The new site of AIIB headquarters near the Olympic Forest Park in Beijing Photo: cnsphoto

Over the past five years since the China-initiated Asian Infrastructure Investment Bank (AIIB) was founded, the multilateral development bank has thrived out of doubts and ramped up efforts to build a new type of development platform.

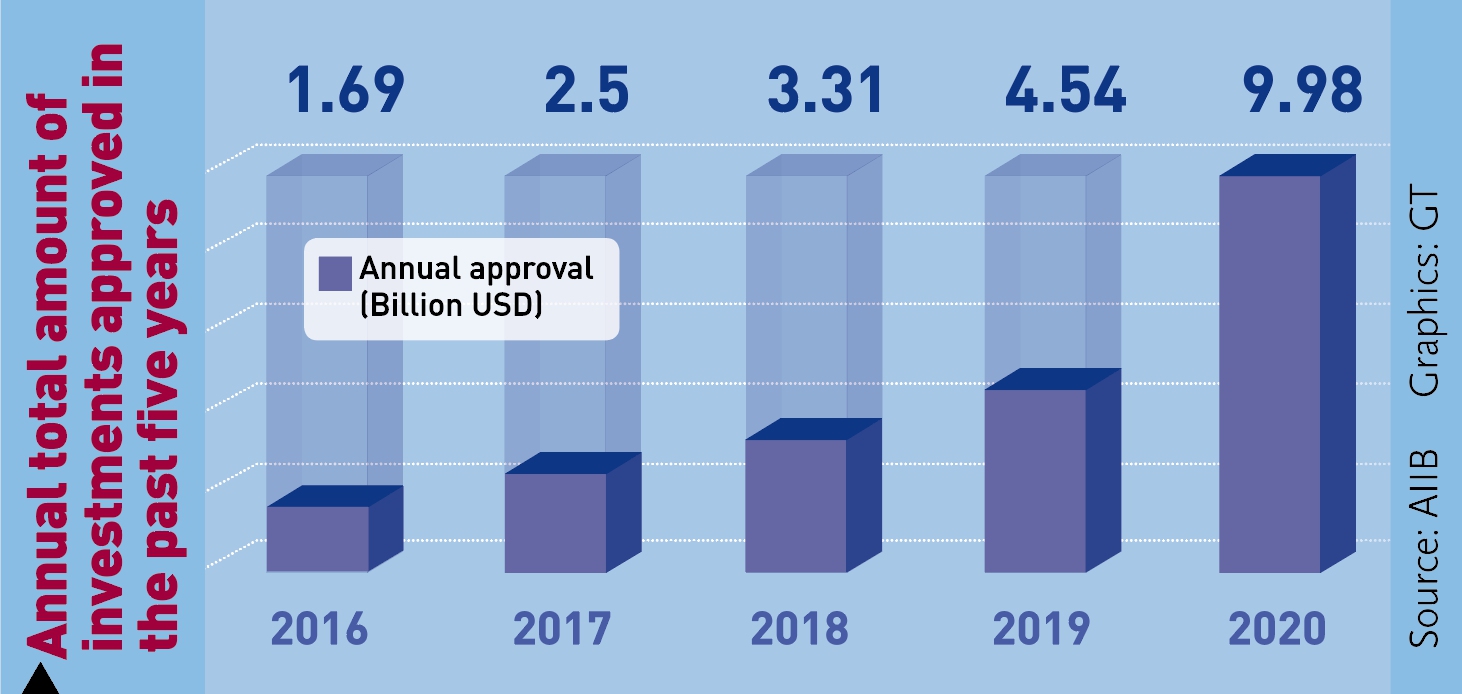

Following its establishment in 2016, the bank has grown its members from 57 to 103, and has approved $22.02 billion investments accumulatively as of the end of 2020.

In addition, it has secured Triple-A ratings from major international credit rating agencies and is now capitalized at $100 billion, signaling recognition of its strength and governance by the international institutions, according to Xinhua.

Even if some countries raised doubts at its early stage about China's role which is the bank's largest shareholder, they soon found out the bank is an international organization in a real sense, AIIB President and Chair of the Board Jin Liqun told Xinhua.

