COMMENTS / COLUMNISTS

Platforms must not become oligopolies, hindering fair competition

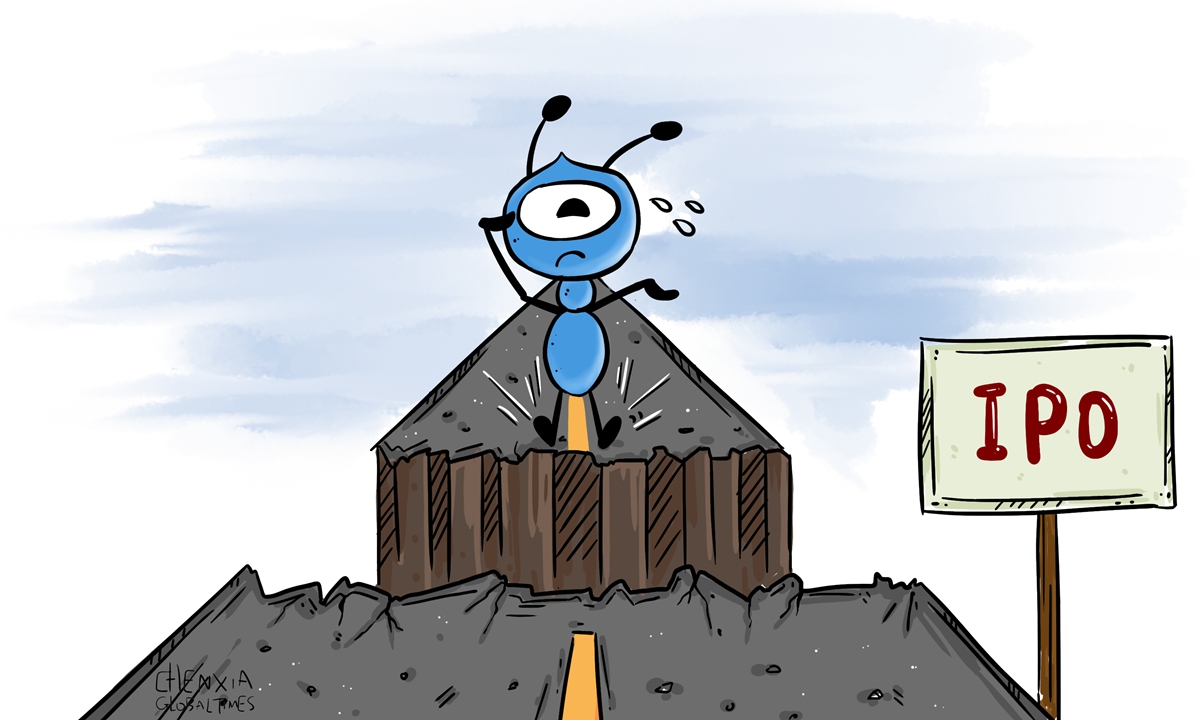

Illustration: Chen Xia/GT

Following an 11-hour shock suspension of Jack Ma's Ant Group IPOs at the Shanghai and Hong Kong stock exchanges, China's market regulators are tightening anti-trust legislation to dial up scrutiny of the country's internet-based platform giants, in an effort to restore fair competition in the increasingly important digital economy, and to protect new competitors and the broader consumers.All of the country's heavyweight digital platforms of e-commerce, food deliveries, parcel couriers, ride hailers, tourism services, music and video-sharing apps, and digital payment services are expected to be reined in by new draft regulations.

The move is also a signal that the policymakers in Beijing want to prevent monopolies and oligopolies from forming in the country that would stifle market competition and innovation, which is crucial for China to sustain its economic growth and all-around social development.

A free-wheeling market order will also benefit the country's planned strategic shift in the next five years to the "dual circulation" economic growth plan - skewed toward fair and unfettered domestic market circulation. It is a prerequisite for the all-important online platforms to keep progressing in their technologies, to be inclusive in welcoming competitors, and to lead the drive of highly efficient "internal circulation".

Last week, the State Administration for Market Regulation (SAMR) published a draft guideline on anti-monopoly acts in the field of the online platform economy to solicit public opinions.

All online platforms must avoid engaging in illegal competition behaviors such as abuse of market dominance, forcing "one platform over others", arm-twisting, coercion of transactions, or rely on algorithm recommendations, artificial intelligence and big data meta-analysis to enable "invisible" unfair competition that disrupt normal economic activities.

The draft is widely deemed as ramming up government oversight and scrutiny of the country's e-businesses. Consequentially, stocks of China's biggest internet platforms including Alibaba, Meituan, JD.com, SF Express as well as the country's dominant online gaming and social media, Tencent, plummeted across the board.

Similar to the focus of lawmakers in the US on tech titans including Apple, Facebook, Amazon and Google which, respectively, have amassed immense market monopoly power in the world and blocked new entrants to the marketplace, China's regulators are, finally, realizing the same risks posed by the country's biggest internet companies, as they sometimes resort to veiled threats, predatory pricing or even team up to squeeze out smaller rivals.

For example, some of the giant platforms have used their dominant market position to throttle competition by practices such as coercing flagged "VIP" retailers to sign exclusive deals so that their products are not allowed to be sold on other platforms, or using third-party seller's proprietary data to develop their own products, or charging exorbitant rent or fees from third party sellers. Occasionally, platforms are exposed for compromising users' data privacy to gain illicit profits.

In 2015, JD.com lodged a litigation against Alibaba's Tmall marketplace for the "choose one from two (platforms)" policy that caused droves of sellers to complain and cry foul. Last year, some music and video-sharing platforms required companies to sign exclusive agreements with platforms to exclude competitors. Now, the draft guideline stipulates that the "choose one from two (platforms)" practice is illegal and outlawed.

It is ethically explicit that internet platforms are untenable to abuse their market dominant position to force merchants to choose one platform over others --- an act of repelling competition by restricting the right for businesses to freely choose partners in the market.

The new guideline would also stop platforms treating different customers with differential prices or services, based on the big data they collect from users or discriminatory algorithms they develop.

The draft guidelines, once approved, is applicable to online payment services like Ant Group's Alipay or Tencent Holdings' WeChat Pay - the two dominant digital payment platforms in China.

On October 25, Jack Ma, in a speech attended by a host of leading Chinese financial regulators, took issue with the Basel Accords for its international banking regulations, just days before his Ant Group was scheduled to launch the world's biggest IPO. "The Basel Accords are like an old people's club...??We can't use yesterday's methods to regulate the future," Ma said.

Ma's comments about the government's oversight of Ant's virtual banking business immediately drew fire from the public and regulators. Chinese bankers say both Ant's Alipay and Tencent's WeChat Pay platforms should be put under the same regulatory regime as the traditional banks, so as to ensure fair competition. They also claim that if Ant's lucrative online lending business is not scrutinized, the platform is likely to cause rising debt risks, while at the same time the company may one day become a "too big to fall" beast.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn