Customers shop for mobile phones at a telecom mall in Xuchang, Central China's Henan Province on January 31, 2021. Photo: VCG

Chinese telecom giant Huawei saw a substantial drop in both smartphone shipments and market share in China market in 2020, following a tough year of US government's strangle on semiconductors supply, allowing US rival Apple to rise to fill up the void.

Under the US' relentless assault, Huawei saw a drop in market share in China from 38.5 percent in the fourth quarter of 2019 to 25.1 percent in the fourth quarter of 2020, the only one of the top five smartphone makers in China whose share declined, an International Data Corp (IDC) report showed on Tuesday.

Industry experts said that Huawei's rare market share decline reflected the US block on chips that affected the supply chain of the company's high-end mobile series.

There were 86.4 million smartphones shipped in China in the fourth quarter of 2020, almost flat year-on-year, with Huawei being the only smartphone maker among the top five that did not grow. The others were Xiaomi, Oppo, Vivo and Apple.

Although there could be many reasons for the changes in market share, Ma Jihua, a veteran industry analyst, told the Global Times on Tuesday that the US chip crackdown on the Chinese technology company created a supply chain crisis for Huawei and left space for others, especially high-end mobile producer Apple, to grab more share.

Apple was the only producer that achieved growth in China last year, with smartphone shipments up 10.1 percent, IDC reported.

Apple, which had a 34.7-percent market share growth in the fourth quarter in China, against Huawei's 34.5 percent, also seized the top spot in the global market with a 23.4-percent share in the fourth quarter of 2020.

Apple released its 2021 fiscal first-quarter results on January 27, with revenue exceeding $100 billion for the first time and net profit of $28.755 billion, up 29 percent year-on-year. China was a particularly strong performer, with revenue from the greater China region at $21.313 billion, up 57 percent year-on-year.

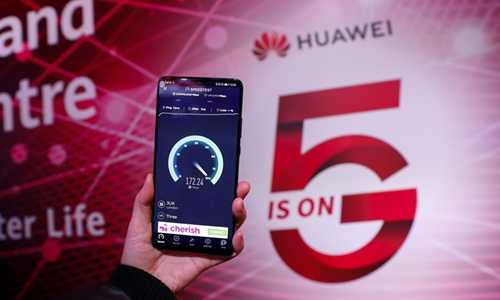

"Apple lost market share to Huawei in 2019, and Huawei's weakened competitiveness last year left it with only one viable competitor to challenge," Liang Zhenpeng, senior industry analyst told the Global Times. Apple's launch of a 5G mobile came later but also helped it to fill a gap as its major market embraced advanced internet connectivity.

However, Apple's growth pace might be hard to sustain at an equivalent high level this year when other Chinese mobile producers such as Xiaomi and Oppo are also targeting the high-end smartphone market, experts said.

"Apple, as an important high-end mobile producer, will see unprecedented competition from a few Chinese brands," said Ma.

Liu Bo, vice president of OPPO, gave a speech on Monday in which the company set higher targets for its growth in 2021, including the comprehensive upgrade of the company's channels and partnership, media reports said.

Meanwhile, Huawei's difficulties may be only temporary.

"Once Chinese 5-nanometer chips can be produced, the whole market will change," said Ma, noting that he expected such chips could be out at the end of this year.