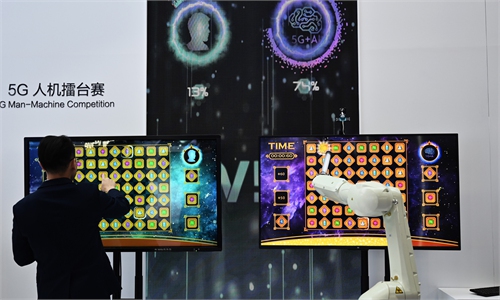

China should prepare for continued US crackdown on tech sector under Biden, as Trump-era rule targeting Chinese firms is to take effect: experts

China should prepare for continuing US crackdown on tech rise under Biden: experts

China US Photo:GT

The Biden administration's reported move to allow a Trump-era rule targeting Chinese technology firms to take effect soon is a signal that the Biden government will continue cracking on China's tech rise like the Trump administration, although Biden's overall strategy toward China would be less extreme and volatile, analysts said.

The interim final rule, issued by the US Commerce Department just days before Joe Biden's inauguration as US president, allows the department to monitor the transactions of certain overseas governments, including China's.

Once the rule takes effect, millions of US businesses will be required to get government licenses if they want to make deals involving sophisticated technology with so-called foreign adversaries, including China, Russia and North Korea.

The US Commerce Department said on Friday that it is accepting public comments on the plan until March 22, when it is supposed to become effective. The exact date to implement the measure has not yet been decided.

Experts read the move as a signal that the Biden administration will not soften policies toward China, at least not in the technology sector, as some people had anticipated when Donald Trump left office.

Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, said that curbs on China's technological rise have become a long-term strategy in the US, and it doesn't matter who is in the White House.

According to Dong, from the Coordinating Committee on Export Control to the Wassenaar Arrangement, the US' crackdown on the technological rise of emerging countries dates back long ago, and although the crackdown seemed to fade for some time with US companies' globalization, it never changed.

"I believe suppressing China's tech companies is a reflection of Biden's strategy, instead of just a passive continuation of previous policies," he told the Global Times.

He also predicted that Biden would preserve most of the Trump administration's crackdown policies on Chinese technology companies, such as the ban on Huawei products.

The Trump administration imposed a number of bans on doing business with Chinese companies from Huawei to WeChat, although some of those measures were blocked by US courts.

Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, also noted that on the issue of technology, which is key to a country's competence, no politicians would soften their policies.

He said that the Biden administration might "build a high wall" around certain technological sectors, such as electric car batteries, where they would impose highly restrictive policies on countries like China.

"Besides, Biden wouldn't let the Republican party hold anything against him for being soft on China-related issues, even though he might face pressure from US business people for adding to the difficulties of their global expansion," Gao told the Global Times.

Reuters cited Business Roundtable, a group representing US chief executives from companies such as Citigroup and Walmart, as saying that the proposal is "unworkable" for US businesses.

Dong said that the influence of US businesses has not accumulated to a level that can sway Biden's policies. "It will take more time to achieve China-US cooperation, maybe another year," he noted.

However, both experts agreed that the Biden administration's general policy toward China would be more rational compared with that of the Trump administration's, and China-US trade ties may recover to some extent in the Biden presidency.

Dong also stressed that as long as China insists on developing independent technologies and expanding cooperation with other countries, US sanctions could not hurt the Chinese economy fundamentally.