COMMENTS / EXPERT ASSESSMENT

China’s hedge funds developing appeal for foreign investors

Illustration: Xia Qing/GT

China's hedge funds, which are smaller in size and less famous than their competitors from the Wall Street, have become a stronger money-making force and attracting more assets in 2020, data released ahead of the Chinese Lunar New Year said.The nearly 15,000 funds offered by Chinese money managers returned 30 percent on average in 2020, with the best-performers surging 10-fold, which dwarfs the average 12 percent gain for hedge funds globally, according to data from Simuwang.com, a Chinese financial-data provider, the Bloomberg reported.

In fact, the outstanding performance of Chinese hedge funds are hardly a surprise as long if we just look back on the resilience of China's economy and its capital market amid the global COVID-19 crisis last year.

Despite the US government's reckless trade war and incessant crackdown on Chinese high-tech companies, Chinese economy has achieved a robust V-shaped recovery from the virus onslaught in the first quarter of 2020.

With the holiday spending spree adding momentum and factory activity remaining steady in January, people's confidence is hardened for the 100-trillion-yuan economy's continuous recovery, while the COVID-19 pandemic continues to ravage many parts of the world.

China's early and strong economic recovery last year fueled rallies in stocks and commodities, supporting the steady performance of all major stock market indexes, directly lifting returns for Chinese hedge funds and attracted more overseas investors to China market.

As China takes concrete efforts to open its financial market, global funds such as Bridgewater Associates and Two Sigma are actively making inroads into China's 3.8 trillion yuan hedge fund market since it was opened to foreign investors.

2020 was a "defining year" for Chinese financial markets, said Ray Dalio, founder of Bridgewater Associates in an interview with the Financial Times in mid-December, noting that China will emerge as the world's financial center.

China's improving financial system is also providing more room and stronger support for US-listed Chinese companies that are facing increasing arbitrary political repression from the US government.

Lead by internet giant NetEase and e-commerce giant JD.com, more Chinese companies have finished IPOs in the Hong Kong stock market and saw rising share prices there last year.

Contrary to the recovery Chinese economy showed, the American economy has experienced havoc as the ferocious pandemic took toll on all aspects of the American society in 2020.

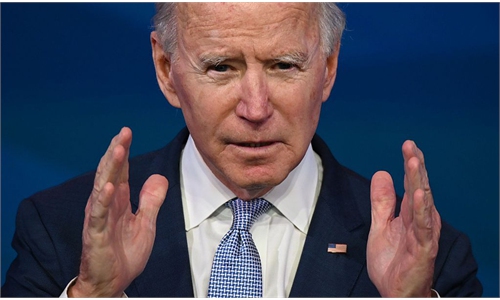

To pull the struggling economy out of recession, US President Joe Biden has spared no effort in promoting the passing of a $1.9 trillion relief package, and his team seemed to have no time to weigh the possible side-effect from the excessive stimulus.

While the third round of stimulus handouts might be able to shift part of the US economic pressure to other major economies, analysts believe, it is most likely to push up the US stock market that has seen a wild volatility in 2020.

While the new relief package may temporarily bail out the underclass in the US who have borne the brunt of the coronavirus hit, it's also expected to heighten financial risks faced by the US economy.

China's overall outbound investment posted a year-on-year increase of 3.3 percent in 2020, but China's investment in US faces bleak prospects, a report issued by the country's commerce ministry said last week, citing the pandemic and US policy uncertainty.

The past few years have proved that the suppression by the US will not affect China's economic and technological performance. While it's clear that more political manipulation won't halt the cooperation trend in all sectors including finance, the Biden administration should take a cautious approach on what policy settings should be selected.

The author is deputy managing editor of Securities Daily and an expert adviser for the China Securities Regulatory Commission. bizopinion@globaltimes.com.cn