US market not primary for payment platforms

Playing tech war is not Trump’s priority: analysts

People visit the Ant Financial stand at an digital economy exhibition in Fuzhou, East China's Fujian Province on April 25. Photo: VCG

Even if the US government tightens restrictions on the digital payment platforms managed by China's Ant Group and Tencent Holdings as reported by US media, the subsequent effects will be unsatisfying for US President Donald Trump, analysts said, because what the Trump administration needs most now is "votes" that often come from "fast track" approaches, but launching trade and tech wars against China only take effect slowly.

In the name of so-called "security concerns" — the old trick played by the Trump administration to crack down on Chinese companies — the US now looks to strike two major Chinese digital payment platforms, possibly barring them from engraining themselves in the US financial system.

Talks over how and whether to restrict Ant Group and Tencent's payment systems have gained traction among US officials in recent weeks, although a final decision is not imminent, Bloomberg reported, citing unnamed sources.

Ant group said that the company was unaware of any such discussions.

"Ant Group's business is primarily in China, and we are excited about our growth prospects in the China market. Our mission is to contribute to economic growth and job creation through serving ordinary consumers and small businesses," the company said in a statement.

Founded by Chinese billionaire Jack Ma, Ant Group provides digital payment services primarily to Chinese citizens via Alipay, including wealth management, credit checks and consumer loans.

Backed by Chinese e-commerce giant Alibaba, the fintech (financial technology) company plans for a record-setting dual listing in Hong Kong and on Shanghai's STAR Market this month, in what could be the world's largest initial public offering, surpassing the IPO of the oil giant Saudi Aramco, in December 2019.

An official at a state-backed Chinese fund, a potential investor in the Ant IPO, told Reuters that he was not worried about the planned US restrictions, as the US market only accounted for a tiny portion of Ant's overall business.

According to Ant's IPO prospectus, the company gets less than 5 percent of its revenue from outside China.

Alipay, together with Tenpay under Tencent, held 93.8 percent of China's third-party mobile payment market in 2019, according to research firm Analysys.

Tencent did not respond to the Global Times' inquiry as of press time.

"From a trade war, tech war, to a possible financial war, it is likely for the US to put limitations on these two successful Chinese enterprises… and such sanctions may be pushed forward by American capital power, such as local internet giants who are lobbying the US government," Chen Bo, director of Digital Finance Research Center at Beijing-based Central University of Finance and Economics, told the Global Times on Thursday.

Citing a 2019 hearing in the US, in which Facebook CEO Mark Zuckerberg said the company's Libra digital currency could serve as counter to Chinese digital currency, Chen noted some US internet giants, such as Facebook and Twitter, may have lobbied for the government's backing in order to maintain their global dominance.

However, their efforts have not achieved the desired results so far. US federal judges in late September temporarily blocked Trump's attempts to ban Chinese social media apps TikTok and WeChat, and a hearing on November 4 will provide a decision on whether the ban with be followed through for TikTok.

Although being hit by the Trump administration, TikTok championed the most downloaded non-gaming app worldwide for September, with more than 61.1 million installs, mobile application data research firm Sensor Tower said on Wednesday.

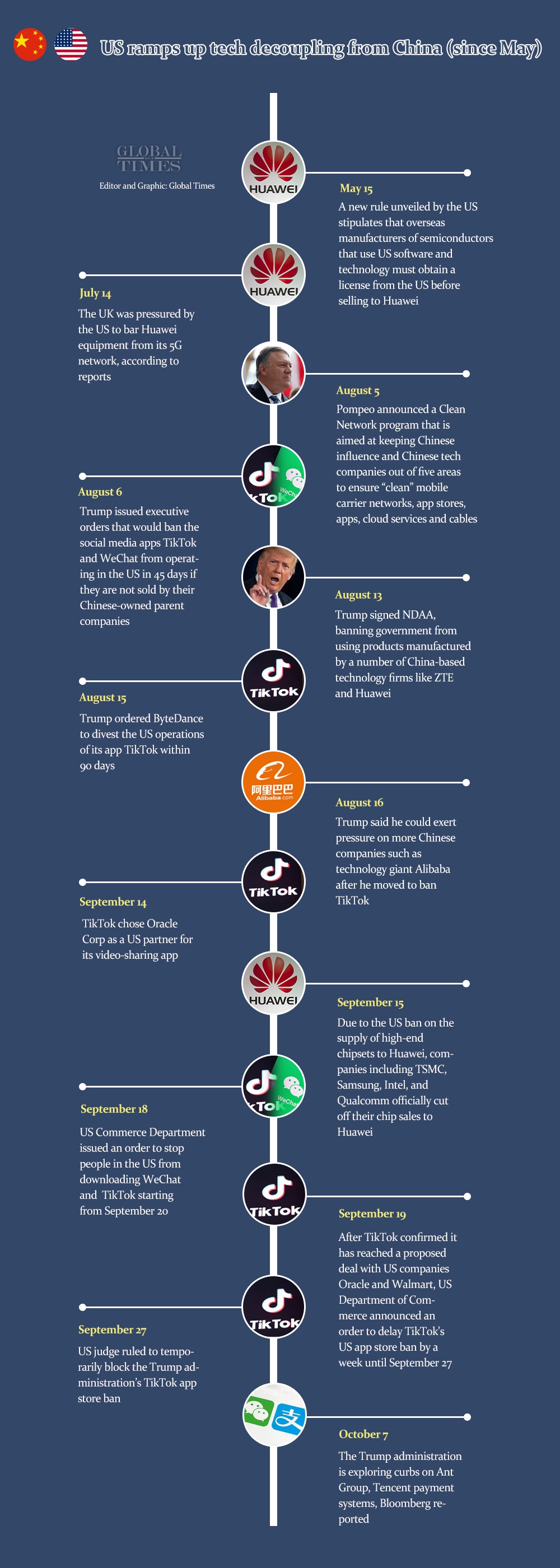

Graphics: GT

"Different from the strikes on Huawei, digital payment apps have weak exclusiveness, which means one user and one country could have multiple payment apps. In addition, the US is not the main market for the two platforms as their primary customers are Chinese," Ma Jihua, an internet industry analyst, told the Global Times on Thursday.

In actuality, Ma noted it is hard for the US government to find any excuses to ban the two enterprises as they have been supervised by the US financial regulatory system since they first entered the US market.

"If Trump wants to gain votes by pushing forward bans on Chinese apps, TikTok and WeChat should come first as he had no success in implementing the bans on these two apps," Ma said.

"With only a month before the US presidential election, his primary job is not playing the 'trade and tech wars' with China as they take effect slowly, but to gain votes quickly through approaches that pay off right away," he added.