COMMENTS / EXPERT ASSESSMENT

Australia benefits from rising ore prices but faces headwinds

Illustration: Xia Qing/GT

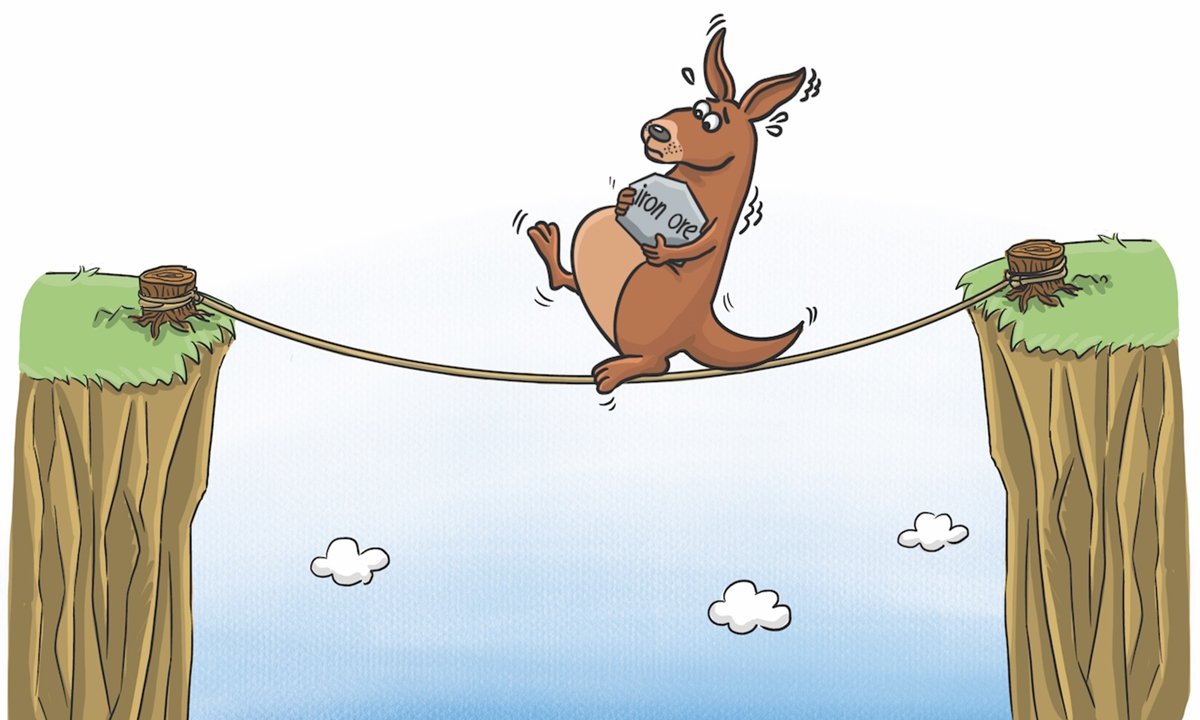

After recording a 7-percent export decline in 2020, Australia, with iron ore exports as its main driving force, may see its trade to improve in 2021 alongside the global economy's recovery from the COVID-19 pandemic.However, the country's iron ore-driven export growth may not be sustainable in the long run, and certainly does not deserve "applause" from some Australian media outlets and politicians for its contribution to offset its export decline, especially to China.

Despite the overall export slump in 2020, Australia has recently seen its trade recover with exports in December surging 16 percent month-on-month, and 3 percent year-on-year, according to latest data from the Australian Bureau of Statistics (ABS).

Metalliferous ore, one of Australia's major exports, increased 31 percent year-on-year. "The increase in iron ore has been a result of both quantity, up 11 percent in December on November, and elevating prices, which has resulted in record values in December for iron ore and consequentially metalliferous ores," read a statement of ABS.

Without a drastic slump, the overall decline of Australia's export was within expectation as nearly all of the nation's major trading partners have not completely recovered from the attack of novel coronavirus in 2020, including China, the US, Japan and India.

With the global economy entering the new year with vaccines being rolled out and governments launching tranches of stimulus, it is expected that Australia's trade in 2021 will improve, including its trading exchange with China.

As Australia's largest trading partner, China has largely recovered from the fallout of the pandemic earlier and faster than other major economies, boosting demand for resources and raw materials, including iron ore.

Since last April, the price of iron ore has jumped by over 80 percent, bolstering Australia's exports. As a major importer of iron ore, China's demand surged after it swiftly brought the outbreak under control and effectively rebooted normal production, this boosted prices.

It is either ignorance or selective blindness for those who do not see the fundamental dynamics behind the iron ore trade between China and Australia - a normal business between the largest buyer and largest seller of iron ore. However, some Australian politicians have been acclaiming that no matter how much bilateral relations fray, its export will remain strong.

In reality this boast on Australia's part will push China to find more suppliers. According to data from China's General Administration of Customs, China's iron ore import from Australia increased 7 percent to 713 million tons in 2020, comparing to a 3.5-percent up from Brazil, and an 88-percent surge from India.

In addition, China's massive infrastructure construction campaign has already witnessed its peak and will taper off. With huge amount of scrap iron stock, the country has rolled out measures to improve utilization of scrap iron. It is estimated that China will largely decrease its iron ore demand in 10 years.

China and Australia enjoy mutually-beneficial relations and high economic complementarity, which has been proven to be highly resilient even in the face of bilateral relations turbulence. However, mutual respect is the prerequisite for cooperation between any countries. Fundamentally, a sound and stable China-Australia relationship is in the interests of both peoples.

The author is chief research fellow at the research center for Pacific island countries at Liaocheng University. bizopinion@globaltimes.com.cn