Huawei spins off sub-brand Honor to survive US supplies ban

Move may enable phones to use Google, regain share overseas: analysts

Huawei. Photo: VCG

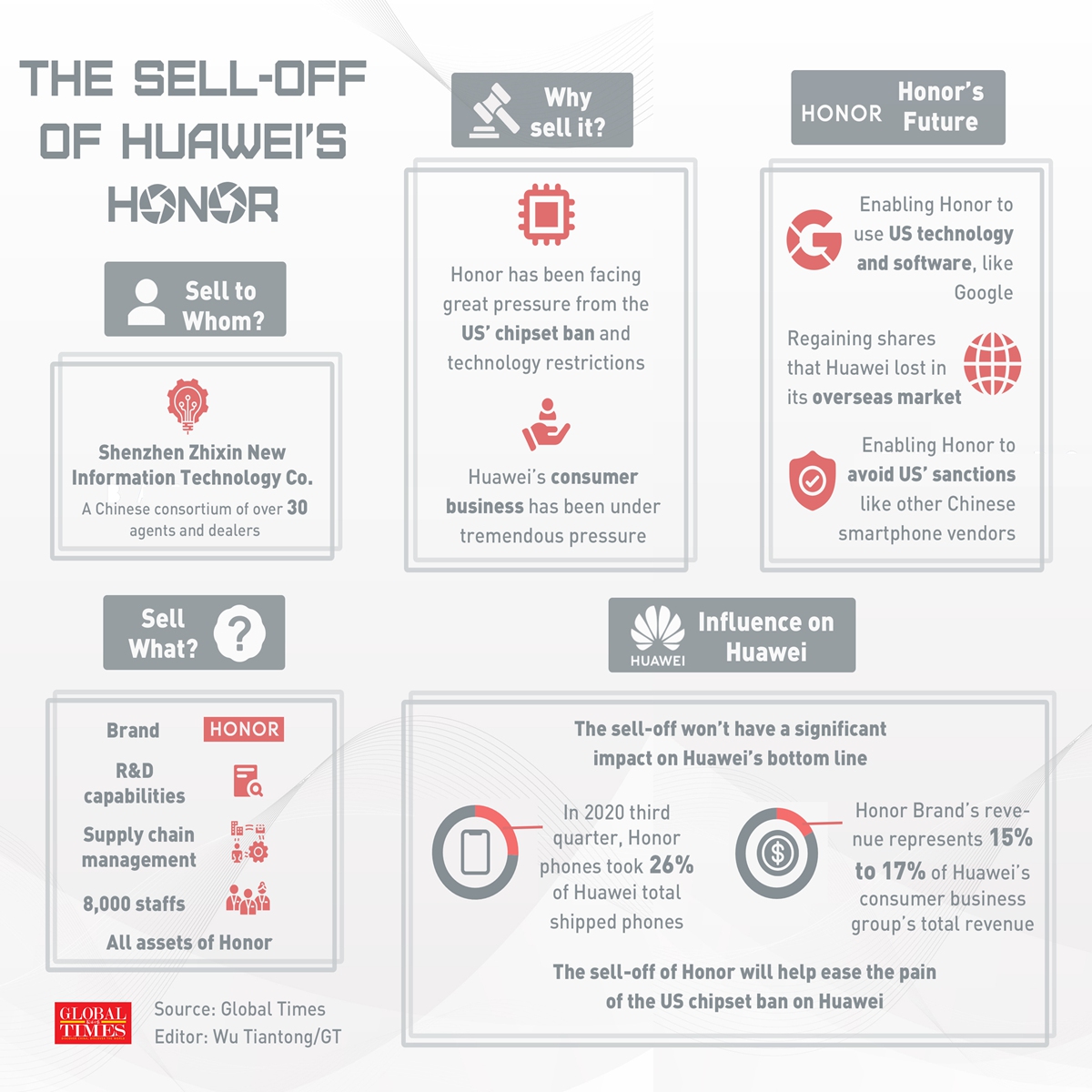

Huawei officially announced the divestment of smartphone sub-brand Honor on Tuesday, and although details such as the value of the sale haven't been revealed, industry insiders said the independent phone maker will largely maintain the structure and operations it had under Huawei.

It may even embark on ambitious overseas foray and emerge as a major rival to Huawei's other phone business if it can be free from US sanctions.

The buyer is a consortium named Shenzhen Zhixin New Information Technology Co, jointly founded by state-owned Shenzhen Smart City Technology Development Group Co and more than 30 previous agents and dealers, including Beijing Songlian Technology Co.

