Purported chip license revocation might affect Huawei’s PC business, but bigger impact in doubt: analysts

A view of a Huawei store in Central China's Henan Province in November 2020 Photo: cnsphoto

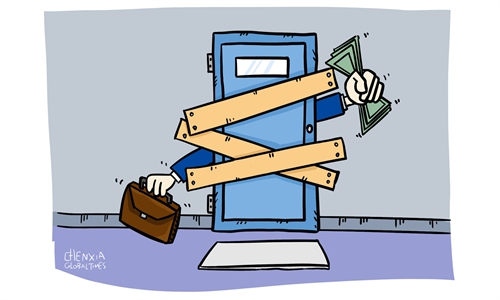

Chinese tech giant Huawei is purportedly being hit by a revocation of some US licenses for chip supplies, as part of the Trump administration's final act of belligerence.

The fresh cutoff woes might affect Huawei's personal computer business, industry analysts say, raising doubts over the feasibility of the revocation while Huawei still has sufficient chip inventory to fend off the threat.

Huawei's foreign suppliers won't simply conform to the outgoing Trump administration's order, they believed, citing China's newly unveiled rules - anything but a "paper tiger" - that could see the country slapping countermeasures on unjustified extraterritorial application of foreign legislation.

Huawei suppliers including Intel were notified by the administration of a revocation of several licenses for exports to Huawei, Reuters reported, citing people familiar with the matter.

The US Commerce Department has issued "intents to deny a significant number of license requests for exports to Huawei and a revocation of at least one previously issued license," said the report.

Huawei had no comment on the latest license revocation when reached by the Global Times on Monday. Intel has yet to respond to a request for comment.

"We currently have no information about this," SMIC, a major semiconductor supplier to Huawei in the Chinese mainland, told the Global Times on Monday.

And, South Korean chipmaker SK Hynix said it "cannot comment on this matter" when reached by the Global Times on Monday.

The semiconductor sector posted gains of over 3 percent in the A-share market on Monday, outperforming the flagship Shanghai Composite Index, which closed up 0.84 percent.

"We urge the US to immediately repeal the wrong decision and stop baselessly cracking down on foreign businesses,"Chinese Foreign Ministry spokeswoman Hua Chunying said on Monday.

China will continue to take necessary measures to safeguard the legitimate rights of Chinese businesses, she said.

Many media outlets, including some in the US, have pointed out that the current US administration is implementing a "scorched earth policy," burning every bridge with an aim to create hurdles for the incoming Biden administration, she said.

The said cut-off of chipset supplies from Intel will mainly weigh on Huawei's consumer business, especially its laptop manufacturing, which has a high demand for Intel's chipsets, Jiang Junmu, a veteran industry observer who is also chief writer at telecom industry news website c114.com.cn, told the Global Times on Monday.

Huawei has reportedly set an internal target of making the laptop lineup its next product to generate $10 billion in revenues. According to the company's financial disclosure in October, its revenues for the first three quarters were up 9.9 percent to 671.3 billion yuan ($103.37 billion).

Huawei's dependency on Intel chips for its PCs is yet to be counted. The three 2021 notebooks Huawei took the wraps off on Sunday, all packing Intel's processor, could offer a glimpse.

"Besides laptop business, such new restrictions may also pose an impact on its server business, however, Huawei has now been acting to replace some with its own Kunpeng server, "Jiang said.

If Intel, a major chip producer, is banned from supplying Huawei, its PC business would take a hit after its smartphone was overshadowed by cutoff concerns, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Monday.

Richard Yu Chengdong, head of Huawei's consumer business group, revealed in August that Huawei's PC business had accrued 16.9 percent market share in China.

Huawei ceded its top spot to Samsung on global smartphone shipment rankings in the third quarter of last year, market research firm IDC disclosed earlier in January.

Huawei's share of the global smartphone market shrank to 14.6 percent in the third quarter from 20.2 percent in the prior quarter while Samsung saw its share jump to 22.7 percent from 19.5 percent, according to IDC, explaining that Huawei "continued to face challenges due to the ever-increasing impact of the US sanctions, which are taking a toll on its performance even in China as the brand is trying to pace out its shipments over a longer period."

But by no means will Huawei be mortally wounded by the latest cutoff action, as the Chinese company has been investing heavily in enhancing self-reliance on core technologies, according to industry representatives and analysts.

"Huawei has prepared sufficient chip inventories enough for keeping its business running for one to two months," Ma Jihua, a veteran industry analyst, told the Global Times on Monday.

In the words of Jiang, "Huawei's fundamentals rely on its carrier business, even without the consumer business, the company will be able to survive," Jiang said.

Sources close to Huawei unveiled recently that the company could not pin their hope on the relaxation of restrictions on Chinese high-tech after Biden takes the office, and facing extreme pressure from Washington, it will continue investing in core technologies in order to major breakthroughs, diversifying its suppliers and not only relying on one single country and company.

Market watchers cast doubts over the feasibility of the revocation order.

The purported cutoff notification, one of the Trump administration's last calls to exert maximum pressure on China, is less likely to be a mind controller, according to Xiang.

US government departments might not implement the revocation order over the last few days and the incoming Joe Biden presidency is unlikely to see Trump's policies implemented unchanged, Ma said, expecting a pullback from Trump's maximum pressure policy under the Biden administration.

What's more, China's newly unveiled rules on unjustified extraterritorial application of foreign legislation are anything but a paper tiger and could deter foreign businesses from blindly following foreign bullying of Chinese businesses, observers emphasized.

The parities benefiting from a judgment or ruling based on foreign legislation could be adjudged by Chinese local courts to compensate for the losses resulting from the said ruling or verdict. The Chinese government may also take necessary countermeasures against the baseless extraterritorial law application based on actual conditions and needs.

Overseas suppliers tend to rethink as a hefty price is likely to be paid if they follow the footsteps of the US government to crack down on Chinese companies, Ma reckoned, referring to the marginal effect of US sanctions that is increasingly in decline.

The continued disruption to tech supply chains, with Huawei squarely in the firing line, will need to be addressed under the Biden presidency as hopes are mounting over reconnection between the world's two largest economies in economic and trade terms, experts said.