China’s exports to the US may jump about 20% in 2021: expert

Costlier raw materials crimp producers’ margins

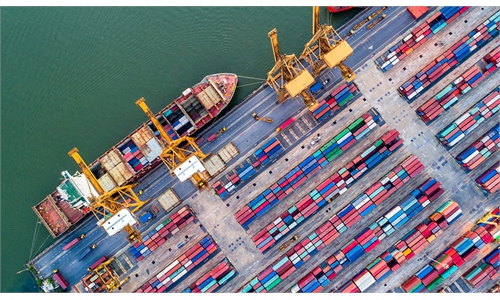

A ship berths at the Lianyungang Port in East China's Jiangsu Province on Tuesday, waiting to load 1,300 cars for export. Photo: VCG

Amid a steady recovery in the domestic economy and strong overseas demand, China posted a year-on-year gain of 60.6 percent in its exports during the first two months of 2021, the General Administration of Customs (GAC) said on Sunday.

Exports reached $468.87 billion during the January-February period in US dollar terms, while imports rose 22.2 percent to $365.62 billion, according to GAC data released on Sunday.

The trade surplus for the two months reached $103.25 billion, compared with a deficit of $7.21 billion for the same period last year.

Graphics: GT

Recovering markets in the EU and the US drove China's export rise, making "a slack reason" busy, with exports headed for Europe, the GAC said.

Meanwhile, the stay-put policy implemented in Chinese localities during the Spring Festival period meant that factories were able to deliver orders uninterrupted by the long holiday.

The rise in exports also reflected the country's faster recovery from the pandemic-induced paralysis.

Electromechanical products and labor-intensive products, from cellphones and cars to textiles and plastics, dominated exports.

Stimulus policies in overseas markets really gave a boost to the so-called stay-at-home economy, said Zhong Wenhui, general manager with Huizhou Densun Musical Instrument Co, a manufacturer of guitars and accessories in South China's Guangdong Province.

Zhong's company saw a rise in orders as overseas consumers rushed to the Amazon online marketplace.

The GAC said more Chinese exporters have bullish views for the next two to three months, but uncertainty persists for foreign trade, given the pandemic situation.

A stable recovery on the domestic front helped boost imports, supporting commodities such as iron ore. The yuan-denominated price of the raw material for steel rose 46.7 percent year-on-year in the January-February period.

A continued surge in raw materials that's expected to persist has eroded the profit margins of Chinese manufacturers, prompting many to increase their product prices, according to industry insiders.

A 3-10 percent hike in steel prices, coupled with skyrocketing freight rates, has eliminated up to 30 percent of the profit margin of China-based manufacturers, said Hong Shibin, deputy executive director of the marketing committee of the China Household Electrical Appliances Association.

"An increasing number of companies are renegotiating with their clients, instead of habitually absorbing inflated raw materials costs to please their customers," Hong told the Global Times on Sunday.

"Even factoring in the price hikes, manufacturers still anticipate stellar growth in the first half of the year, as people can feel the tangible benefits of China's political and economic stability," Hong said.

The GAC said the exceptionally high trade figures are partly due to the low base in the first two months of 2020, when China's foreign trade was decimated by the pandemic. Measured against comparable periods in 2018 and 2019, the growth of foreign trade in January and February this year was still more than 20 percent, the GAC said.

The Association of Southeast Asian Nations (ASEAN) was China's largest trading partner during the period, trailed by the EU and the US.

China-US trade rose 81.3 percent year-on-year to $109.8 billion in the first two months of this year, the highest growth among all regions including the EU and ASEAN. China's exports to the US rose 87.3 percent during the period, the second-highest after New Zealand, whose imports from China rose 89.2 percent.

The high growth rate reflected burgeoning demand from the US following the country's economic recovery and stimulus policies, said Tian Yun, vice director of the Beijing Economic Operation Association and former economist at the state economic planning agency.

Tian predicted that China's exports to the US may jump about 20 percent in 2021, should the Biden administration not take action to undermine such a trend.

In comparison, China's trade with the US rose 8.3 percent in 2020 to reach $587 billion.

Tian said that the US market actually provided the strongest momentum for growth for China's exports in 2020, and the growth trend is more visible in 2021.

"This is beyond the expectations of many economists, given the two countries' lingering tensions, and the fact that the Biden administration has not yet done anything to correct the Trump administration's trade crackdown policies targeting China," he told the Global Times on Sunday.

According to Tian, the rising trend was mostly a result of surging demand in the US, as the US economy recovered and government stimulus bills were approved, but it was also due to the completeness of China's industry chains and China's pandemic control success, which let the world see that made-in-China goods are safe.

"As long as the Biden administration does not make the current trade policies tougher for China, China's export growth to the US might reach a record high this year," he said.

But he said that the current trade structure, with the US being China's third-largest trading partner behind the EU and ASEAN, would not change in the short term.