Aviation firms to see recovery of domestic transport from February

Chinese carriers to see recovery of domestic travel from February: report

Photo: Courtesy of China Eastern Airlines

Several listed airlines and airports have recently issued their fiscal report forecasts, and it is clear that the aviation industry suffered heavy losses in 2020, which could be nearly 100 billion yuan ($15.48 billion).

Insiders predicted that the profits for the industry in first quarter this year could also be under pressure as governments at the national and local level are encouraging residents to stay where they are for the Chinese New Year holidays.

But analysts and insiders said that the worst time is about to pass, and more optimistic signs have emerged.

Slump in profits

Although carriers have been offering promotions to boost sales and transferring passenger airplanes to cargo planes in the past year, their losses have still been heavy.

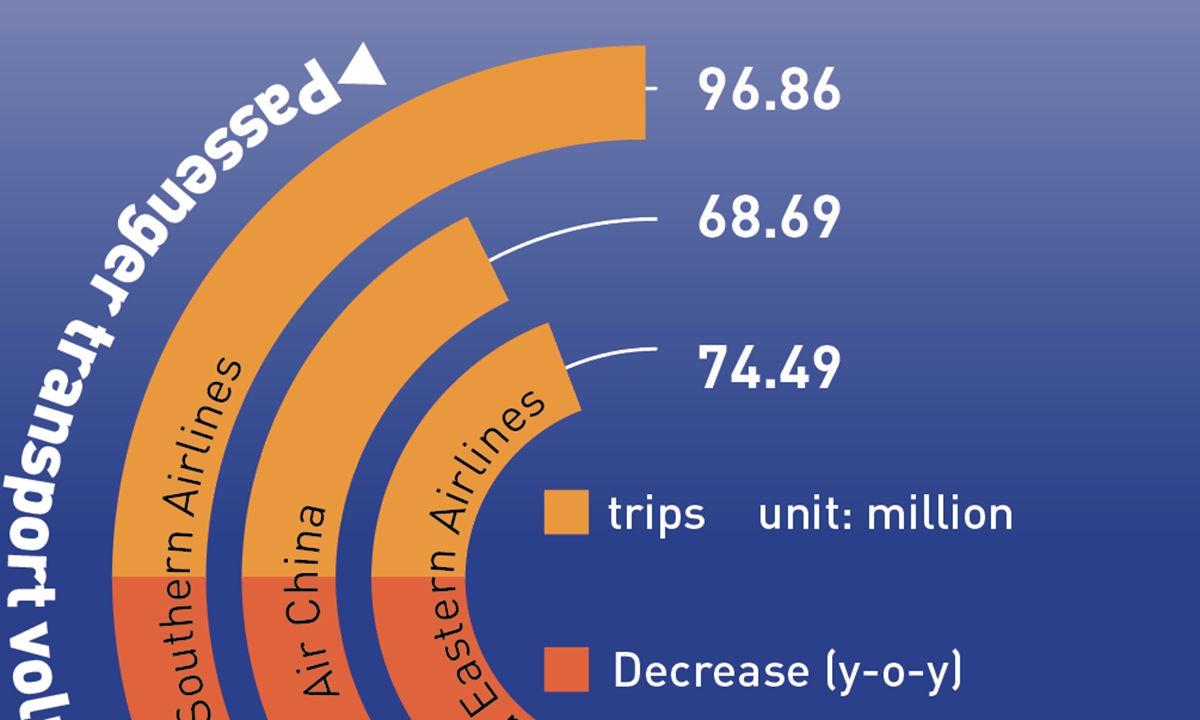

Air China, the domestic carrier with the biggest overseas network, predicted that its loss in 2020 could reach 13.5 to 15.5 billion yuan, dragged down by lower overseas market performance. The company's data showed that the passenger capacity on international routes dropped by 82.9 percent year-on-year in 2020.

China Eastern, which has shifted from carrying passengers to cargo, predicted a loss of 9.8 billion to 12.5 billion yuan for 2020.

