Chinese A shares falter after strong start on 1st trading day of Year of the Ox

Market expected to continue rallying in Year of the Ox

Illustration: VCG

The Chinese mainland A-share market faltered at the close on Thursday, the first trading day in the Year of the Ox, after a strong rally in the morning. The market's moves were within expectations and the equities are likely to stage a bull run this year, given the solid fundamentals of China's economy, analysts said.

The benchmark Shanghai Composite Index rose 0.55 percent to close at 3,675.36, while the smaller Shenzhen Composite Index edged down 1.22 percent. The NASDAQ-style board ChiNext plunged 2.74 percent.

The blue-chip CSI300 index hit a record of 5,891.72 points during early trading hours but ended 0.68 percent lower.

Turnover at Shanghai and Shenzhen bourses exceeded 1 trillion yuan ($155 billion) on Thursday. Gains were widespread, with non-ferrous metals, coal and oil rising significantly, but most spirit distillers and medical care companies dropped.

The Peoples' Bank of China (PBC), the central bank, drained 260 billion yuan of liquidity from the market on Thursday, raising investor concerns about policy tightening.

"The capital market taper-off was within our expectations and it is normal, as stock prices rose too high in the days prior to the weeklong holiday," said Dong Dengxin, director of the Financial Securities Institute at Wuhan University of Science and Technology.

Dong told the Global Times that the market faltering was not a reaction to the PBC's monetary operation, but was more related to massive declines in liquor stocks represented by distiller Moutai, which has the largest market cap in the A-share market. Shares of Moutai dropped 5 percent from previous session.

As an important occasion for family reunion, this year's Lunar New Year holiday was different from previous ones as many cities encouraged residents and migrant workers to stay put for the festival to reduce personnel flows and curb the risk of COVID-19 spreading.

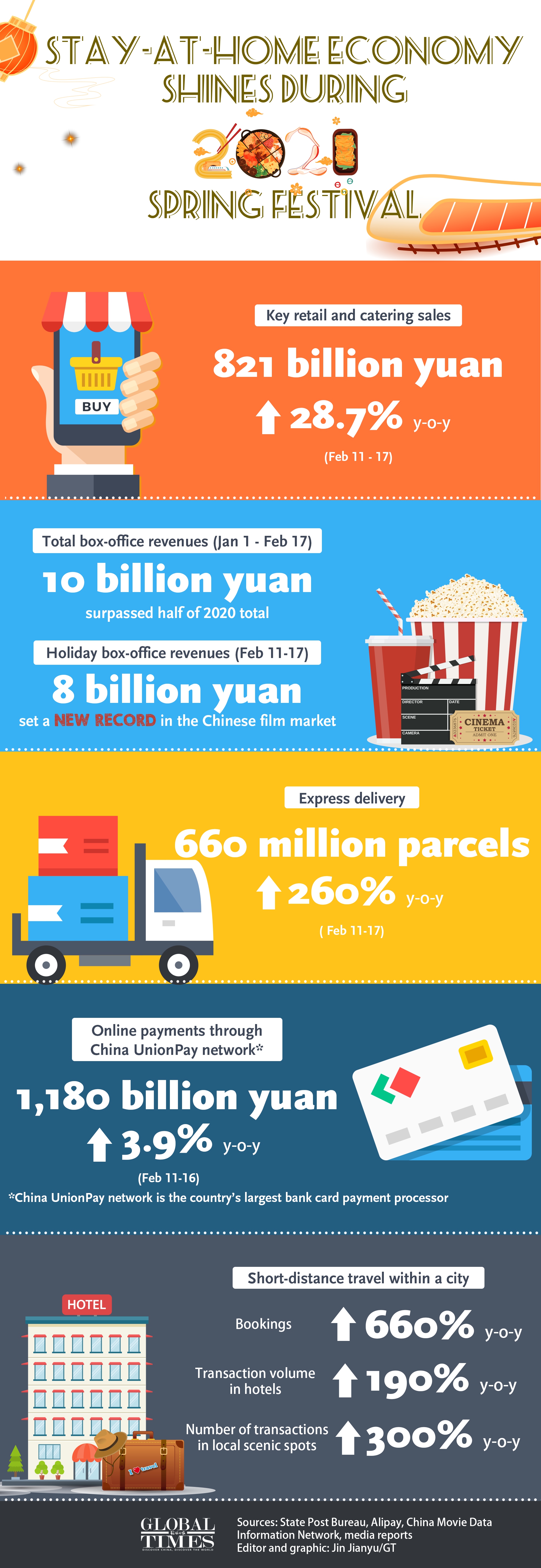

The stay-put order across the country throughout the holiday drove consumption including short-distance driving tours, skiing, visiting scenic spots and cinemas.

Taking movie industry for an example, box office revenues during the 2021 Spring Festival holiday (February 11-17) exceeded 7.8 billion yuan, up 32.5 percent from 2019, with new records set for ticket sales and attendance during the holiday, data from the China Film Administration showed on Thursday.

Retail sales during the festival rose 28.7 percent year-on-year to reach 821 billion yuan, data from the Ministry of Commerce (MOFCOM) said. Online sales exceeded 122 billion yuan, with online catering sales surging 135 percent from last year as more Chinese ordered ready-to-eat meals through e-commerce or online food delivery platforms.

Stay-at-home economy shines during 2021 Spring Festival Infographic: Jin Jianyu/GT

"The eye-popping figures are a reflection of the country's huge consumption potential," said Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co.

"Under the 'dual circulation' economic strategy, both internal and international circulation will boost GDP growth this year, but we should not neglect the fact that the economic driving force is still not that strong, like domestic consumption," Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies of Renmin University of China, told the Global Times on Thursday.

Last year, retail sales fell 3.9 percent year-on-year due to COVID-19 disruptions.

Yang said that the stock market is likely to have a bull run in the Year of the Ox. "But it will rise slowly over the longer term, with the trend set to continue for many years to come," he said.

"The Chinese economy is the first to emerge from the COVID-19's impact and the recovery is the strongest in the world, which lays a foundation for growth," said Yang.

Economists interviewed earlier forecast that GDP will grow at least 8 percent in 2021.

The A-share market is projected to keep rising in 2021, the first year of the 14th Five-Year Plan (2021-25), according to an analysis by the Industrial Securities. The analysis cited capital market reforms, growing public investment in the market, and the increasing inflow of overseas capital to the market.

Dong said the Shanghai index may hit 4,000 by the end of the year.

The Year of the Rat in 2020 was a bullish one for the Chinese capital market, with the Shanghai stock index gaining 25.19 percent.