SOURCE / INDUSTRIES

Major US semiconductor firms tighten sales channels in China

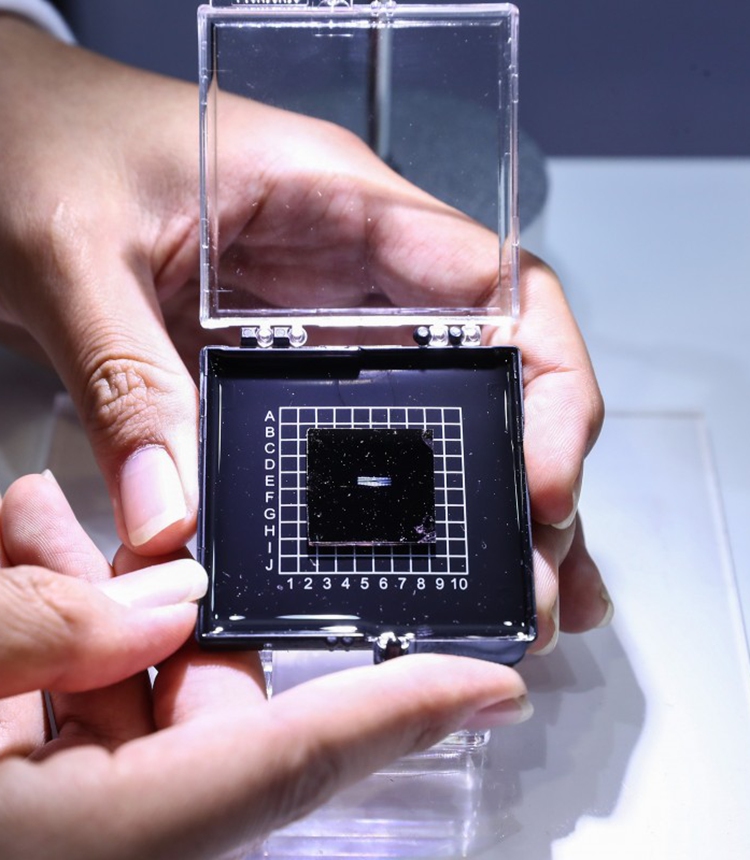

chip Photo:Xinhua

Major US semiconductor firms such as Texas Instruments and Micron Technology have tightened their sales in China to prevent American-made semiconductors from being sold to Chinese companies on which US President Donald Trump has imposed sanctions.

"It was getting hard to find Texas Instruments agents in the Chinese mainland at mid-year. The ones I knew of have lost their agency qualifications," Sun Zhenxiang, head of Shenzhen Yudamei Electronic Ltd, told the Global Times Tuesday. The company is a secondary dealer of imported chips used in consumer electronics like tablet computers and auto navigation systems.

Sun said that Texas Instruments dropped a couple of dealers in the mainland in the summer of 2019 and began selling directly to terminal manufacturers, sending a shockwave through semiconductor dealerships.

As a large maker of analog integrated circuits (ICs), Texas Instruments exported about $8.6 billion worth of chips last year to Asia, a large proportion of which entered the Chinese mainland market via its agents and dealers.

Sun said it has been difficult recently to get memory chips from Micron agents in China. "Since June, a Micron agent has repeatedly said it's out of stock. It's also imposed many restrictions — for example, which companies can buy chips," he said.

Neither Texas Instruments nor Micron could be reached for comment.

Liu Kun, a Beijing-based semiconductor industry analyst, told the Global Times Tuesday that Texas Instruments has been trying to prevent sales of its semiconductors to countries and companies that the Trump administration has placed on a blacklist.

"China's Huawei Technologies is obviously one of the US Government' main targets," Liu said, noting that Huawei could develop broader cooperation with other industry suppliers like Taiwan-based MediaTek Inc, though at a higher cost.

Sun said that the normal inventory turnover is between four and six months, but as far as he knows some companies, which he declined to identify, have stored sufficient chips for the next three years.

However, lower reliance on US-produced semiconductors would in turn create new opportunities for China's domestic chip makers.

Over the past several years, China's semiconductor industry has made outstanding progress, with world-class firms such as integrated chip design provider Goodix Technology having made breakthroughs in the high-end chip application market.