China Southern Airlines achieved a single-quarter profit in the third quarter of 2020, but it is still expected to lose 7.9 billion-10.86 billion yuan for the year.

In addition to airlines, the performance of airports has been poor. The downturn in passenger traffic has led to a significant decline in advertising and rental revenue.

Guangzhou Baiyun International Airport predicted a drop in net profit of 247 to 302 million yuan, a year-on-year decrease of 123.03 percent to 128.14 percent.

Shenzhen airport was still able to maintain a positive income, with net profit attributable to the parent company of 22.6 million yuan to 33.7 million yuan, but that is still a year-on-year decrease of more than 94 percent. Shanghai airport expects a loss of 1.21 billion yuan to 1.29 billion yuan for 2020, as the rental income from duty-free shops has dropped sharply.

Air China starts services in two terminals in Beijing Capital International Airport from January 15. Photo:cnsphoto

Continued pandemic fallout

The passenger volume of civil aviation fell dramatically as the epidemic hit the world.

The International Air Transport Association in November predicted carriers will lose a combined $157 billion in 2020 and 2021, almost 60 percent more than it had suggested in June and five times the deficit racked up during the 2008-2009 recession. It called the crisis "devastating and unrelenting," according to Bloomberg.

In 2020, the total passenger traffic volume in China was 420 million, a decrease of about one-third compared with 2019, a report released by carnoc.com showed on Wednesday.

The report said that international flights have not yet resumed, and the overall capacity of domestic airlines has not yet recovered to the level of 2019.

As for overseas routes, data from the Civil Aviation Administration of China showed that as of November 2020, the passenger traffic volume of China's civil aviation decreased by 38.2 percent year-on-year, and the passenger traffic volume on domestic and international routes decreased by 32.1 percent and 86.1 percent respectively.

China launched its "Five-One" policy at the end of March in a bid to curb imported COVID-19 infections, allowing one airline to serve one country, from one Chinese city to one foreign city, with no more than one flight a week.

Later in December, the CAAC said flights with five COVID-19 cases on board will be suspended for two weeks, up from the earlier one-week suspension.

Recently, Chinese governments both at the national and local level have been encouraging residents to stay where they are and not travel during the Chinese New Year holiday, as sporadic COVID-19 cases in China have triggered a new round of protective measures.

This has caused another blow for the aviation industry, which is eager to see a recovery.

The civil aviation industry transported 498,000 passengers on Tuesday, a decrease of 72.6 percent from the same period in 2019. The top ten airports across the country have handled 400,000 passengers, a decrease of 74.3 percent over the same period in 2019, official data showed.

Light at the end of the tunnel?

Photo: GT

One of the three giants, China Eastern, said on Wednesday that it plans to issue A-shares with a price for the non-public offering of 4.34 yuan per share, and the proposed capital increase will not exceed 10.83 billion yuan. The aim is to ease liquidity problems and repay debts, the company said.

Airlines continue to face pressure on cash flow, and the asset-liability ratio of the three major airlines is at a worrying level. From 2014 to 2019, the asset-liability ratios of the three major airlines were all above 50 percent, but things have worsened since then, a report released by China Galaxy Securities showed.

However, there are some signs of light at the end of tunnel, and some insiders predicted that the worst time for the industry has passed.

The latest data from information provider VariFlight showed that starting from the 49th week of 2020, the domestic flight volume and passenger traffic for civil aviation fell sharply and continued to decline into January 2021, due to the impact of the second round of the epidemic.

But thanks to effective controls by government departments at all levels, the number of flights began to bottom out in the last week of January.

It predicted that starting from February, the domestic flight volume and passenger traffic volume will gradually return to the level of the second half of 2020.

A report released by Everbright Securities on January 31 said that with the steady progress of vaccination, passenger confidence will gradually recover, which will promote the recovery of domestic aviation demand, and income from overseas routes will also increase.