Alibaba Photo:VCG

China's top market watchdog has launched a probe into e-commerce giant Alibaba's suspected monopolistic acts including forcing merchants to choose one platform between two competitors, the Xinhua News Agency reported on Thursday, in an effort considered to rectify market order and facilitate free, fair and non-discriminative business environment.

The State Administration for Market Regulation (SAMR)'s move was based on tip-offs, said the Xinhua report.

Meanwhile, the country's central bank, the banking and insurance regulator, the securities regulator and the foreign exchange regulator will conduct regulatory talks with Ant Group within the next few days, according to a separate statement on the central bank's website on Thursday. The talks are expected to urge Ant to implement financial regulatory requirements, hold onto fair competition and protect consumers' legitimate rights, in accordance with market-oriented and law-based principles, thereby regulating the operation and development of financial businesses, the statement said.

The news came on the heels of the annual tone-setting economic meeting, which stressed that strengthening anti-monopoly and preventing disorderly expansion of capital will be the top priorities for next year. Financial innovation should be carried forward in the context of prudential regulation, the just-concluded Central Economic Work Conference said.

The investigation is one of the first of its kind into a large Chinese internet company. These efforts were seen as part of the country's broad push to tighten regulations in the internet sector, prevent large internet companies from abusing its market dominance and protect consumers' interests.

People's Daily, a flagship newspaper, said in a commentary published on Thursday morning that the move is an important step in strengthening anti-monopoly supervision in the internet sphere.

"This investigation does not mean that the country's attitude toward the platform economy has changed. On the contrary, it is good for the market and can enhance development of the Chinese economy," the People's Daily said in the commentary.

Strengthening anti-monopoly enforcement, the platform economy will welcome a better development environment in the future, read the commentary.

The SAMR has earlier issued draft anti-monopoly rules relating to the country's online economy to enhance oversight of the country's giant online service platforms, and it invited public comments as it takes steps toward protecting consumers' interests.

Chinese lawmakers will deliberate revisions to the country's anti-monopoly law, according to Yue Zhongming, spokesperson for the Legislative Affairs Commission of the National People's Congress (NPC) Standing Committee last week.