"No matter how big your stake is, or how many percent of the right to vote you hold, we welcome discussion," he added, noting the bank's development also reflects China's international credibility and responsibility as a major country.

Wang Yiwei, director of the Institute of International Affairs at the Renmin University of China, told the Global Times that the achievements of the AIIB are not unexpected. "Decisions at the bank are not made by a single member or one country. The bank is not exclusive," he noted.

COVID-19 response

"AIIB's milestone arrives against the backdrop of increasingly uncertain and challenging economic conditions across the world," the bank's president Jin said on January 13 at press conference.

"While taking stock of what we have done over the last five years, we keep our eyes firmly set on very concrete ways to refine our investment strategy, strengthen our responsiveness to the evolving needs of our members and position ourselves as a leading force pushing for new and often overlooked investment areas," he said.

Last April, the AIIB created a Crisis Recovery Facility which would offer up to $13 billion of financing, helping both public and private sector entities in its members deal with the impacts of COVID-19.

For instance, it approved a $750 million loan to India last June to assist the government to strengthen its response to the adverse impacts of the virus on millions of poor and vulnerable households, in addition to a $500 million loan to assist India's emergency response to the pandemic approved last May.

During the press conference on the bank's future strategies, Jin vowed that AIIB will follow other development banks, including the World Bank and the Asian Development Bank (ADB), in helping to finance the rollout of COVID-19 vaccines, but did not give detailed financing scale.

"The World Bank and ADB have allocated resources to finance (the purchases of) the vaccine, which is in my view very, very important, and we will certainly do the same," Jin told press.

Last year, the bank approved $9.98 billion investments despite the pandemic, more than double than the figure in 2019. Jin said the bank's lending in 2021 is expected to reach the same level as last year.

Graphics: GT

Future strategies

Highlighting green, technology-enabled infrastructure and regional cooperation that will shape Asia's recovery in the post-COVID-19 era, the AIIB said its future strategies reflect the need for the infrastructure sector to manage short-term challenges of the pandemic and the global economic downturn, as well as mid- to- long-term revolutions of demographic changes, climate change and the ongoing digital transformation.

Facing future shocks from climate change, the bank suggested post-crisis recovery programs "should not be carbon-dependent," which presents policymakers with an opportunity to align public policies more closely with climate objectives, thereby limiting the risk of locking-in carbon-intensive infrastructure.

"Green is in our DNA as everything we do has to be sustainable," Stefen Shin, AIIB principal investment officer, told the Global Times in a previous interview.

Responding to a question whether the bank will consider funding nuclear power projects, Jin during the press conference dismissed the idea, saying AIIB instead is interested in supporting safe new energy projects, including solar power, wind energy and hydroelectric projects.

Another trend identified by the bank is a weakness in social infrastructure which has suffered from underinvestment in many countries at difference income levels.

According to estimates from the Global Infrastructure Hub, transactions in social infrastructure fell from $19 billion to less than $3 billion in 2019.

"Given the limited public spending in social infrastructure and the challenges of a post-COVID-19 recovery, catalyzing private capital flows into public investment takes on more relevance and is absolutely necessary," the bank stressed.

Warning that countries will have to deal with widespread bankruptcies, increased unemployment and high debt levels, the multilateral development bank suggested asset recycling or privatization as a potential path forward.

Although new technology and innovation have already engaged in infrastructure building, COVID-19 has been a game changer heightening the awareness of wider usages of technologies, the bank noted.

Connectivity infrastructure and regional cooperation will still be likely to face mixed fortunes over the years ahead. "The global supply chain has been basically resilient throughout the crisis. But supply chain infrastructure investment will continue to face uncertainty, given the trade and technology-related tensions as well as ongoing discussions on reshoring or nearshoring of activities," according to the bank.

However, there will be "no-regret" approach to investments. Investing in smarter road infrastructure, with greater digitalization and in preparation for an all-electric future, are also likely to pay off in the long run, it added.

Giving recognition on the strong regional cooperation in Asia over the recent years, Jin also highlighted a point that "Asian countries don't just look inward. Asian countries try to reach out, to improve the connectivity with the rest of the world."

Setting ambitious targets, AIIB aims to allocate 50 percent of its financing for climate action by 2025, 25-30 percent for cross border connectivity by 2030 and half for private sector operations by 2030 as well.