HK investors are headed for mainland

Entrepreneurs cite innovation, favorable policy, market potential

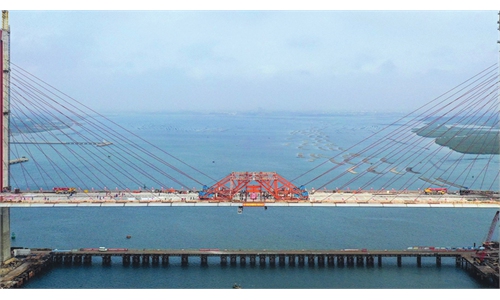

Photo taken on Oct. 24, 2019 shows a view of the Hong Kong-Zhuhai-Macao Bridge from the "Ngong Ping 360" cable car in south China's Hong Kong. (Xinhua/Cheong Kam Ka)

Lured by favorable policies, an improving business environment and a push for innovation, more businessmen from China's Hong Kong Special Administrative Region (HKSAR) are seeking opportunities in the Chinese mainland while expressing the hope that their hometown could regain steady development pattern and emerge from the social unrest and COVID-19 disruptions.

Starting from scratch with three men and now having more than 100 staff, it has been a cherished opportunity for Michael Wong, chairman of international forwarder M&S International Forwarding, to chase his dream in Shenzhen, South China's Guangdong Province, which neighbors Hong Kong.

Instead of choosing to start his career in 2006 in his hometown Hong Kong, where international logistics were well developed, Wong set foot in Shenzhen because he was attracted by the city's vitality and abundance of young workers.

"Settling my business here has also enabled it to have direct communications with our customers - a large pool of exporters in the Pearl River Delta, one of the major manufacturing hubs in the mainland," Wong told the Global Times, adding that the lower costs of land and human resources were also obvious advantages.

In the past four decades of China's reform and opening-up, investment from the HKSAR has played a significant role. As of end-2018, Hong Kong funds accounted for 54 percent of the total overseas investment absorbed by the Chinese mainland, data showed.

According to Wong, local governments in the mainland have continuously shown a welcoming attitude toward his company's investment and offered support measures to help the company grow, which made him feel more integrated into local circles.

"When an important circular is issued, the local transport authority in Shenzhen will organize a meeting to help us better understand the policy and comply with the regulations," Wong said.

"Apart from favorable policies to attract business, one obvious improvement is that the local government has become more aware of services," he added.

Norman Lin, general manager of Avic Sanxin, a company based in Shenzhen specializing in the processing of construction materials, told the Global Times that compared with a decade ago when he started his business in the mainland, the bureaucratic process of applying for licenses and getting government approval has been drastically simplified.

"Business people back then had few government connections, and would have to run to many places to get their licenses," Lin said. "Now, many local governments in the Greater Bay Area offer one-stop application service."

"Some of the preferential policies are very considerable. For example, investors from Hong Kong can enjoy up to 100,000 yuan [$15,000] of travel reimbursement every month if they register a company in Nanhai District in Foshan city, Guangdong," Ye Xinghua, founder of Gongho Space, an incubator for Hong Kong companies in the mainland, told the Global Times on Thursday.

Many other mainland cities in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) are also offering discounts in real estate to appeal to Hong Kong investors.

A push for innovation and an entrepreneur-friendly attitude in the GBA in recent years has ended the stereotypes that many Hong Kong investors held about doing business in the mainland, according to Wong. "We used to take much interest in Western businesses, but we've now turned our eyes to the mainland where new business models and ideas are booming."

Despite the efforts of local governments in GBA cities, obstacles persist when Hong Kong investors try to operate businesses in the mainland, from getting a loan to hiring new employees.

"Getting a credit card is still extremely difficult for people from Hong Kong, and the credit systems in the mainland and Hong Kong are disconnected."

Many recruiting platforms in the mainland are also shut to them because they don't have an ID card to register.

Around 40 percent of the Hong Kong businesses seeking to enter the mainland market through Ye's company are fintech companies, Ye said, but to explore the fintech sector, Hong Kong investors face both written and unwritten restrictions.

"State-owned banks in the mainland are very cautious about letting Hong Kong companies provide core technical services, even when there is no regulation against it," Ye said.

In terms of the number of companies currently operating, fintech remains the leading technology sub-sector in Hong Kong's entrepreneur scene, accounting for 465 of the city's 3,184 start-ups, according to InvestHK.

While expanding their presence and investment in the mainland, entrepreneurs from Hong Kong also care much about the development and future of the HKSAR.

"I hope that Hong Kong will regain its momentum with more cooperation with the mainland. With the national security law in place, the city will be better guided and supported after experiencing turmoil," said Wong.

The Hong Kong economy contracted 6.1 percent for 2020, the sharpest yearly decline on record. The economy saw a visibly enlarged year-on-year contraction of 9.0 percent in the first half of 2020 as the COVID-19 pandemic dealt a heavy blow to global and local economic activities.