SOURCE / INDUSTRIES

China’s top AI chip unicorn Cambricon surges more than 290% on first trading day

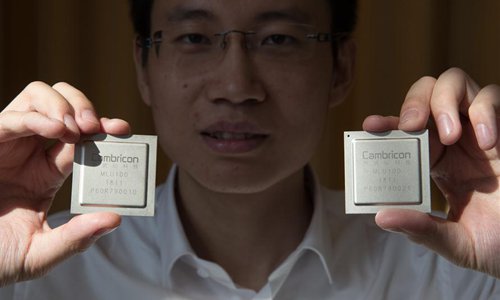

Cambricon Technology CEO Chen Tianshi shows a pair of MLU100 cloud AI chips in Shanghai, east China, May 3, 2018. China's first cloud artificial intelligence (AI) chip was released by the Chinese Academy of Sciences (CAS) on Thursday in Shanghai. The cloud chip MLU100, developed by Cambricon Technology, will have accurate and fast big data processing ability, especially in image and voice search methods. (Xinhua/Jin Liwang)

Chinese AI chip firm Cambricon, once Huawei's AI chip supplier, saw its shares surge by more than 290 percent on its first trading day in Shanghai on Monday, indicating Chinese investors' strong confidence in the crucial sector amid intensifying China-US tech competition.

Cambricon's shares had surged 234.2 percent to 215.22 yuan ($30.77) by press time, significantly higher than its proposed price of 64.39 yuan per share.

Cambricon was founded in 2016 by Chen Tianshi, a researcher at the Chinese Academy of Sciences, China's top research agency. Key strategic investors of Cambricon include Lenovo Group, the world's largest personal computer maker, and Chinese smartphone maker OPPO. The two investors also participated in Cambricon's IPO.

Huawei, once Cambricon's biggest client and a key source of revenue, has become a direct competitor after it decided to use AI chips designed by its own chip arm HiSilicon, Cambricon said in its prospectus.

The company's net losses hit 1.18 billion yuan in 2019, expanding from 41 million yuan a year earlier, although its revenues more than tripled to 443.9 million yuan, Cambricon said.

Industry insiders said market expectations for the firm are quite high given its sales performance and peak competition in the AI chip sector, noting that only with accelerated development could the firm be "worth its share price."

Moreover, Cambricon's funding gap is still relatively large with even after the fundraising. 3-3.6 billion yuan will still be needed to invest in chip research and development involving five to six chip products, analysts noted.

Cambricon's share sale came days after China's biggest chip maker, Semiconductor Manufacturing International Corp (SMIC), listed on the Shanghai STAR market. SMIC saw its share price surge 245 percent at opening on its first trading day in Shanghai on July 15.

Shares of SMIC dropped by 3.7 percent on Monday morning.