China could be the second Japan in terms of market size as second-hand market swells: market watcher

China could be the second Japan in terms of market size in five years

A second-hand luxury store in Shanghai File photo: VCG

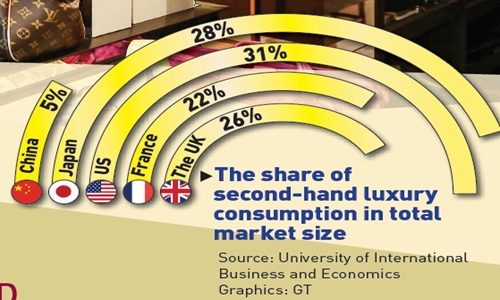

The share of second-hand luxury consumpiton in total market size

Miss Bao has a special way to kill time, shopping at the second-hand luxury bag websites.

She spends hours on checking the bags, set alarm to snap up for the chosen style. In her eyes, she is saving money for a good quality luxury-brand bag.

Her favorite brands are Hermes, LV and Chanel. Her newly purchase one is a used Burberry bag priced at 1,899 yuan ($294), the original price is around 6,000 yuan.

The secondhand luxury market, including bags and coats have witnessed rapid development in China, and the market watchers even predicted that the market is about to hit an explosive development in two years and the market size could reach that of Japan within five years.

A report released by University of International Business and Economics in June of 2020 showed that China's luxury inventory in the past ten years is about four trillion yuan, but the second-hand luxury market only accounts for 5 percent of total market size, in comparison, second-hand luxury goods consumption can reach more than 20 percent, or even 30 percent in several developed countries.

Young people prefer second-hand bags?

Zhang Chen, founder of Beijing-based Extraordinary Luxuries Technology Co started his second-hand business more than 10 years ago.

He said the consumers of second-hand luxury goods are not the wealthy, but the white-collar professionals with the monthly income of around 6,000 yuan who are value conscious.

The buyers are young, and follow Key Opinion Leaders (KOLs) when it comes to bags recommendation, and that bags with average price of 5,000 yuan are the most popular, Zhang told the Global Times on Monday.

His comment is also in line with the report, which said in 2019, 50 percent of second-hand luxury goods consumers are under the age of 30, and the current main consumer force is the Y generation (including those in the post-80s and post-90s). Overall value is the main reason why consumers choose second-hand luxury goods.

The report said those people not only have interest in buying luxury goods, but also have growing spending power as they care about the brand, pursue good value deals , and are willing to buy second-hand luxury goods.

The report shows luggage and leather goods are still the first choice of consumers, accounting for 60.2 percent of the transactions; followed by clothing, shoes and hats, accounting for 22.1 percent.

Epidemic creates second-hand boom

China has always been an important market for the world's luxury brands. A report released by consultancy firm Bain & Co in November showed that China will become the world's biggest luxury goods market by 2025, with Chinese consumers set to account for nearly half of the global spending in the sector in the same period.

The report said the Chinese mainland will be the only market in the world to see a growth in luxury goods sales this year, and consumers continued to buy high-end luxury bags, clothes, jewelry and wine in China due to international travel restriction.

To a certain extent, the size of primary luxury goods reflects how much potential there will be in the second-hand luxury market. And the epidemic has accelerated the development of China's second-hand luxury goods market.

On the supply side, rising costs and falling sales under the influence of the epidemic have caused global luxury goods giants to raise prices. Such as French luxury house Chanel has increased prices for a second time in November last year, followed in May it hiked prices of handbags and other small leather goods worldwide by between 5 percent and 17 percent, according to Reuters.

Economic pressure brought by the epidemic has caused luxury customers to sell their luxury goods to alleviate the income crisis, and customers also choose to buy more cost-effective due to the decline in income, Gu Jin, founder of chenzhen.com told the Global Times on Sunday.

As a second hand online bag website, it started the business from the maintenance and repair for bags from 2015, then began the second-hand bag business in 2018.

She said the second-bag business has grown fast over the recent two years, and currently, the company can receive packages nearly1,000 packages for maintenance, upkeep or second-hand sales per day, much higher than previous years.

Zhang from Extraordinary Luxuries Technology Co said the company's transaction in 2020 is about 30 percent up than previous years.

He predicted that China's second hand market is still developing rapidly, and to enter into the outbreak period in 2023.

The second Japan?

The rapid development of the domestic second-hand luxury market is also affecting the world, and market watchers said China is about to reach the size of Japan in terms of second-hand market in five years.

Japan used to be the global luxury goods center driven by rapid economic development, but in the 1980s Japanese consumers began to cut their luxury purchases and sold their own collections, making their second-hand market developed rapidly.

But Minnie, a vintage dealer in Dalian, Northeast China's Liaoning Province found now it is becoming more difficult to find good quality vintage bags in Japan for the market is almost ground to a halt, and at the same time, the price has been soaring.

With the help of short-vidio, weibo and xiaohongshu, or Little Red Book, a popular social shopping application in China, Chinese consumers have become more educated when it comes to the vintage market in Japan, she told the Global Times on Sunday, adding those popular bags in China also make the price higher in Japan.

Zhang echoed that in the years of 2009 or 2010, buyers from China were only one or two at the auctions, and the profit per bag can be doubled or tripled in 2014, but now the buyers at the Japan auctions from China could be sit back two rows, and the profit per bag are declined to 10 to 15 percent.

Insiders also said there has been a recent trend that buyers from Japan are looking for second-bags in China for China has a vast second-hand market of new models.

Zhang explained that it is very hard to find a second hand of LV neonoe or Chanel's Garbielle in Japan's second hand market for the inventory is limited.

Japan is almost at the tail end of second-hand market growth after more than 20 years' of expansion, as the new products are sold slowly and the second-hand stores are quite alot, Zhang said.

"Japan's vintage is like a gold mine, and it will be unearthed sooner or later," Zhang said, "China could be the second Japan in terms of market size in five years."