Shenzhen Zhixin New Information Technology Co was established on September 27, 2020 with an investment of 100 million yuan ($15.27 million). Shenzhen Smart City Technology Development Co - controlled by the State-owned Assets Supervision and Administration Commission of Shenzhen city - will hold a 98.6-percent share of Zhixin, according to information from qixin.com, a company data platform.

"Basically, it's a 'rescue action' led by the government," Fu Liang, a veteran telecom industry analyst, told the Global Times on Tuesday.

The sale will include all the assets of Honor, and Huawei will not hold any shares in the "new" Honor company, according to a joint statement from Honor's buyer.

The deal value hasn't been unveiled, but given Honor's 6 billion yuan profit in 2019, it's estimated that the deal could be worth as much as 100 billion yuan. The proceeds may be used by Huawei for research and development, analysts said.

"This is a first for the industry, with buyers including many previous dealers along the industry chain," Liu Dingding, a veteran internet analyst, told the Global Times on Tuesday. It is also the best solution for Honor, as these buyers - channel distributors - whose interests are integrated with those of Honor, are also the ones that wish it the best," Liu said.

Infographic: GT

The deal represents "a market-driven investment made to save Honor's industry chain," the joint statement said. All the shareholders of the new Honor firm will fully support the development of the Honor brand, enabling it to leverage the industry's advantages in resources, brands, production, channels and services, and compete in the marketplace.

The new Honor will become China's only mobile phone producer with physical dealerships as its main backers, unlike the previous internet-centric entity. This new model will also bring new blood to the domestic mobile phone market, Wang Xi, a smartphone industry analyst from IDC, told the Global Times on Tuesday.

Media reports said the sale included the brand, research and development (R&D) facilities, supply chain management and all 8,000 employees. In addition to its smartphone business, Honor also makes tablets, laptops and wearable devices.

Zhao Ming, chief executive of Huawei's Honor handset line, will become the CEO of the spin-off, Honor confirmed to the Global Times, while other members of the management team are yet to be confirmed.

"It's widely believed that Honor will not only bring all its original employees from Huawei, but it will also take some elite staff to empower growth of the brand," Ma Jihua, an industry expert and a close follower of Huawei, told the Global Times. This "package deal" also means that the operations and structure of the new Honor could still adopt the "Huawei way."

The joint statement said that the "change in ownership will not affect Honor's development direction or the stability of its executive and talent teams," indicating high autonomy for the new company.

"Honor may still maintain some relationship and cooperation with Huawei, but the only difference will be that it will have to pay Huawei for technology or other types of support," said Liu.

Previously, Zhao, CEO of the new Honor, announced that Huawei and Honor were completely separated in terms of branding and sales channels, while sharing some basic R&D technologies.

Honor has contributed greatly to the rise of Huawei's consumer business, and it was created largely to rival domestic competitor Xiaomi. In the second quarter of 2020, Huawei sold 55.8 million smartphones, of which the Honor series accounted for 26 percent, according to Canalys.

Selling off Honor, Huawei's low-end phone line, is considered a forced decision, enabling the world's second-largest smartphone vendor to ease the impact of the US supply ban. The move will also conserve limited chipsets for its high-end phone series under the pressure of the chip cut-off, while ensuring the cheap phone brand could survive.

But whether the new company's structure can be truly recognized by the US and avoid US sanctions is still up in the air, analysts said.

"If the US wants to kill you, any structural shift will not work," Liu said.

An IPO of Honor later would offer a large return on investment for the current investors, and it would also make the ownership transparent enough to clear any doubts within the US government, Neil Shah, a veteran analyst at Counterpoint, told the Global Times on Tuesday.

In theory, after the spin-off from Huawei, Honor can immediately buy chips from suppliers such as MediaTek, get access to Google's Android and regain the market share Huawei has lost overseas, Ma noted.

Lately, Honor phones are on the verge of losing market share outside of China because of lack of Google Android, and if this move allows them to access Google Android, the lost momentum can be regained, Shah said.

Honor was the fifth-largest brand in Europe in the third quarter of 2020, and the Honor brand's global market share stood at 4 percent, making it one of the world's top 10 phone brands

An independent Honor could become a major competitor to the rivals. The new company will initially affect Chinese smartphone competitors such as Xiaomi, Oppo,and Vivo, and Samsung's low- and middle-end products may also be affected one day, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Tuesday.

"It's also possible that Honor, which goes for low- and middle-end handsets, will develop high-end handsets and directly compete with Huawei," Liu said.

Zhao, the new Honor's CEO, said last year that Honor accounted for about 14 percent of the domestic phone market in 2019, and that might rise to about 17 percent in 2020.