Chinese EV brands gaining a foothold in Europe

Further growth expected in 2021: analyst

A U5 model of Aiways is seen in Germany in August 2020. Photo: Courtesy of Aiways

Different traditional vehicles powered by internal combustion engine, new-energy vehicles (NEVs) have provided a fresh opportunity for Chinese auto brands, which have found it quite hard to make a solid footprint in developed markets for years. In the fast-growing NEV market in Europe, Chinese electric vehicle manufacturers are ramping up their efforts to take a share of the growing market.

According to the latest European Electric Car Report issued by Berlin-based Schmidt Automotive Research, total sales volume of Chinese electric vehicle (EV) brands in 18 major European automobile markets recorded 23,836 units last year, an increase of more than 13 times compared with the same period in 2019, and their market share has reached 3.3 percent, signaling a fast development phase that Chinese EV makers are embracing on the European continent.

Chinese EV makers including state-owned firms and a rising force of pure EV players are eager to tap into the diversified European market where growth potential is highly expected and business environment is under a favorable condition driven by local governments' push for a low-carbon society.

Electric cars - battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) - have been gradually penetrating the EU market over recent years. Across the Western European market, PHEV sales rose to 12.3 percent of car sales in 2020, according to auto analyst Schmidt, while the broader market fell 25 percent during the COVID-19 pandemic to 1985 levels of just 10.8 million.

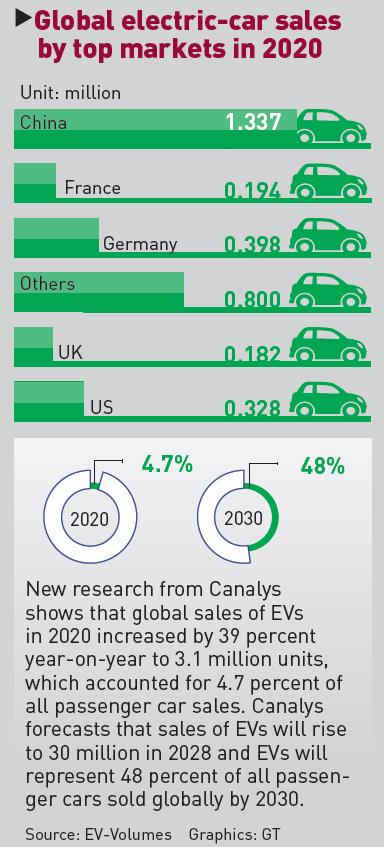

Global electric-car sales by top markets in 2020 Graphic: GT

In most countries, BEVs and PHEVs were more resilient to the pandemic crisis than the auto markets in general. Europe passed China in EV sales with a 137 percent increase in a disturbed auto market, which had suffered volume losses up to 80 percent during the second quarter. The real EV boom in Europe started in June and July 2020 and reached its peak in December with nearly 285,000 sales, according to ev-volumes.com, a research group.

"Heavily relying on government incentives handed out during the pandemic, consumer demand was largely triggered, registering record sales of EVs in Europe," Cui Dongshu, secretary general of the China Passenger Car Association, told the Global Times on Tuesday.

However, local EV products in Europe were not yet that competitive, thus leaving some market space for Chinese players, which have gained hang of making market-oriented EVs in China, the world's largest NEV market, said Cui.

"As the EU continues to roll out aggressive policies to fulfill its green mobility target to steer countries away from fuel-based transport, the markets need more competent players to participate in the shifting process, and the entrance of Chinese automakers will also help stimulate vitality of local industry to some extent," said Cui.

The EU commission wants to place at least 30 million zero-emission cars and 80,000 clean-energy trucks on Europe's roads by 2030, according to a draft document.

Prospect, challenges

Fu Qiang, founder and chairman of Aiways, a Chinese EV start-up based in Shanghai, said that apart from the favorable policies, Europe has a more solid base than China in terms of NEV infrastructure including the charging facility, which have higher penetration rate.

"Europeans tend to have higher awareness of environmental protection thus consumers there are more mature, stable and rational in car consumption. Due to the advantages of driving and usage that EVs can bring, it is easy to be recognized by consumers," Fu told the Global Times.

Another bright side of entering EU's NEV market is that European consumers will not turn away from products made by a new brand at the initial phase just because of the latter's low brand awareness, Fu noted. "European users will not hold strict screening criteria different from Chinese users who generally admire big brands."

He took the example of Aiways' U5 SUV model, toward which European consumers have not shown lack of trust because it is a start-up brand or a new product.

"The current shortage of electric vehicle models and the polarization of price ranges among European companies have created conditions for the entry of Chinese EV brands," Fu noted.

The Chinese firm launched the European version of its all-electric U5 last year. It was the first EV from a Chinese start-up to go on sale in Europe.

Aiways has so far entered France, Germany, the Netherlands, Belgium and other European countries. Despite impact on the fledgling of the firm at the early phase of COVID-19 last year, it began receiving business-end orders since April 2020.

Within weeks it opened reservations to consumers in Germany, the number of its orders exceeded four digits, the company told the Global Times.

Separately, Xpeng Motor, a leading Chinese EV start-up, said in February it has shipped the second batch of its G3 SUVs, more than 200 units, to Norway from a port in Guangzhou, South China's Guangdong Province. Xpeng delivered its first batch of G3 vehicles to Norway in December.

Betting on its supportive policies for clean energy, advanced charging infrastructure, high awareness of EVs among consumers, Xpeng chose Norway as its first destination in expanding its overseas business.

The market share of EVs in Norway increased to 54 percent in 2020 from 42 percent the previous year, becoming the world's first country with its EVs taking up over half market share, according to data published by Norwegian Road Federation.

Nio, another homegrown EV maker, plans to enter the European market in the second half of this year, company's PR told the Global Time on Tuesday.

In addition to passenger cars, Chinese automakers have also enlarged their footprint in the logistics vehicles sector across Europe.

As of October last year, the cumulative sales of SAIC's MAXUS brand have exceeded 10,000 units, according to data provided by SAIC. MAXUS has successfully entered nine European markets including the UK, Ireland, Norway, Spain, the Netherlands and Belgium. Its large orders cover such industries as retail, postal, supermarket and the municipal sector.

It is expected that Europe will continue maintaining its fast speed in pushing the NEV development and add further momentum this year, according to Cui. "And Chinese auto brands are forecast to see further sales growth in the market this year."

As new players in a developed market, more observation is still needed for Chinese automakers in terms of local law and regulation, while heeding the competition environment, he added.