China’s ports could not be blamed for the stockpile of cold-chain containers

Global factors, not China’s anti-epidemic efforts, cause port congestions: industry insiders

Trucks moving containers around at the Port of Qingdao in East China's Shandong Province File photo: VCG

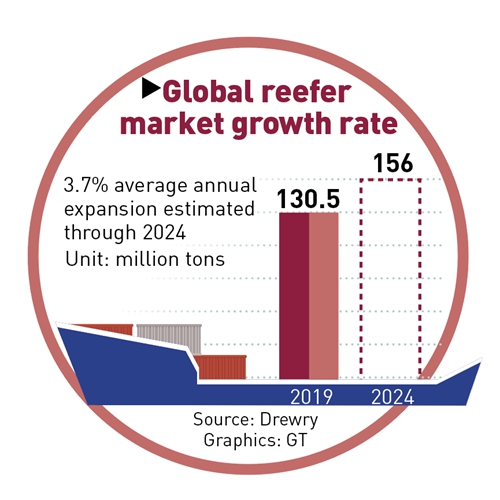

Source: Drewry Graphics: GT

Some foreign media outlets have reported that congestion of cold-chain containers at China's sea ports could impact the global supply chain, but a Global Times investigation into the matter revealed that while stricter inspections of frozen food may cause some delays, it is a confluence of global factors, including poor handling of the virus and a lack of inspection overseas causing the congestion.

In interviews with the Global Times, industry insiders and businesses describe a domino effect across the globe, in which cold-chain shipments face serious delays and uncertainties, given the raging epidemic in many parts of the world which has led to a shortage of containers that has disrupted cold-chain commerce.

To address the problem, efforts are needed from ports across the world, including improved inspections of shipments, industry insiders said. Chinese ports and related industries are also ramping up efforts to tackle the stockpile of cold-chain containers, and container manufacturers are accelerating production too.

Congestion

Bloomberg reported on Thursday that a huge pile-up of fish cargo at a Chinese sea port risks impacting shipments of frozen food across the country and beyond, suggesting that China's tightened testing of foreign food for the coronavirus is slowing down supply chains.

Industry insiders also say that the pandemic is the main reason for the congestion.

If there is proper inspection at the port of departure from other countries, the pressure on Chinese ports will not be so heavy. The reason why inspection time is longer and stricter is because other countries are not strict at all, a leading industry insider told the Global Times on Friday.

China has the right to protect the safety of its people, he added.

The latest outbreak in Dalian, Northeast China's Liaoning Province, has seen 51 confirmed COVID-19 cases and 31 asymptomatic carriers as of January 7. Local health authorities say that most of the initial infections were among dockworkers unloading contaminated cold-chain cargo.

Shijiazhuang, the capital of North China's Hebei Province, announced on Sunday the suspension of fruit imports, removal of on-shelf products and the sealing of stock after detecting coronavirus on a batch of imported cherries at a wholesale market. Aside from imported cherries, more imported food products, including red king crab, pork and ice cream, have been found with the virus present on outer packaging.

As of midnight on January 13, national customs had sampled nearly 1.3 million items, with 47 positive results detected, according to the latest report by the General Administration of Customs.

To reduce the risks of imported cold chain cases, COVID-19 nucleic acid sampling detection is carried out on imported cold chain food, especially imported seafood, customs say.

Global container shortage

Currently all food imported through cold chain containers needs to be tested for coronavirus before being sold on the market and the rest of the world has formulated similar anti-epidemic policies in keeping to local conditions.

The testing for COVID-19 in cold chain imports at Chinese sea ports is proceeding at the normal speed and it is unusual for refrigerated containers to get stuck in ports due to not passing the customs inspection, a person from a Shanghai-based international logistics company, who did not wish to be identified, told the Global Times. "In general, we export more than we import, which is also one of the reasons why there has been a lack of refrigerated containers," the person said.

Wu Minghua, a Shanghai-based independent shipping industry analyst, agreed that China is dispatching more containers, but their return rate is low.

Wu said the number of workers in European and US sea ports has decreased significantly since the public health crisis - for example, the number of workers at the Port of Los Angeles has been reduced by almost 50 percent - which has had a major impact on port efficiency, resulting in a shortage of cold chain containers. He predicted that the container shortage will be difficult to reverse before March-April.

The problem of turnover of refrigerated containers is not due to testing for the coronavirus, said an employee, surnamed Wilson, from a Shanghai-based import and export trading company.

"A lot of issues - from the time of unloading at the port, the speed of customs declaration, the efficiency of the consignee to the returning time - affect the turnover of the refrigerated containers," he said.

"The biggest difficulty is the fact that the US pandemic remains serious and there is too much uncertainty about the US port of destination," he said.

Market watchers say the shortage of containers is not caused by the ports, but the companies that own the containers and the shipping companies that send them.

International shipping volume has shrunk in the past year due to the virus, and shipping companies would normally expect to be losing money, but shipping companies actually made strong profits last year, the senior industry insider told the Global Times.

Maersk, the world's largest container shipping firm, reported a 39 percent quarterly increase in earnings before tax in the third quarter, amid a stronger-than-expected pickup in demand.

Even if there has been a pile-up of containers in Dalian, it is an exaggeration to say this can affect the global supply chain, industry analyst Wu said.

China's efforts

To address the problem, efforts are needed from ports across the world to rein in the disease and improve inspections of shipments, industry insiders say.

China's inspections show the responsibility it is taking for global cargo transport. If contaminated containers leave China, it will be bad for virus control in other countries, they say.

Meanwhile, the rising number of imported cases indicates the prevention work at the Chinese ports needs to be sustained despite the difficulties. "The sterilization cycle is long and therefore leads to a backlog, which is common in almost all the ports across the country," Qin Yuming, secretary general of the cold-chain logistics professional committee of the China Federation of Logistics & Purchasing, said.

"Given the difficulties of sterilizing all the containers at each port, we are designating new warehouses for sterilization work to take place," said Qin, adding that this may include distributing containers to inland ports for sterilization first, as the warehouses there have more available space.

Industry analyst Wu said China is trying to tackle the container shortages by helping shipping companies to return as many empty containers from overseas as possible on the return journey.

Port of Dalian said on Thursday that the production efficiency of the domestic cruise terminal (DCT) has steadily improved, and the waiting time for ships to get berths and the entrance and exit of the terminal gate has been greatly shortened. The port has vowed to spare no effort to maximize operating efficiency.