An engineer assembles an axial-flow compressor at a workshop of the Shaanxi Blower (Group) Co., Ltd., a state-owned enterprise, in Xi'an, northwest China's Shaanxi Province, Nov. 18, 2020. (Xinhua/Shao Rui)

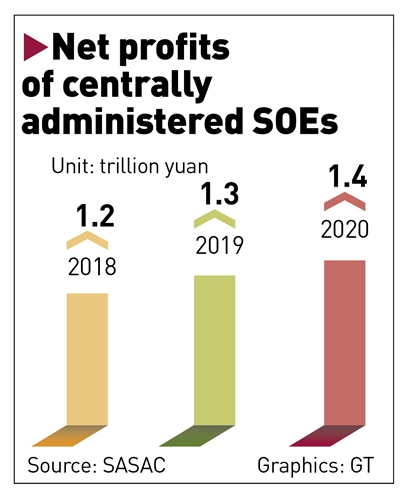

Against the backdrop of the coronavirus pandemic, the global economic downturn and a sustained US crackdown, China's centrally administered state-owned enterprises' (SOEs) net profits were up 2.1 percent to 1.4 trillion yuan ($215.89 billion) in 2020, with officials and experts giving recognition to their vital roles in China's fight against the virus and as a mainstay in China's economic growth.

Nearly 80 percent of the centrally administered state-owned giants reported year-on-year profit growth, Peng Huagang, spokesperson of the State-owned Assets Supervision and Administration Commission of the State Council (SASAC), told reporters on Tuesday.

However, the total operating revenue of centrally administered SOEs last year was down 2.2 percent to 30.3 trillion yuan, Peng noted, but those in the automobile, mining, construction, telecoms and steel sectors reported revenue growth.

Tian Yun, vice director of the Beijing Economic Operation Association, said the combination of surging net profits and declining revenue reflected the adverse impacts of the China-US trade war and the coronavirus pandemic.

"Internal structural adjustment at centrally administered SOEs is another reason. For instance, competition in sectors that allow private enterprises to enter has become more intense," Tian told the Global Times on Tuesday.

The number of overseas projects for the centrally administered SOEs has also declined in recent years, as some have shifted to key countries and regions with a changed focus, he noted, while the overseas expansion of Chinese private enterprises intensified the competition.

In addition, the reform of several SEOs in the energy sector has pushed up the prices of commodities, keeping the profits of the SOEs high, despite slightly decreasing total revenue, according to Feng Liguo, a research fellow at China Minsheng Bank's research center.

Graphics: GT

According to the SASAC, production and sales of oil, gas, power, steel and coal at centrally administered SOEs saw steady growth year-on-year across 2020. The cumulative production of crude oil was up 0.6 percent year-on-year, while coal output grew 4.4 percent and commercial coal sales were up 6.8 percent.

Feng also noted that a regulation on government investment, implemented in 2019, clearly defined the scope of government investment to ensure that it has a focus and target, and this has ensured ample and fair market competition.

Such results did not come easily. Facing the coronavirus pandemic, which created supply disruptions and economic contraction, together with drastic price fluctuations of bulk commodities such as crude oil and iron ore, the global economy has fallen into the most severe recession since World War II, SASAC spokesperson Peng said.

On top of these challenges, and the intensification of the US containment and crackdown on China, "centrally administered SOEs have withstood pressure" and made significant contributions to China's fast containment of the virus, quick work resumption and stabilizing supply chains, Peng said.

Centrally administered SOE Sinopharm last year took the lead in developing COVID-19 testing kits and brought the first domestic COVID-19 vaccine to the market at the end of last year.

A construction marvel was produced by centrally administered SOEs, which built the Huoshenshan Hospital and Leishenshan Hospital in Wuhan in a matter of days last year.

Electronics and telecoms enterprises introduced big data-related services in a timely way, such as online platforms that facilitated work resumption and digital health codes, to help the country and the people combat the virus.

Such marvels are still taking place in China. As of 10 am on Tuesday, China Railway Construction Corp had completed 1,615 temporary houses in North China's Hebei Province, which now has about 800 coronavirus confirmed cases.

"These SOE giants showed their role as a mainstay in China's economy during the coronavirus outbreak. They are capable of rising to the challenge. This is one of the reasons why we have adopted macro-economic controls for years, a policy that is hard to copy for many other countries," Tian noted.

In the near term, he said the centrally administered SOEs and SOEs will continue to be the backbone of China's economy, while a growing number of private enterprises will continue to develop rapidly.

"The proportion of SOEs in terms of their number and revenue may drop in the future, but they will still play an irreplaceable role in core areas related to national security," Tian stressed.

Dismissing accusations of China implementing state-monopoly capitalism, Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission said on Monday that such claims are a huge misunderstanding.

Guo said "SOEs' tax burdens are on average about double those of privately run businesses," and they have actually broader social responsibilities, factoring in relevant budgets arranged by governments at various levels for the distribution and relocation of redundant employees, grants for employees' social security, and public services spending.

The mixed-ownership reform and reorganization of Chinese SOEs have always been in the spotlight. As China has unveiled a three-year action plan addressing the reform of SOEs to further focus on mixed-ownership reform and reorganization, Peng noted that 2021 is a vital year, as the country aims to complete more than 70 percent of the tasks of the three-year action plan.