Global chip demand in boom

Enterprises increase investment, consider plants to expand production

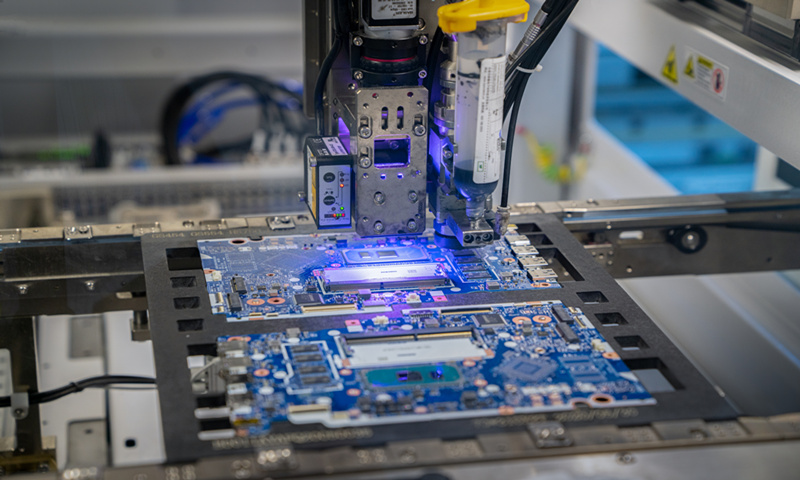

A chip manufacture machine Photo: VCG

GlobalFoundries will invest $1.4 billion this year to raise output at three factories in the United States, Singapore and Germany, as a global shortage of semiconductors has boosted demand for chips, its chief executive said.

The US-based company, a unit of Abu Dhabi's state-owned fund Mubadala, may also bring forward its initial public offering to late 2021 or the first half of next year, from a previous target of late 2022 or early 2023. It is aiming for revenue growth of 9 percent to 10 percent from just over $5.7 billion last year.

Automakers and electronics producers are facing a global shortage of chips which has fueled manufacturing delays.

"The adoption of technology that would normally have taken a decade happened in one year in 2020 because of COVID-19," GlobalFoundries CEO Thomas Caulfield told Reuters.

Before the pandemic, the chip industry was projected to grow 5 percent over a five-year horizon and now it has accelerated to grow at twice that rate, he said.

While the supply crunch has resulted in car makers such as Volkswagen, Ford and General Motors cutting output, an increase in supply would create further demand.

GlobalFoundries said the $1.4 billion, which will be divided evenly among its fabs in Dresden, Germany, Malta, New York and Singapore, will begin to ramp up output through 2022 to produce chips from 12 to 90 nanometers.

About a third of the investment will come from clients seeking to lock in supply over several years, Caulfield said, forecasting a 20 percent rise in production next year following an expected 13 percent increase in 2021.

If demand continues to rise GlobalFoundries could build a new plant adjacent to its Malta, New York, plant after securing a purchase option agreement for about 66 acres of undeveloped land last year.

But a decision to break ground there would hinge on the US Congress funding a set of measures to incentivize chip manufacturing in the US known as the Chips Act, which was approved last year.

"It's not a question of 'if,' it's just a question of 'when,'... And a key element of going forward will be the funding of Chips Act," per Caulfield.

US President Joe Biden, who took office in January, has pledged to support the effort, and senators are looking at providing emergency funding for the law as part of a bigger package to counter China's rise, as chipmaking has shifted to Asia.

GlobalFoundries is the world's third-largest foundry by revenue behind Taiwan Semiconductor Manufacturing Co Ltd and Samsung Electronics Co Ltd but ranks second when factoring out the part of Samsung's foundry business.

Samsung is considering two sites in Arizona and another one in New York in addition to Austin, Texas, for a new $17 billion chip plant, according to documents filed with the US' Texas state officials.

The tech giant is also seeking combined tax abatements of $1.48 billion over 20 years from Travis County in Texas and the city of Austin, it added in the documents dated Feb. 26, up from the $805.5 million previously mentioned.

Samsung is in talks with the sites at Arizona and New York, with each offering property tax abatement and "significant grants and/or refundable tax credits" to fund infrastructure improvements, read documents.

The new plant Samsung plans to build would produce "advanced logic devices" for Samsung's chip contract manufacturing business, and could create 1,800 jobs, per previous documents filed with Texas state officials.

Samsung already has a chip plant in Austin, which due to shutdowns caused by a winter storm last month is expected to need a couple of weeks to resume production.

Samsung is considering a number of possibilities in terms of expansion, a spokesman for Samsung told Reuters on Wednesday.

Chipmakers like Samsung will need a couple of weeks to resume production in Texas after shutdowns caused by severe weather, and customers could face knock-on effects in several months' time, a representative of a trade body said.