People visit a shopping area in Shanghai on July 4. Photo: CFP

After turning in its first contraction on record in the first quarter amid the epidemic, China's economy is back on a growth track in the second quarter, market estimates collected by the Global Times show, a feat that sets the economy apart from the rest of the world that is still seeing the disease acutely undermine growth.

Business owners and industry insiders, who have survived the growth-freeze and job-slashing pandemic, say they were prepared for the worst but are now seeing things are turning out better than expected. Attributing the snap-back V-shaped rebound largely to the nation's swift and effective coronavirus response, they told the Global Times that it was the nation's institutional advantages that helped them out of the virus plight.

As a veteran entrepreneur who has gone through multiple crises including the 1997-98 Asian financial crisis and the 2008 global financial crisis, Wei Guoxian, founder of Jiangsu Shengli Tools Co, an export-oriented hardware tools manufacturer, said that the COVID-19-induced economic hit is the worst he's ever encountered.

Wei's company exports 95 percent of its products to overseas markets including the US, Europe and Southeast Asia. It was raking in a gross profit margin of 20 percent annually before the pandemic slammed its business.

The nation's quick COVID-19 response has helped reboot the economy to the amazement of Wei's overseas clients, and has effectively alleviated damage to a broad band of businesses betting on an economic rebound.

"I had hoped the company would break even - the best possible result for the year - but it seems now we'll remain slightly profitable," Wei said with relief.

Snap-back in sight

Other entrepreneurs are anticipating a thriving economy that's slated to report an expansion of close to 3 percent from its worst quarter.

The economy has staged an impressive comeback since mid-March, "bolstered by pent-up demand, a catch-up in production, a surge in medical product exports and stimulus in both China and other major economies that has boosted demand for goods made in China," Nomura economists led by Lu Ting said in a note sent to the Global Times.

They put real GDP growth at 2.6 percent year-on-year for the second quarter, up from a previous prediction of 1.2 percent.

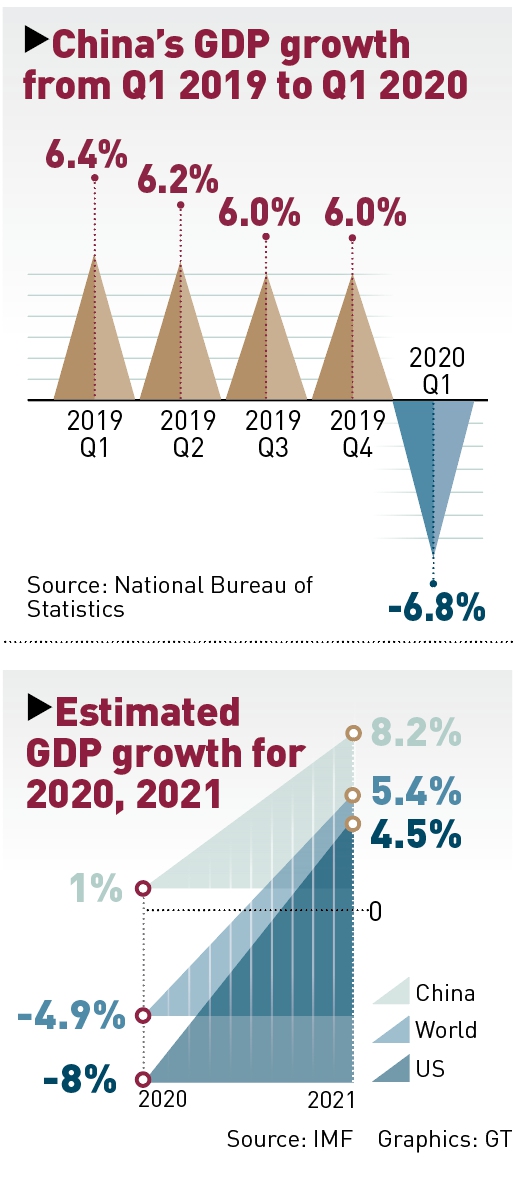

A raft of economic indicators, notably the quarterly GDP, are scheduled to be announced by the National Bureau of Statistics (NBS) on Thursday. The economy contracted 6.8 percent on a yearly basis in the first quarter, NBS data showed.

Along with the accelerated domestic production recovery since April, manufacturing activities in the second quarter may recover to the level of last year, and an investment drop in the sector will narrow in the latest months, said Zhao Jinping, former head of the foreign economic research department at the Development Research Center of the State Council.

"We will see stronger momentum in domestic consumption recovery in the second quarter," he said.

Wanda Group told the Global Times the conglomerate has opened three new Wanda Plazas in China, with each of them providing 4,000 new jobs on average with more than half of the positions open to graduates.

"Compared with the first quarter, Wanda Plazas have seen significant improvement in the second quarter, thanks to the well-implemented epidemic control and prevention measures, release of consumption vouchers, rent-free policies of Wanda and various campaigns to boost consumer confidence," Wanda said, adding all 326 Wanda Plazas across China have recovered operations.

Powering ahead

But what exactly makes the Chinese economy so resilient to warrant being singled out by the IMF as the only major economy to post positive GDP growth this year in its latest world economic growth projections released in late June?

Zhang Jiening's experience could arguably offer a glimpse into the fundamental vitality of the economy, which has institutional advantages that allow companies like Zhang's to survive transitory economic bruising from the pandemic.

Zhang has run Lotus Restaurant in Shanghai since 2004. The two-floor restaurant had revenue of about $57,179.60 a month before the coronavirus. Now epidemic control measures have eased, and even more gourmet diners are visiting the restaurant and monthly revenue has increased to around 450,000 yuan.

The restaurant's 70 percent-recovery in the second quarter was beyond Zhang's expectations. Sales of the restaurant's stored-value cards doubled year-on-year.

"China has submitted a satisfactory answer sheet in stabilizing its economy," said Zhao who believes the Chinese economy will account for a notably bigger part of the global economy when the pandemic grinds to a halt.

Unrecovered international travel and disrupted global supply chain may have a greater impact in the third quarter, said Zhao.

Wei says his business could be subject to potentially greater uncertainty in months to come, as some of the clients have canceled orders while some have postponed their orders due to the still raging disease outside of China.

But the stronger-than-expected first half - proof that the Chinese economy will only press ahead with indomitable will - instills him with confidence about what lies ahead for the rest of the year.