SOURCE / INDUSTRIES

Civil aviation industry rebounds nearly 100%, but losses expected in Q1-3

Passengers at the Kunming Changshui Int'l Airport in Kunming, Southwest China's Yunnan Province, on October 8, 2020 Photo: IC

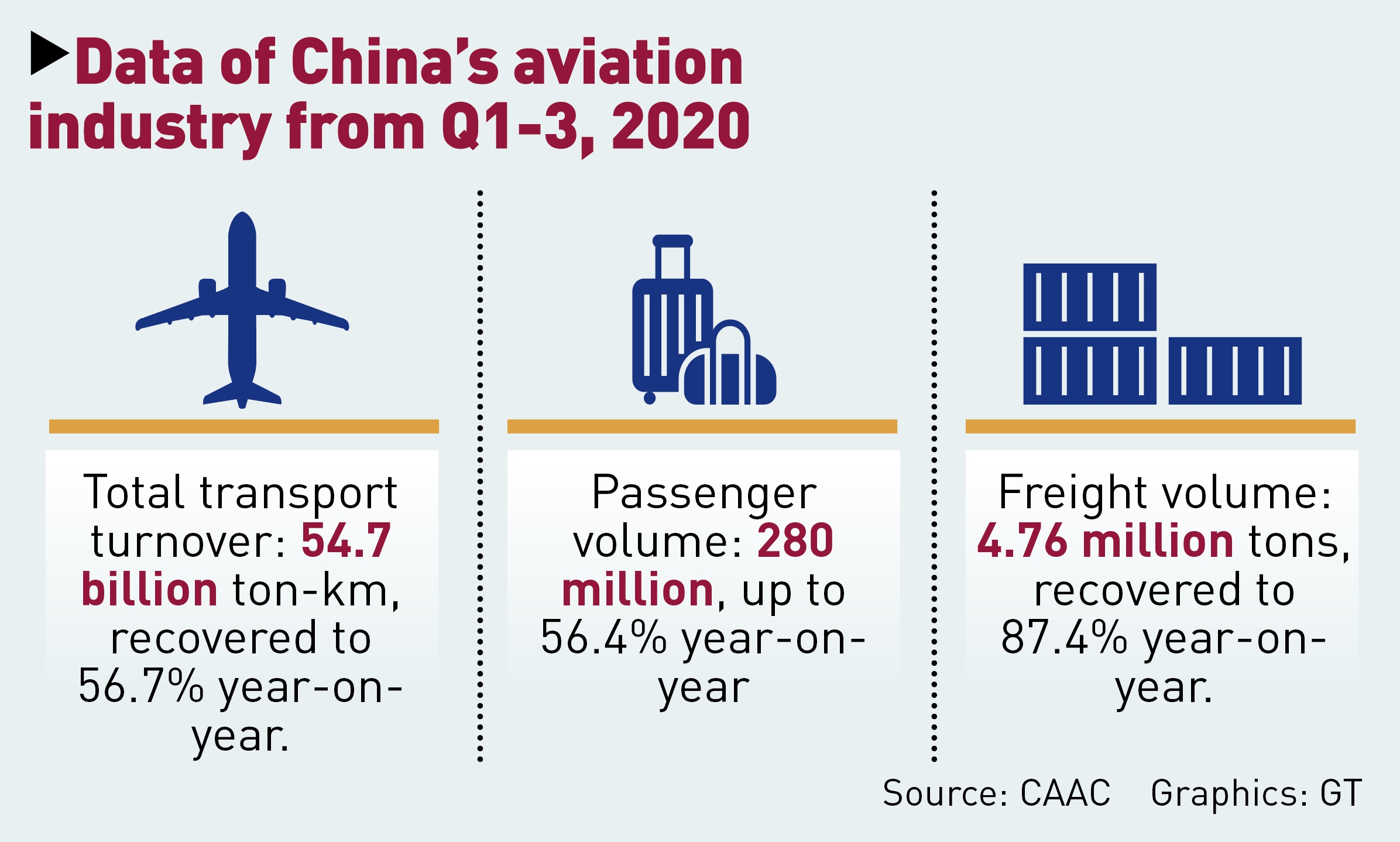

Chinese civil aviation industry is in a full swing of recovery, as latest data showed that the passenger trips in September reached the level of the same period last year, thanks to the robust domestic demand.The industry reported domestic passenger trips of 47.75 million in September, 98 percent of the volume in the same month last year, Chinese civil aviation regulator Civil Aviation Administration of China (CAAC) said on Thursday.

The September data also improved the figures on the industry performance for the first three quarters, as the official data showed that the passenger volume in the first three quarters stood at 133 million, recovering to 56.4 percent of the same period last year, which was attributed in large part to the data from the third quarter.

The industry started to see the upturn since the summer vocation as domestic airlines such as China Eastern Airlines and China Southern Airlines increased flights during the summer holiday amid a gradual recovery of flying and tourism.

China Eastern Airlines said in July that transport capacity for domestic routes was restored to more than 70 percent, and China Southern said it would focus on hot spots such as the Greater Bay Area, and redirect some of the capacity of international routes to the domestic market.

Shanghai-based budget carrier Spring Airlines said on Wednesday that it has opened over 60 new routes to capitalize on demand as domestic travel outpaced overseas journeys amid the epidemic.

The domestic market flight volume has already recovered to the level of the same period last year at the end of August, and the passenger traffic volume has also recovered at the end of September, said Lin Zhijie, a market watcher.

Further, the October data could also boost the performance, as the industry saw about 90 percent of the average daily passenger traffic and average daily flight volume during the National Day holidays, which is likely to contribute greatly to the yearly performance of the sector.

However, the recovery involume does not mean return to profitability, as more data indicated that the financial performance in the first three quarters will still be worrying.

Shandong Airlines estimated that in the first three quarters of 2020, it will incur a loss of 1.51 billion yuan ($224.45 million) to 1.84 billion yuan, compared to a profit of 694 million yuan in the same period last year.

Shenzhen Airport said it will have a loss of 54.38 million yuan to 64.38 million in the first three quarters, compared to a profit of 480 million yuan year-on-year.

Experts said low occupancy rate, low ticket prices, and limited overseas flights are still hurdles to profitability, although the passenger traffic and number of flights are recovering.

China Eastern Air Holding Co said on Monday that it will receive a cash injection of 31 billion yuan from four companies, which is believed to cut the asset-liability ratio of the group, as by the end of June this year, the asset-liability ratio of the airline was 78 percent, the highest among the three giants.

China Eastern said in its half-year report that its passenger turnover on international routes had dropped by 73.64 percent, and its income on international routes was also down more than 61 percent. A note written by Guotai Junan Securities even predicted that the loss recorded by China Eastern in 2020 would rise to 9.333 billion yuan.

The industry continues to suffer severe losses since the outbreak of the pandemic, losing 34.25 billion yuan in the second quarter, 3.85 billion yuan less than in the first quarter, the CAAC said.

The global aviation industry is still bleeding. According to data from travel data firm Cirium, due to the plummeting demand for air travel caused by the virus, 43 commercial airlines have gone bankrupt so far this year, close to the full year number of 46 in 2019, and more are expected to go into bankruptcy in the coming months.

The International Air Transport Association early predicted that the COVID-19 crisis will cause airline passenger revenues slashed by $314 billion in 2020, a 55 percent reduction compared to that of 2019. It also said the full-year passenger demand, for both domestic and international, is expected to be down 48 percent compared to 2019.

Graphics: GT