Australia to pay heavy economic price, if acting as a US attack dog: experts

Acting as US attack dog will hurt many sectors

Visitors take a look at beef in the Hunter Beef booth from Australia during the China International Import Expo. Photo: Yang Hui/GT

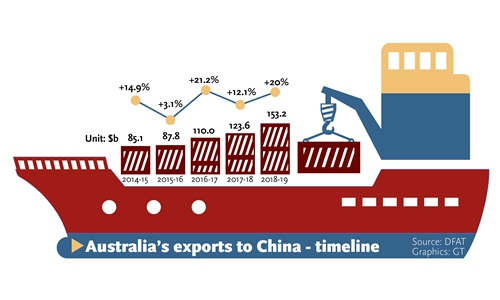

Graphics: GT

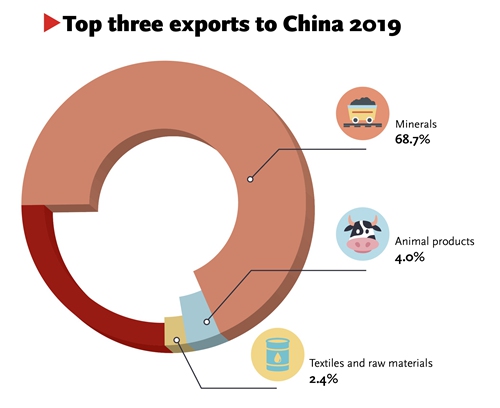

Graphics: GT

Australia will have to pay an economic price if the South Pacific nation, blinded by lust to act as a US attack dog, opts to destroy ties with its most important trade partner, a GT Source investigation into the mainstay of its business bonds with China - including farm produce, iron ore, tourism and higher education - has found.China hasn't imposed any trade sanctions on Australian products, even though it is angered by Australia's move. But if Beijing is forced to do so, Australia will face much more pressure than China as its economy relies on exports, particularly to China, Li Guoxiang, a research fellow on the agricultural sector at the Chinese Academy of Social Sciences, told the Global Times on Thursday.

Beef imports from four Australian firms were suspended by Chinese customs, citing food safety concerns.

There are also media reports that Australia fears potential tariffs on its barley, which caused the Australian trade minister to call for trade talks. The alleged potential tariffs and China's partial suspension on Australian beef were perceived by some Western media outlets as China's retaliation for Australia's move on a COVID-19 probe.

When asked whether China would impose tariffs on Australian barley imports, Gao Feng, a spokesperson for China's Ministry of Commerce, said on Thursday that China would ensure the legitimate rights of various interested parties, including the Australian side, and will make an objective, fair and equitable final ruling in accordance with law.

According to Australia's Department of Agriculture, about 65 percent of the nation's agricultural products are exported, with the majority going to China (the largest single market), Japan and the US. Beef, wine, wool and barley are among China's major imports from Australia.

After China's beef suspension, Queensland Premier Annastacia Palaszczuk said that 3,200 jobs related to the four beef companies are at risk, ABC reported.

Fu Denghua, general manager of Chinese meat importer Haiyunda, told the Global Times that, despite Australian beef's good reputation in China, its advantage in the Chinese market is shrinking as more beef is available from South America and other places, and profit margins are higher.

"I don't worry about the suspension, as I have many import sources," Fu said.

According to Australia's wine regulator Wine Australia, 62 percent of wine produced in Australia was exported from April 2019 to March 2020, and China topped its overseas market list with A$1.2 billion ($770 million) worth of wine going to China.

That was more than the combined value of wine going to the US, UK and Canada, which were the second through fourth markets.

Long Guanyu, a Xiamen-based wine importer who mainly deals with Australian wine brands, told the Global Times that because of a free trade agreement and acceptance by Chinese consumers, Australian wine has been dominating the Chinese imported wine market.

For iron ore, one of the pillars of Australia's economy, any countermeasures to be taken by China would be unbearable.

China could ditch Australian iron ore for African alternatives in case the country chose to ban iron ore exports, in what seems to be an ongoing bilateral economic rift. Li Xinchuang, a vice chairman of the China Iron and Steel Association, gave the response when asked to comment on the likelihood of any bilateral action on iron ore trade, the single largest-value item in bilateral trade in 2019. Sporadic comments have been found on Twitter calling for a boycott of Australian iron ore exports to China.

However, Li said the chance of such a scenario taking place is zero and if China wants to seriously tap iron ore deposits in Africa, there would be a gap of four to five years that would be very difficult. But Li said that "once such a transition is completed, Australia's place as an iron ore supplier to China will be lost forever."

In the case of tourism, a hostility-induced backlash would be destructive for Australia.

From 2009 to 2019, Chinese tourist arrivals in Australia rose 297 percent, but this year, the numbers are expected to be dire, with almost no Chinese visitors, Yang Jinsong, a senior researcher at the China Tourism Academy, told the Global Times on Wednesday.

"The epidemic is of course one cause but it's not the only one, as other factors, including politics, are also included," Song said, noting that being unfriendly to China can change people's perception of the country and make them feel less secure in going there.

A manager with Galaxy Dragon Travel based in Sydney, who declined to be identified, told the Global Times on Wednesday that business from China this year will tumble, and there may not be a single Chinese tourist during the whole year - for various reasons.

The company's main customers are Chinese tourists, who account for 80 percent of all customers. Because of the pandemic, no tour groups came in late January, so the company closed its office and hasn't reopened yet.

Tourism Australia had expected 42 percent of all international arrivals to come from the Chinese mainland by 2020.

The travel agency's plight is shared by companies that capitalize on Australia being favored among Chinese international students.

"There will be an especially sharp drop in Chinese students, not just from the effect of the COVID-19 restrictions, but also from the mounting tension in bilateral relations," Liu Qing, director of the department for Asia-Pacific Security and Cooperation at the China Institute of International Studies, told the Global Times on Thursday.

There were 152,591 Chinese students in Australia for higher education in 2018, accounting for more than one-third of the total. However, according to Liu, the bottom fell out of the relationship between China and Australia recently, and the unclear future is likely to weigh heavily on families' choices of higher education destinations.

An anonymous education consultant from one of Australia's biggest agencies told the Global Times that inquiries from China regarding applications to Australian universities have dropped sharply, and there will probably be few Chinese students coming in next year.

"One big reason is that it is not yet clear when or how the COVID-19 outbreak will be contained," he said, "but for many students coming to Australia, it is very important to be able to join and assimilate into the local communities, and that looks increasingly difficult now."

For many students, rising sentiment against immigrants is also an issue. Last month, Prime Minister Scott Morrison himself urged people to "make your way home" if they were visitors or international students, making many Chinese students feel that they are being reduced to residents only for economic purposes.

"His statement made me feel that we are only welcome when our tuition fees and the related economic effects are needed," Cindy, a Chinese student studying marketing at the University of Melbourne, told the Global Times. "Chinese people have been turned against and sometimes attacked because of the COVID-19 pandemic. Such a negative statement from the PM is sure to fuel discrimination," Cindy said.