COMMENTS / EXPERT ASSESSMENT

Using SWIFT settlements to threaten China will backfire

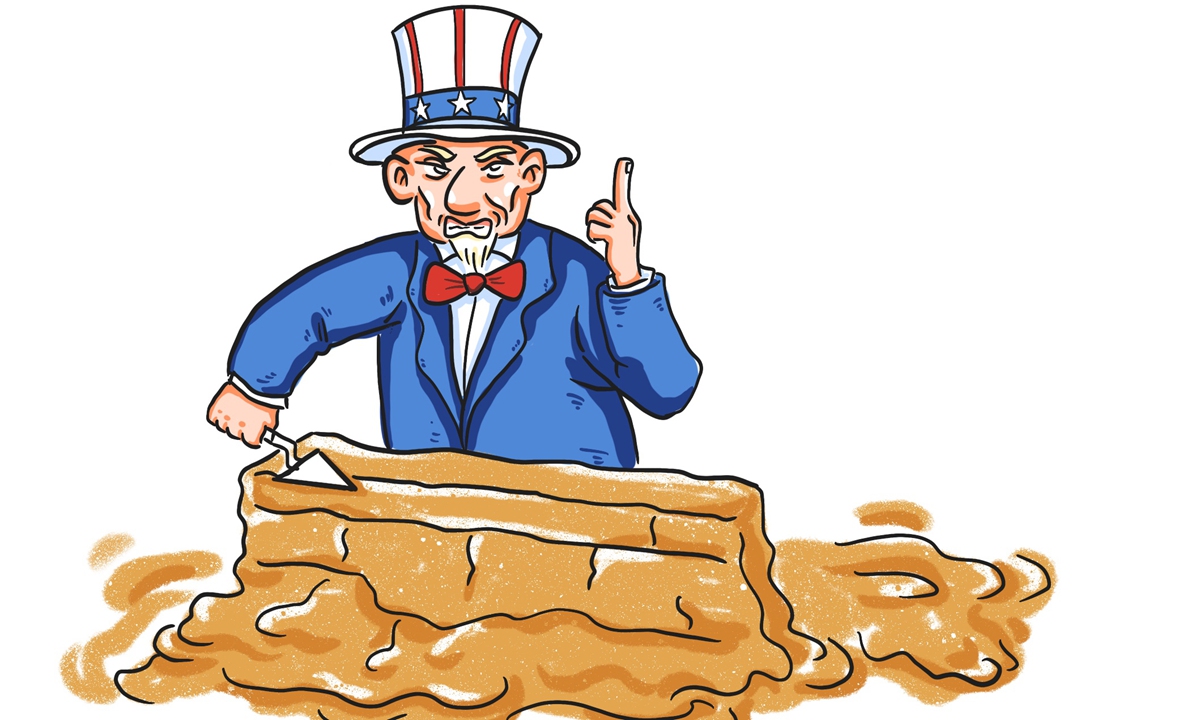

Illustration: Tang Tengfei/GT

As bilateral tensions continue to elevate, the US has been taking up various measures to contain China. Russian media recently reported that the US may even roll out extreme financial blockades to hamstring China and Russia, which could mean excluding the two countries from the US dollar denominated international payment network or SWIFT, a drastic move that will bring huge destruction to the international financial system.

From restricting exports of US technological products to China, slapping punitive tariffs on Chinese imports, forcing US firms to leave China market, to cracking down on the world's top telecom equipment maker Huawei, the US has been tightening its economic and trade restrictions on China using all means at its disposal.

And, it is possible that US could resort to its last remaining weapon, by restricting or even blocking China from the dollar clearing and settlement system.

The dollar clearing and settlement system or the Society for Worldwide Interbank Financial Telecommunication (SWIFT), is a global payment system in which US dollars are traded, transferred, settled, and stored around the world. The system's quote currency is US dollar, and is therefore controlled by the US government.

SWIFT was nominally a non-profit organization before the September 11 terror attacks in 2001. Its operation mechanism was then altered by the George W. Bush administration, which forcibly broke the global payment network's operating rights. Its safety, reliability, speed, standardization and automation were greatly damaged so that the network could become a US foreign policy tool, a feature which has since dominated the system's operation.

SWIFT became a weapon of the US, allowing the nation to force other countries and regions out of the global financial market by limiting or blocking them from the clearing regimes. Iran, Venezuela and Zimbabwe are among the countries that were impacted. With the dollar as a major global reserve currency, the US financial watchdogs can monitor the non-cash circulation of every cent.

In order to form a substitute platform, the EU established the Instrument in Support of Trade Exchanges (INSTEX), but the attempt resulted in almost nothing. China launched the Cross-border Interbank Payment System (CIPS) in 2015, an independent clearing system with the yuan, China's currency, as the quote currency.

For any trade activity using the US dollar, SWIFT serves as an inevitable path. However, a complete economic "decoupling" from China is impossible for the US, as is isolating China from the global economic system, no matter what kind of restructuring is promoted by the US.

Moreover, any such move would backfire if the US intends to limit or block China's usage of SWIFT services, though the move could also cause some problems for China. Although America's superpower status will not be immediately at risk, the US dollar hegemony will collapse given that China is the second-largest economy, with huge dollar reserves and bonds.

The animosity held by the US cannot be overlooked. Amid the current COVID-19 pandemic, China's viable route for a stable growth is to continue promoting the development of the yuan, including the promotion of the digital yuan and the yuan-denominated transactions, and expanding the usage of the yuan in trade and investment.

The author is chief scientist of the Center for Country Risk Studies. bizopinion@globaltimes.com.cn