China's export law gives teeth to national security

US’ long-arm jurisdiction against Chinese firms can be fought: analysts

rare earth Photo:VCG

China's new export control law, which authorizes the government to take countermeasures against any country or region that abuses export-control measures and poses a threat to China's national security and interests, could be used to break the US' "long-arm" jurisdiction against Chinese companies in an increasingly brutal face-off between Beijing and Washington.

In particular, analysts said, the new law could pave the way for state-sanctioned export controls on rare-earth metals, in what they described as a "no chips, no rare earths" tactic, with reference to the US government's cutting off major supplies to Huawei Technologies Co.

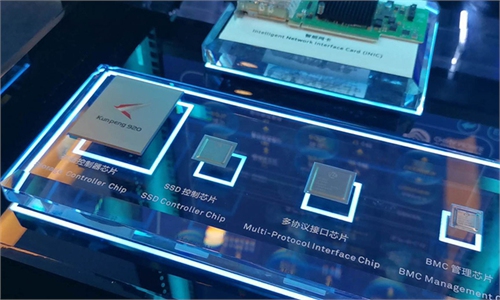

The Trump administration has been abusing "national security" protection and using excessive export-control measures to attack Huawei to counter the company's rapid global rise. The US government has endangered global technology supply chains by coercing technology companies in other countries to comply with its export control measures, pushing Huawei to the brink of losing its smartphone business, with its stockpiles of chips set to run out next year.

Zhou Shijian, a senior research fellow at the Center for US-China Relations at Tsinghua University, said the malicious approach adopted by the Trump administration to assault Huawei, one of China's technology champions, has made the US vulnerable to reciprocal export control measures by China, as authorized by the newly adopted law.

"It makes no sense for the Trump administration to use chips made with rare-earth metals from China to suffocate some of the best Chinese companies," Zhou said. "It is time for China to respond to such insolent bullying by stopping rare-earth metal exports to the US, affecting the chip-making business of a number of US companies such as Qualcomm, Micron and Intel."

"The US fifth-generation joint strike fighter F-35 uses 500 kilograms of rare-earth metals per plane... that should be stopped, too," Zhou said, adding that Chinese rare-earth metal exporters implementing such bans could recoup their losses from an insurance program citing the force majeure clause.

The export regulation will serve as a countermeasure against the US, which has been suppressing Chinese companies, and will most likely restrict the export of rare-earth metals and integrated circuit boards, He Weiwen, a former senior trade official and an executive council member of the China Society for World Trade Organization Studies, told the Global Times.

"A significant proportion of rare-earth metals and integrated circuit boards in the US are from China," He said. "Although China agreed to the non-discrimination principle when it joined the WTO, it should not shy away from taking retaliatory action in response to the US attacks on Chinese companies."

China contributes around 70 percent of global rare-earth metal output, according to He. The US currently produces only 5 percent of the world's integrated circuit boards, and it relies heavily on imports from Asian countries, including China.

"Rare-earth metals and integrated circuit boards are important materials for high-end technology sectors in the US," he said. "If China decides to cut off the supplies to the US, it will cause chaos among US businesses."

The law comes as big Chinese companies such as Huawei, ByteDance's TikTok, Tencent's WeChat and even Semiconductor Manufacturing International Corp find themselves on Washington's attacking list. The US is also reportedly mulling adding Ant Group to its Entity List.

The Standing Committee of the National People's Congress, China's top legislature, passed the law on export control on Saturday after a third reading. The law will go into effect on December 1.

Besides authorizing China to hit back at countries abusing export-control measures, the law clarifies that technical documentation related to the items covered by the law is also subject to export-control stipulations, potentially giving China some control in the pending sale of TikTok's overseas assets to US companies, including Oracle, analysts said.