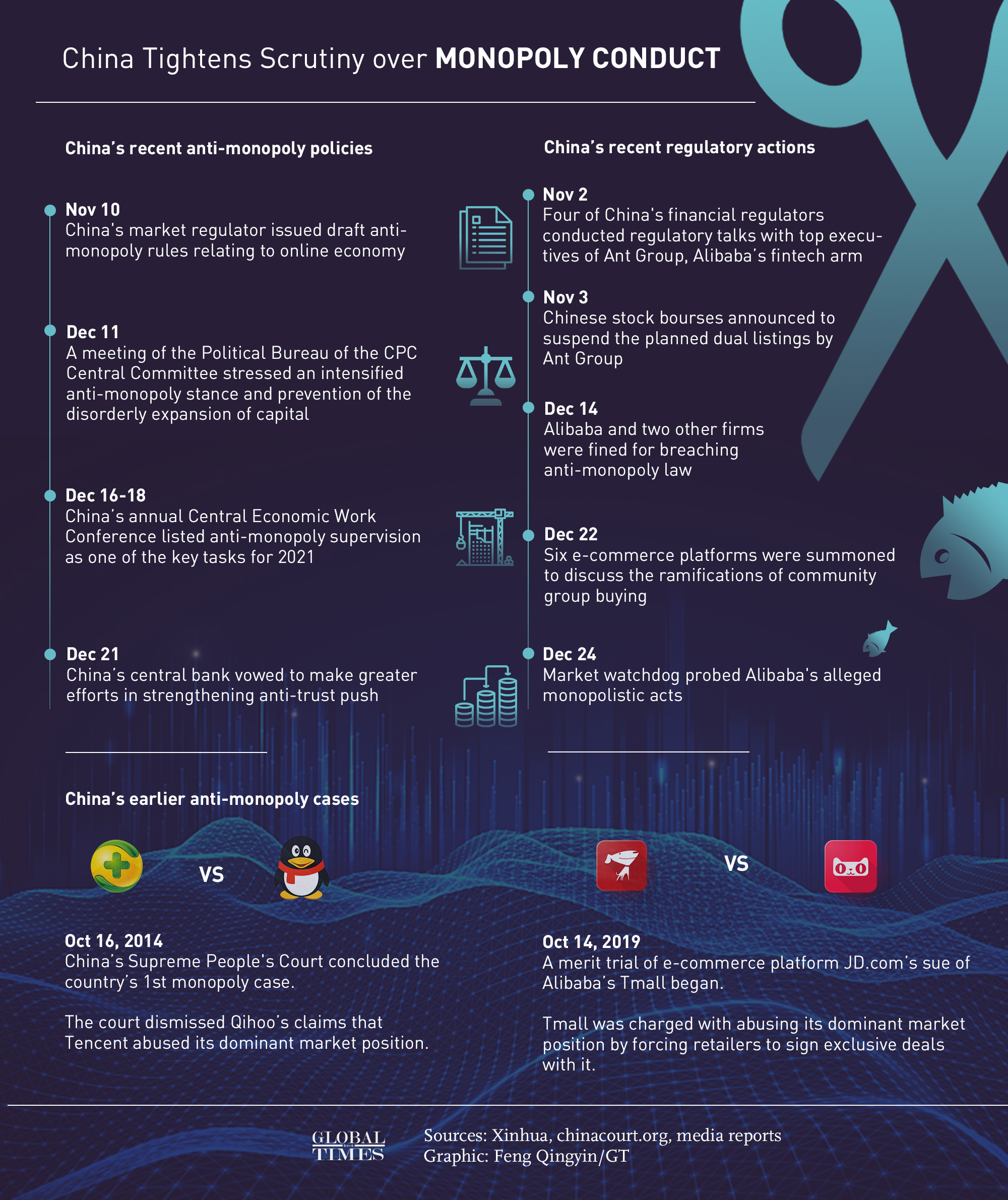

From the first anti-monopoly case between software developer Qihoo and Tencent in 2014 to the latest probe into Alibaba’s alleged monopolistic acts, China is dedicated to creating a better business environment for all of its market participants. Graphic:Feng Qingyin/GT

The news sent Alibaba's shares in the Hong Kong market to plunge 3.4 percent at the opening on Thursday. In a statement through its official Sina Weibo account, Alibaba stated it had received notification from the SAMR that an investigation has been initiated into the company pursuant to the Anti-Monopoly Law. "Alibaba will actively cooperate with regulators to complete the investigation," according to the statement, adding that the company's business operations remain unaffected.

The SAMR and the Ministry of Commerce already held a meeting with leading e-commerce platforms on Tuesday, and stressed that the authorities intend to step up supervision and clamp down unfair competition in the community group buying sector.

Alibaba was among six large internet firms participating in the Tuesday meeting that also included Tencent, JD.com, Meituan, Pinduoduo and Didi Chuxing, the market watchdog said in a statement posted on its website.

The market watchdog bans internet companies from taking advantage of service agreements, transaction rules and technologies to impose unreasonable limitations or additional conditions or collect fees on businesses operating on the platforms.

Alibaba's offshoot, Ant Group, whose dual listing in Shanghai and Hong Kong has been suspended amid regulatory toughening, also faces a more complicated pathway back to listing.

Ahead of Ant's planned IPOs in early November, the country's top financial regulatory authorities summoned Jack Ma Yun, the actual controller of Ant, and the fintech giant's management for a regulatory talk in Beijing, preluding Ant's IPO suspension and a range of other measures to ramp up anti-trust regulation.

In another effort to rein in the unchecked expansion of capital - an effort that has been flagged on multiple occasions during the nation's recent key economic meetings, Alibaba Investment, Tencent-backed online literature platform China Literature and express locker solutions provider Shenzhen Hive Box Co were each fined 500,000 yuan ($76,465) earlier in December for breaching the country's Anti-monopoly Law.

Global Times