SOURCE / INDUSTRIES

Japanese firms keep focus on China

Early economic recovery after pandemic offsets tensions with US

The launch event of the White Paper Photo: Yin Yeping/GT

Japanese companies will continue to focus their supply chains in China, where the economy is recovering rapidly in the post-epidemic era, business representatives and experts said, despite rising US-China tensions and the Japanese government's drive to bring factories back.

A recent White Paper by the Japanese Chamber of Commerce and Industry in China drew on 10 surveys since January that involved the active participation of 8,678 member companies. The results reflected the importance of the Chinese market to Japanese companies.

A key factor that's driving up demand for Japanese businesses in China is the successful containment of the COVID-19 outbreak, along with the steady economic resumption.

As China's domestic market has recovered, so has the business performance of Japanese companies, said Takeo Donoue, director-general for the Beijing office of the Japan External Trade Organization, who spoke at the launch of the white paper.

Donoue noted that the auto industry and its suppliers, for example, are doing much better in the resumption.

More than 70 percent of the companies said they appreciated the Chinese government's response to the COVID-19 pandemic. Some also called for the early normalization of travel between Japan and China and a response to the expiration of visas and residence permits, said the paper.

However, not everything is going smoothly. Rising US-China trade friction makes it difficult for Japanese companies to discern trade trends and make production plans, and it is unclear how much the friction, which has expanded from trade to technology, will affect Japanese companies, said Donoue.

Japan allocated 220 billion yen ($2.1 billion) in its economic stimulus package in April to help Japanese companies in China move back home or to Southeast Asian countries. Tokyo aims to diversify its supply chains and ensure domestic industrial security.

Some Japanese companies in China have applied for this funding, but most of them make masks and other medical protective equipment. The general trend of increasing investment in China by Japanese companies won't change, Xiang Haoyu, a research fellow at the China Institute of International Studies, told the Global Times on Wednesday.

"Many Japanese companies saw China's advantages through COVID-19 and want to expand and upgrade their production capacity in China," Xiang said.

Toyota Motor Corp's car sales in China rose 27.2 percent in August from a year earlier to 164,400 units, the fifth straight monthly increase, the company said in early September.

Major Japanese automakers such as Toyota and Honda enjoyed strong sales in China in the second quarter and many of them plan to expand investment and production in China, experts said.

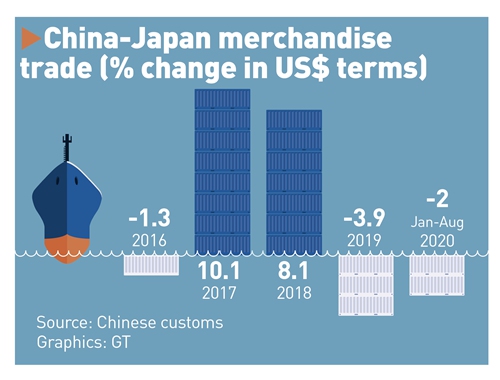

Japanese investment in China has been growing steadily in recent years, especially last year, and despite the inevitable impact this year from the epidemic, bilateral trade and investment has flourished.

Japan's direct investment in China in the first half of this year amounted to $6.45 billion, according to Japan's Ministry of Finance, little changed from a year earlier.

In the second half of the year, Japan's investment in China is expected to remain stable as the impact of the epidemic wanes and China, in particular, takes the lead in resuming work and production and the economy rebounds strongly, experts said.

Experts believe that these trends will persist after Japan welcomes its prime minister.

"Yoshihide Suga's top priority will be to revive the economy, and China's huge market and economic and trade cooperation with China are very important to Japan's economy," said Xiang.

According to a survey, more than half of the Japanese companies have no plans to change their business in China. A separate survey last year found that only 9.2 percent of Japanese companies planned to move any of their facilities out of China, said Donoue, noting that he personally does not think there will be a big change in the way Japanese companies do business in China.

"Whoever is in the government, China and Japan should always have a partnership that is based on dialogue, and it is our hope that bilateral business will reach a new level," Donoue said.

Yoshinori Ogawa, chairman of the Japanese Chamber of Commerce and Industry in China, is also confident in the Chinese market and its importance for Japanese firms. "Japanese companies are striving to develop with China as the economy becomes globalized and supply chains become further intertwined," Ogawa said.