Shares of Chinese major chipmaker Semiconductor Manufacturing International Corp (SMIC) plunged on Monday after news broke over the weekend that the US is considering imposing export controls on the company.

SMIC's shares fell 7 percent on the Shanghai Stock Exchange to 49.94 yuan ($7.33) and 4 percent to HK$17.86 ($2.3) on the Hong Kong Stock Exchange on Monday.

According to some Western media reports, US suppliers will be banned from exporting to SMIC without obtaining export licenses from the US government.

SMIC said it has yet to receive an official notice from the US administration, and on Monday, Wang Wenbin, spokesperson for China's Foreign Ministry, said that China will take necessary measures to defend Chinese companies' interest.

Seen as a premium production base in China's drive to be more self-sufficient in semiconductor manufacturing, SMIC's shares jumped more than 200 percent on the first day of trading, after its secondary listing in Shanghai in July, lifted by broad enthusiasm among investors.

"Although it is unclear whether the sanctions will be as harsh as those involved with the Entity List, investors are chilled by rising concerns over SMIC's future business, especially when the US seems determined to cut it off from US supplies," Geng Bo, deputy secretary-general of the China Solid State Lighting Alliance, a semiconductor industry association, told the Global Times.

Despite the ambitious plan to achieve more technological self-sufficiency, there is still a huge gap between China and the top-tier players in the world, in making ever-smaller semiconductor wafers, Geng said.

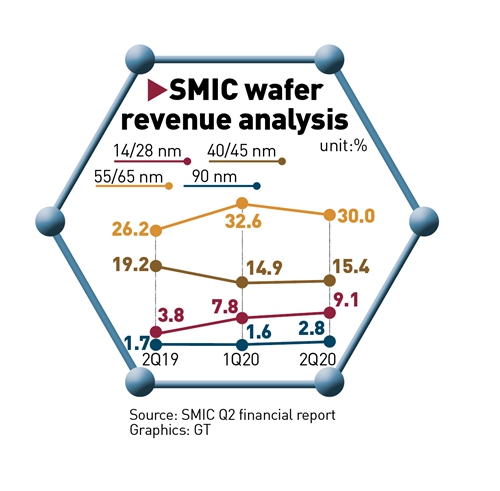

While many international bellwethers have been making 5-nanometer microchips for years, SMIC only started 14nm production last year. Most of SMIC's products fall into the range between 28nm to 90 nm, and chips of or smaller than 28nm accounted for less than 10 percent of SMIC's total revenue in the second quarter this year, according to the company's financial report.

In the meantime, Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker, is planning to produce 5nm chips in volume within this year, and it will begin manufacturing 3nm processors around 2022. Samsung, another leading chipmaker, has also started mass production of 5nm chipsets.

Apart from manufacturing equipment and hardware, electronic design automation (EDA) software development, which is a set of software for designing integrated circuits, is also an area where China needs to make more effort to achieve independence.

"EDA is like the brains of the industry. Currently, most of the best EDA companies are in the US", Geng said.

"If China cannot address its weaknesses like the lack of an EDA supply chain, it will still be reliant on importing technology and vulnerable to any future US sanctions."