SOURCE / INDUSTRIES

Early start on blockchain prevents West from kicking China out of digital currency race

Photo: IC

Shares of digital currency-related Chinese companies edged up on Tuesday's opening, with some rising by the daily limit of 10 percent. Investors were encouraged by a tone-setting central bank meeting on Monday which paved the way for the steady development of China's Digital Currency Electronic Payment (DCEP) in the second half of 2020.BJCA and Huijin shares, soared by the 10 percent limit on Tuesday's closing, and other shares including GRG Banking and Feitian rose by more than 3 percent.

The rally came after the People's Bank of China (PBC), China's central bank, said late on Monday that the closed trials of China's sovereign digital currency, DCEP, had been launched successfully. The PBC also said that in the second half, it will proactively and steadily promote the research and development of DCEP. The statements were posted on the PBC's website following a teleconference on Monday.

China has been accelerating the push to launch its central bank-backed digital currency in recent months amid fraying relations between the world's two largest economies and Washington's threat to recklessly cut Chinese financial institutions from the SWIFT payment system.

Some analysts say the cryptocurrency is a way for Beijing to challenge US dollar hegemony.

"The central bank's meeting sent an important signal that DCEP's closed testing has achieved positive progress. Certain issues involving the underlying technologies as well as how the digital currency will be run and distributed have been resolved. An official launch is likely imminent," Wang Peng, assistant professor of the Gaoling School of Artificial Intelligence at Renmin University, told the Global Times on Tuesday.

Accelerated push

In late July, China's central bank established Chengfang Fintech in Beijing, with a registered capital of over 2 billion yuan ($286 million), according to company information platform Tianyancha.

Investors of the new firm are all state-owned players, including the PBC Credit Reference Center, China Gold Coin Incorporation, China Financial Computerization Corp, China Banknote Printing and Minting as well as the clearing center under the PBC.

In mid-July that the digital currency research institute under the PBC had been cooperating with ride-hailing platform Didi Chuxing, Tencent-backed video platform Bilibili, and food delivery giant Meituan Dianping, with plans to test the digital currency on those platforms. The three platforms are now trialing the digital currency.

Meituan has 450 million active users, Didi 550 million, and Bilibili 170 million. The launch of the trials marks a major step for the virtual legal tender's mass application, as the three companies market transaction volumes could each amount to billions of yuan a day.

The Global Times has learned four commercial Chinese banks and the country's three major telecoms carriers are also participating in the trials.

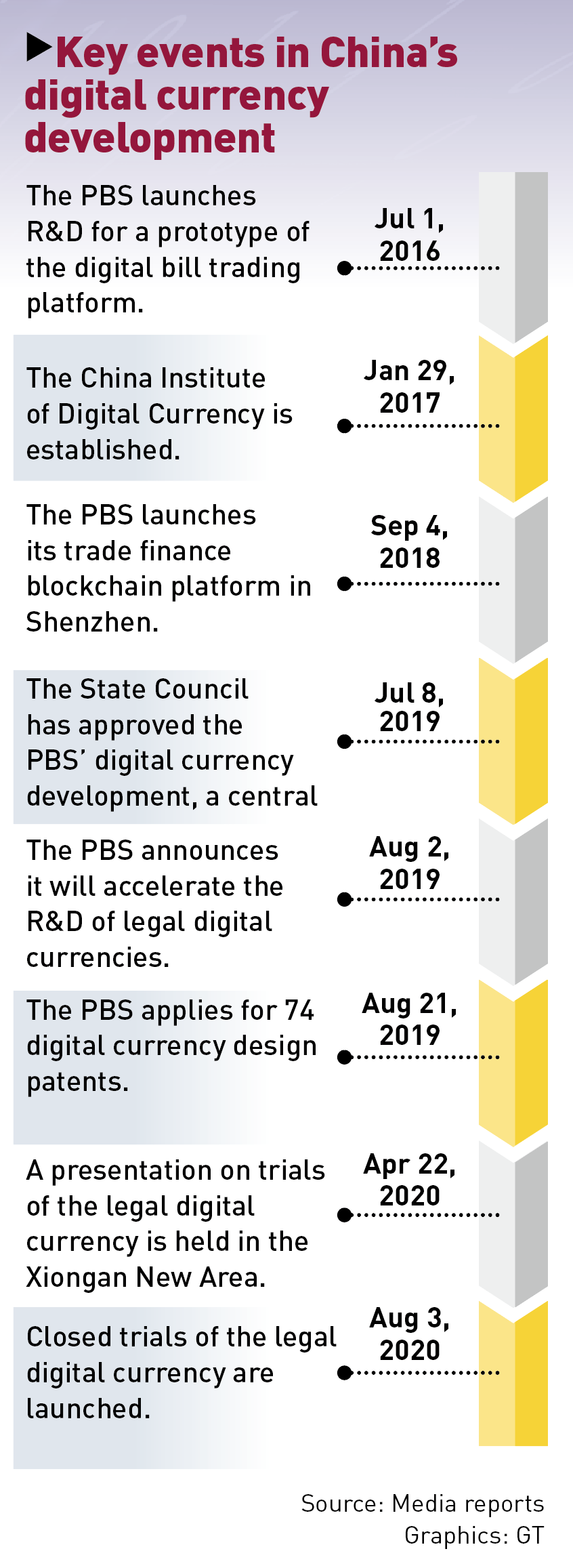

China's research into DCEP started as early as in 2014. But pilot testing programs only began this year.

Yi Gang, governor of the PBC, said in late May that internal pilot tests of the central bank's digital currency will be carried out in four cities including Shenzhen in South China's Guangdong Province, as well as in the Xiongan New Area. The central bank will carry out testing in scenarios for the 2022 Winter Olympic Games in Beijing.

Cao Yin, a Beijing-based blockchain industry insider, told the Global Times that it is unlikely China will see the large-scale application of DCEP in 2020. But more Chinese cities, like Shanghai and cities in South China's Hainan Province, could be included in pilot testing next year.

DCEP could also be trialed in more industries in 2021 in addition to its pilot testing in the retail sector, for example in foreign trade, Cao predicted.

Global race

In recent days, G7 countries have reportedly been promoting cooperation on central bank digital currencies (CBDCs) and will discuss the issue at the annual G7 summit that is scheduled for late August or early September.

"The US dollar has been dominating the financial order, but a conspiracy from some Western countries to use CBDCs to kick the Chinese yuan out of the global digital currency race is doomed to fail. As the race heats up, Beijing has taken the lead, thanks to an early start and an advanced blockchain industry," Wang said.

He stressed that the digital currency is another form of sovereign currency that China must safeguard for its financial security.

Analysts said the US' hegemony is partly aided by its dollar system, and China should therefore unite with other partners, such as the countries and regions along the Belt and Road Initiative, to create another financial system to counter US unilateralism.

US politicians have been threatening to cut certain Chinese banks and companies from the SWIFT international payment system as part of a malicious crackdown on China.

Cao said that if a DCEP-supported financial system is established, countries that object to US bullying could join, bypassing the dollar system to make transactions so as to avoid arbitrary US sanctions.

On July 23, the Bank of Lithuania issued LBCOIN, the world's first digital collector coin. It is the first digital coin issued by a central bank across the world.

Graphics: GT