COMMENTS / EXPERT ASSESSMENT

Global market needs to be on alert for possible Biden stimulus

Illustration: Xia Qing/GT

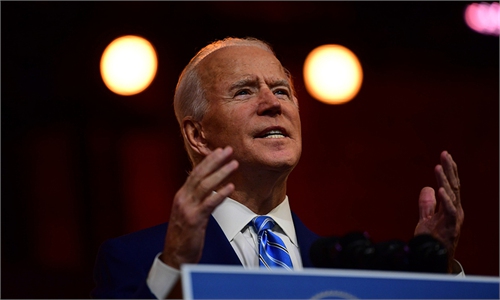

As Washington DC prepares for a presidential inauguration after the Capitol was ransacked by a mob, the global market is also on higher alert for potential policy shift to be brought about by the incoming Biden administration.

Pledging to swiftly contain the virus and accelerate economic recovery, US President-elect Joe Biden's imminent plans, including a $1.9 trillion stimulus package, have come under the spotlight as they may impact not only the US but also the global economy.

In Biden's first 10 days in office, there will be decisive actions rolled out to address "four overlapping and compounding crises," including the wildly spreading COVID-19 pandemic, the economic fallout, the climate change, and a national reckoning over racial equity, Bloomberg reported, citing Biden's Chief of Staff Ron Klain.

Detailed plans include a "100 Day Masking Challenge," an extension of student loans, among others. The moves will be launched to "prevent other urgent and irreversible harms, and restore America's place in the world," said Klain.

Biden is set to enter the White House against the backdrop of an unprecedented turbulence in the US, with the coronavirus claiming nearly 400,000 lives in the country while the world's largest economy expecting a 4.3 percent contraction in 2020, per IMF estimates.

On Thursday (US time), Biden proposed a $1.9 trillion stimulus plan to counter the economic recession and the massive health crisis, which has been regarded as the initial efforts or the first test of the new administration's ability to pull the nation out of the quagmire.

With priorities focused on domestic issues, from containing the virus to rebooting the economy, a huge stimulus plan is a more of rising importance for the new administration to choose under such circumstances so as to boost recovery though it will lead to skyrocketing national debt levels.

To promote such amount of a stimulus plan, it means that the US Federal Reserve may need to speed up printing of dollar notes. Again, by abusing the dollar's global hegemony position, the US will try to shift its burden onto others.

It is not the first mega stimulus package of the US since 2020. The US passed a $2.2 trillion stimulus plan in March 2020, and another $900 billion bill at the end of the year. Though it still needs to be approved by the Congress and may be scaled down, further stimulus packages are in the pipeline after Biden is inaugurated.

On one hand, there will be benefits from the US' mega aid package. It may promote economic and trade exchange. However, the overly expansionary fiscal policy of the US will inevitably lead to rampant liquidity across the global market, exacerbating financial risks, such as wild exchange rate fluctuations.

In the long run, flooding the US dollar into global markets will undermine the currency's global standing. However, in the short term, it is crucial for the international community to prudently prepare and assess fallout from the new policies of the US government which will have global implications.

The article was compiled based on an interview with Gao Lingyun, an expert from the Chinese Academy of Social Sciences in Beijing. bizopinion@globaltimes.com.cn