bunge, Cargill and Louis Dreyfus (known as "ABCD").

He added that from US Gulf Coast shipping terminals to China, it only takes about 35 to 40 days for US soybeans - which may have been stored in American soybean farmers' granaries for long periods - to arrive in China.

China imposed additional tariffs of 25 percent on US soybeans in July 2018 and 5 percent in September, lifting the total duty rate from 3 percent to 33 percent.

On December 6, China announced that it would exempt some US soybeans and pork from tariffs, based on applications from related enterprises. Chinese companies have already imported "certain quantities" of goods from the US, said the customs tariff commission of the State Council, China's cabinet.

No rush to buy

"However, it doesn't mean that Chinese companies will flock to buy US soybeans because of lower prices. They will make orders based on China's downstream demand, and it takes time to judge the demand," an industry insider who closely follows the country's soybean imports told the Global Times on Thursday.

Jiao noted it is also a "misunderstanding" to say China's soybean imports heavily rely on the US. Since 2012, China has gradually enlarged its soybean import portion from South America.

"China is promoting its own soybean revitalization plan, plus domestic soybeans are coming to the market at present. As a consequence, the nation's current demand for soybeans is low. Even if a term saying the US will be exempt from the tariff on soybeans exported to China is included in the phase one deal, it will not have a great impact on the global soybean market. China's soybean import situation will come back to a balance between South America and North America, as before," he said.

Experts also said that although the soybean trade between China and the US might go back to its normal with the easing of China-US trade tension, China will continue to diversify its soybean import sources around the world.

"We should encourage our own traders such as China Grain Reserves Group and COFCO to explore markets along the routes of the Belt and Road Initiative, namely Kazakhstan, Kyrgyzstan, Russia and Ukraine." Zhang Lichen, manager of the strategic development department at Heilongjiang Province-based Longjiang Agricultural Investment, told the Global Times on Thursday.